Ethereum Shanghai upgrade-hype dissipating causes DeFi investors to resort to this behavior

- Ethereum DeFi tokens have observed a decline in the user base due to the Shanghai upgrade hype dying down.

- Staking and lending protocols emerged as the ones to benefit the most from the Shapella upgrade.

- The DeFi market is on the path of developing a shield against the impact of the spot and TradFi market events.

The Ethereum Shapella hardfork fever is coming down, and the price is once going back to depending on supply and demand. The vanishing effects from the hype is also impacting users’ behaviors who are seen dispersing out of DeFi protocols. Is this a bad sign, or does the situation differ from reality?

Ethereum DeFi networks since the upgrade

Owing to the Shanghai hardfork, the Decentralized Finance (DeFi) protocols were expected to draw in users and investors in high volume. But these users were expected to stick around even after the hype died down, which is not the case at the moment.

Most of the top DeFi tokens peaked in terms of active addresses around the time of the upgrade going live on the mainnet. However, right after, these daily active users went back to being dormant, resulting in active addresses falling. These tokens included the likes of Lido, Uniswap, Aave, etc.

DeFi daily active addresses

This declining interest in DeFi protocols and tokens could also result in the network observing the presence of fewer users than last month. The monthly total of unique users for the month of March was nearly 600,000, but at the moment, April has registered only 350,000 users.

DeFi monthly unique users

The only front Ethereum is safe at is the spot market price action, where the altcoin is trading above $2,076, the level it was last at in May 2022. Although, at the time of writing, the cryptocurrency is observing a 2% decline, it would likely maintain its nearly year-long high.

Where is the demand going?

While the DeFi markets are suffering from user retention, protocols continue to observe an inflow of funds, and many users still believe that Decentralized Finance still is the best to come out of Ethereum - past, present and future. In line with the same, Mr. Edul Patel, CEO and Co-founder of Mudrex, a global crypto-investing platform, stated,

"The successful implementation of the Shanghai upgrade in Ethereum will substantially drive the DeFi and smart contracts in the foreseeable future. Integrating PoS and other enhancements would make the network more expandable, streamlined, and fortified. This will pave the way for the growth and progression of DeFi and smart contracts. Therefore, Ethereum is expected to persist as one of the top blockchain platforms for many years.

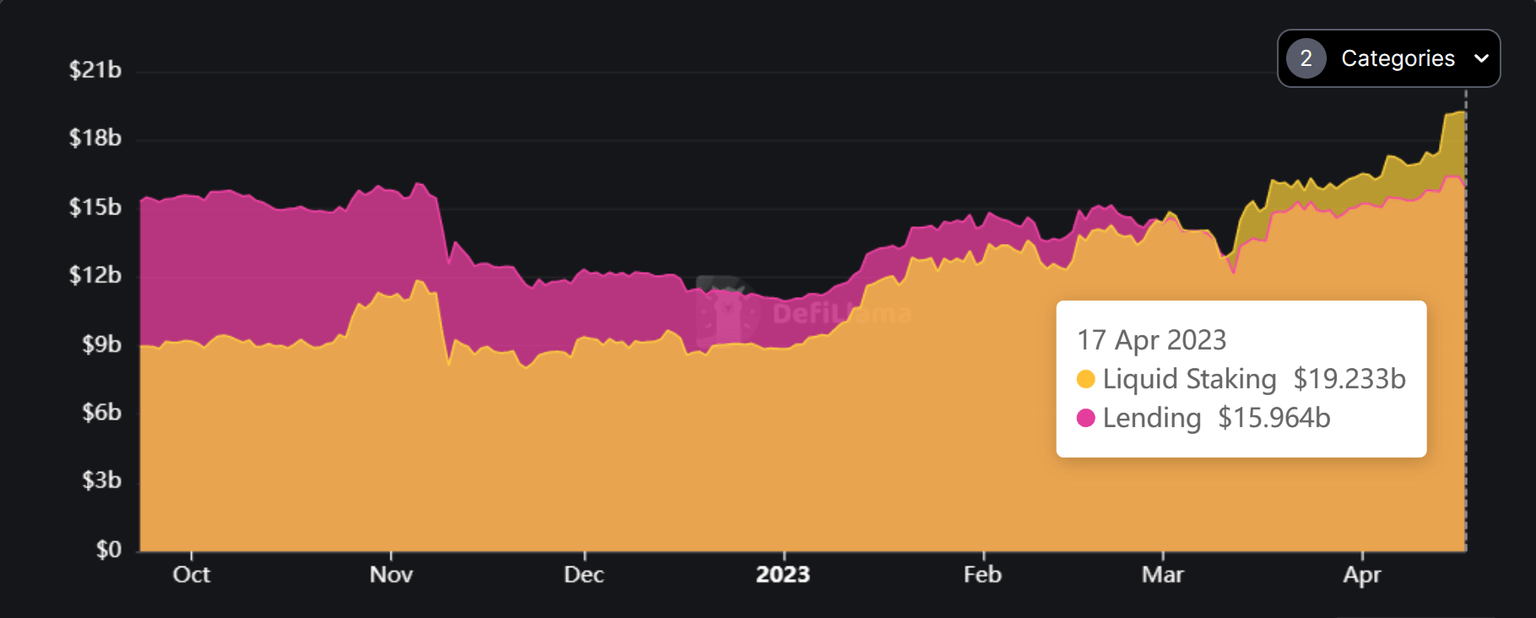

Furthermore, the DeFi market is still prospering, it's just that the money is being moved from the top categories of protocols, such as DEXes, to liquid staking and lending protocols. Since the beginning of the year, the total value locked (TVL) among the lending protocols' has risen from $10.95 billion to $15.96 billion.

DeFi TVL across lending and liquid staking protocols

On the other hand, the liquid staking protocols have observed a 116% increase in their combined TVL. While a positive sign, it was expected since Ethereum's Shanghai hardfork had staking withdrawal at the core of the upgrade.

Even though the Shanghai hype has dissipated, and the users might be backing off, for now, the DeFi market will keep evolving to stay relevant. The rising demand for web3 will eventually turn the DeFi space resilient to the events of the spot and macroeconomic conditions.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.