Ethereum could outshine Bitcoin in 2023 with massive growth in layer-2 transactions

- Ethereum has advanced steadily against Bitcoin despite deflation in most risk assets in 2022, according to Bloomberg strategist Mike McGlone.

- Ethereum’s layer-2 scaling solutions accounted for 58% of the 152 million transactions processed on the altcoin’s network.

- ETH is ready for a run-up to $1,273, with massive growth in the number of transactions processed by Ethereum layer-1 and 2.

Ethereum, the second largest cryptocurrency by market capitalization, witnessed massive growth in its ecosystem despite deflation in risk assets in 2022. Bloomberg strategists believe the altcoin is set to outshine the largest cryptocurrency, Bitcoin, in 2023.

Also read: Bitcoin and stablecoin whales scoop up BTC, USDT, BUSD and DAI: Recipe for crypto Santa Claus rally

Ethereum competes with Bitcoin ahead of 2023 with explosive transaction growth

Ethereum, the largest altcoin by market capitalization and the second-largest cryptocurrency, is competing with Bitcoin for dominance. Strategists at Bloomberg noted that Ethereum price increased consistently against Bitcoin, despite the bear market.

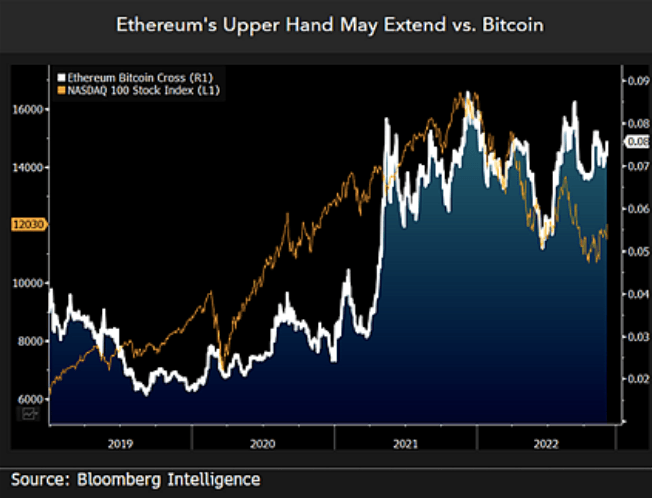

Mike McGlone, Senior Commodity Strategist at Bloomberg, believes Ethereum is the strongest contender to Bitcoin as ETH’s advances versus Bitcoin are unshaken. The Ethereum/Bitcoin (ETH/BTC) cross rate is 0.08, nearly the same as May 2021 when the Nasdaq 100 stock index was 20% higher. The annual volatility of Ethereum is nearly 1.3 times that of Bitcoin.

Ethereum is expected to outperform Bitcoin in 2023

Interestingly, the selling pressure on Ethereum has decreased as the ETH balances on exchanges declined throughout 2022. ETH exchange balance recently hit a four-month low, according to data from CryptoQuant.

ETH balance on exchanges

Large wallet investors on the Ethereum network scooped up the altcoin at the fastest rate in history in W4 of November 2022. Based on data from CryptoQuant, key Ethereum whale addresses holding between 100 and 100,000 ETH tokens scooped up 2% of the total supply within three weeks in November 2022.

Key Ethereum sharks and whales accumulated ETH tokens

One of the key factors contributing to the altcoin network’s unprecedented growth against Bitcoin is the massive spike in transactions. In the last two months, ETH layer-1 and layer-2 together processed 152 million transactions of which layer-2 solutions Arbitrum, Optimism and others accounted for 58%.

The last two months have been special for #Layer2 in terms of activity.

— L2BEAT (@l2beat) December 20, 2022

Both layers of Ethereum processed a total of over 152 million transactions, 58% of which happened on L2. @arbitrum and @optimismFND combined are also becoming close to flipping Layer 1 daily transactions. pic.twitter.com/ohKUzy01rr

Ethereum price is on track to hit the bullish target of $1,286

Analysts evaluated the Ethereum price trend and have predicted a bullish breakout in ETH. The altcoin is currently changing hands at $1,212 and analysts believe the asset has the potential to hit $1,286.

ETH/USDT price chart

In the chart above, technical analyst Phoenix_Ash3s predicts a rally in ETH. The expert believes ETH could climb higher crossing resistances at $1,238 and $1,270.

A decline to the 61.8% Fibonacci extension level at $1,177.41 could invalidate the bullish thesis for the asset’s price.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.