Ethereum sees spike in gas fees as inscriptions debut on blobs

- Ethereum blobs create inscriptions at a record rate in the last two days.

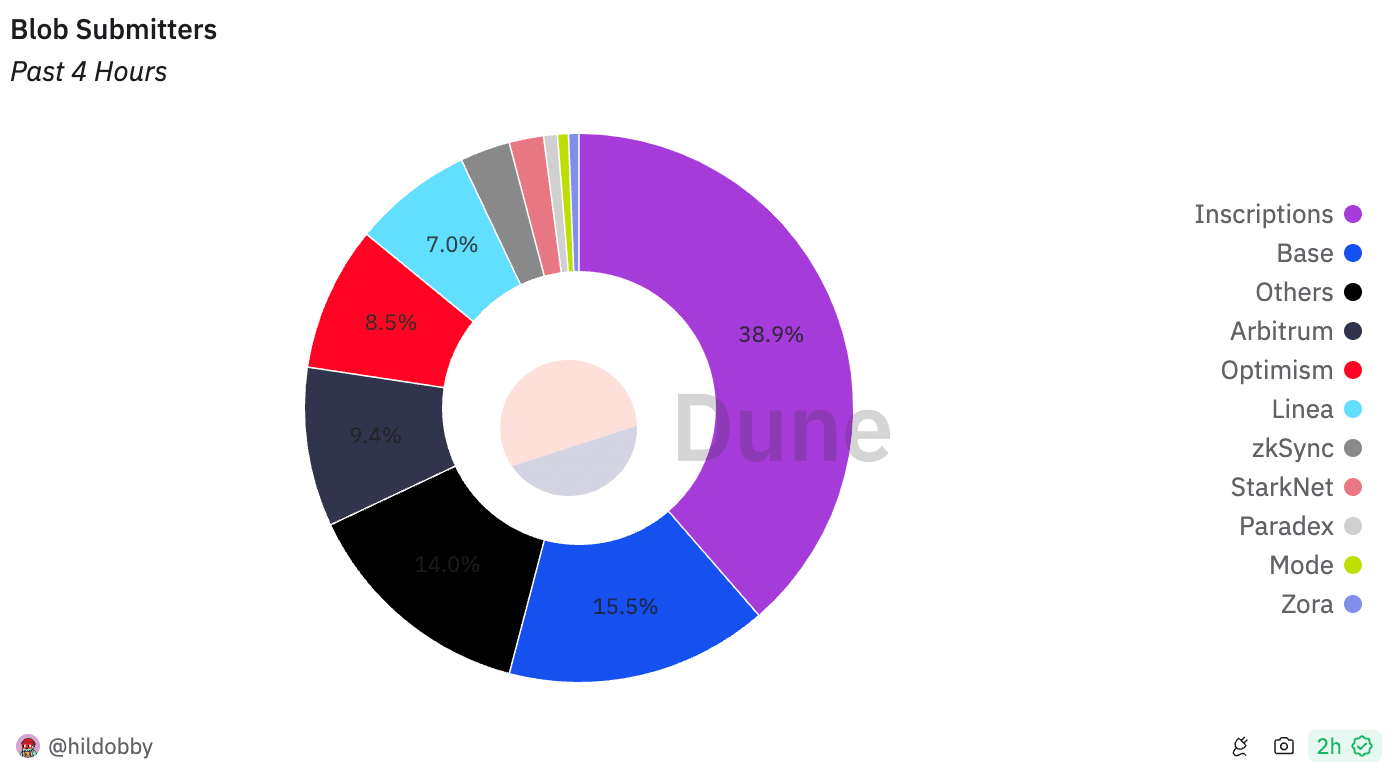

- Nearly 40% of blobs account for Blobscriptions, similar to Ordinals on Bitcoin.

- ETH price gained 2% on the day.

Ethereum’s (ETH) temporary and cost-effective memory segments, or blobs, are being plagued by inscriptions. Nearly 40% of blobs are being utilized by text or image storage inscriptions, popular as Blobscriptions.

The arrival of blobscriptions on the Ethereum blockchain has increased the transaction cost.

Ethereum sees rise in Ordinal-like inscriptions

Data from crypto intelligence platform Dune Analytics shows that Ethereum blobs are being used to create inscriptions at a record rate. On March 27 and 28, there was a spike in inscriptions, embedding text or images in blobs or “memory segments” on the Ethereum blockchain.

The development is reminiscent of the Ordinals that caused high traffic on the Bitcoin blockchain. On Wednesday, nearly 40% of blob submissions in Ethereum were for inscriptions.

Blob submitters on Ethereum.

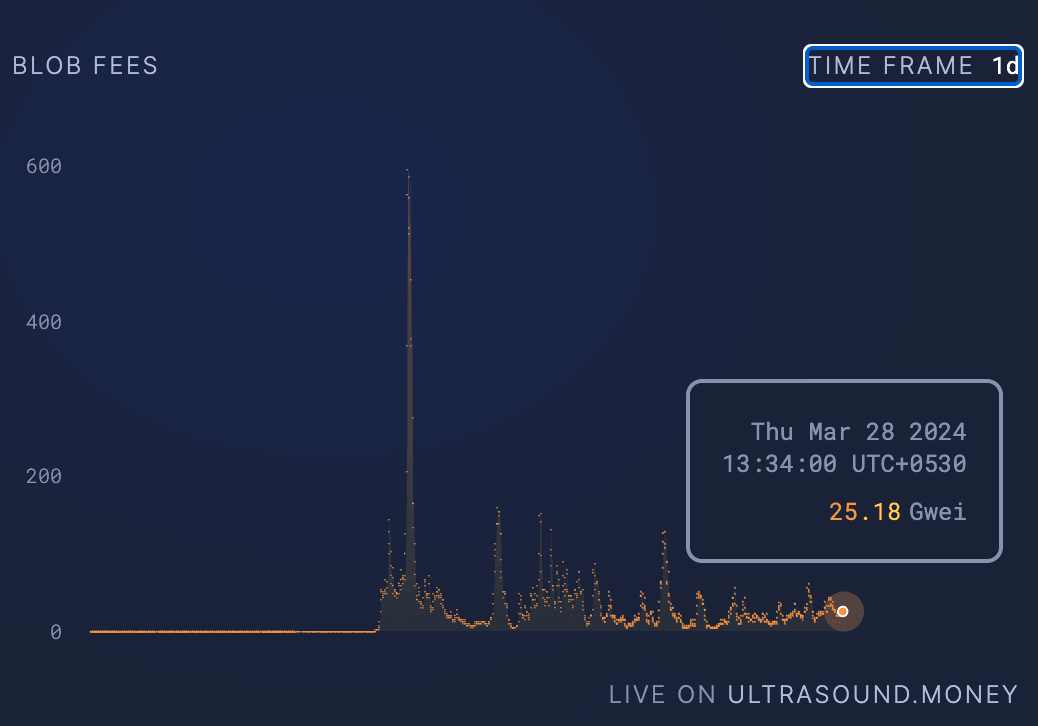

The surge in blob submissions on the Ethereum blockchain has resulted in a spike in transaction fees. These reached a peak of 586.26 Gwei on March 27 before falling to 25.18 Gwei on Thursday, as seen on Ultrasound.Money.

Blob Fees on Ethereum.

Ethereum price could rebound to year-to-date peak

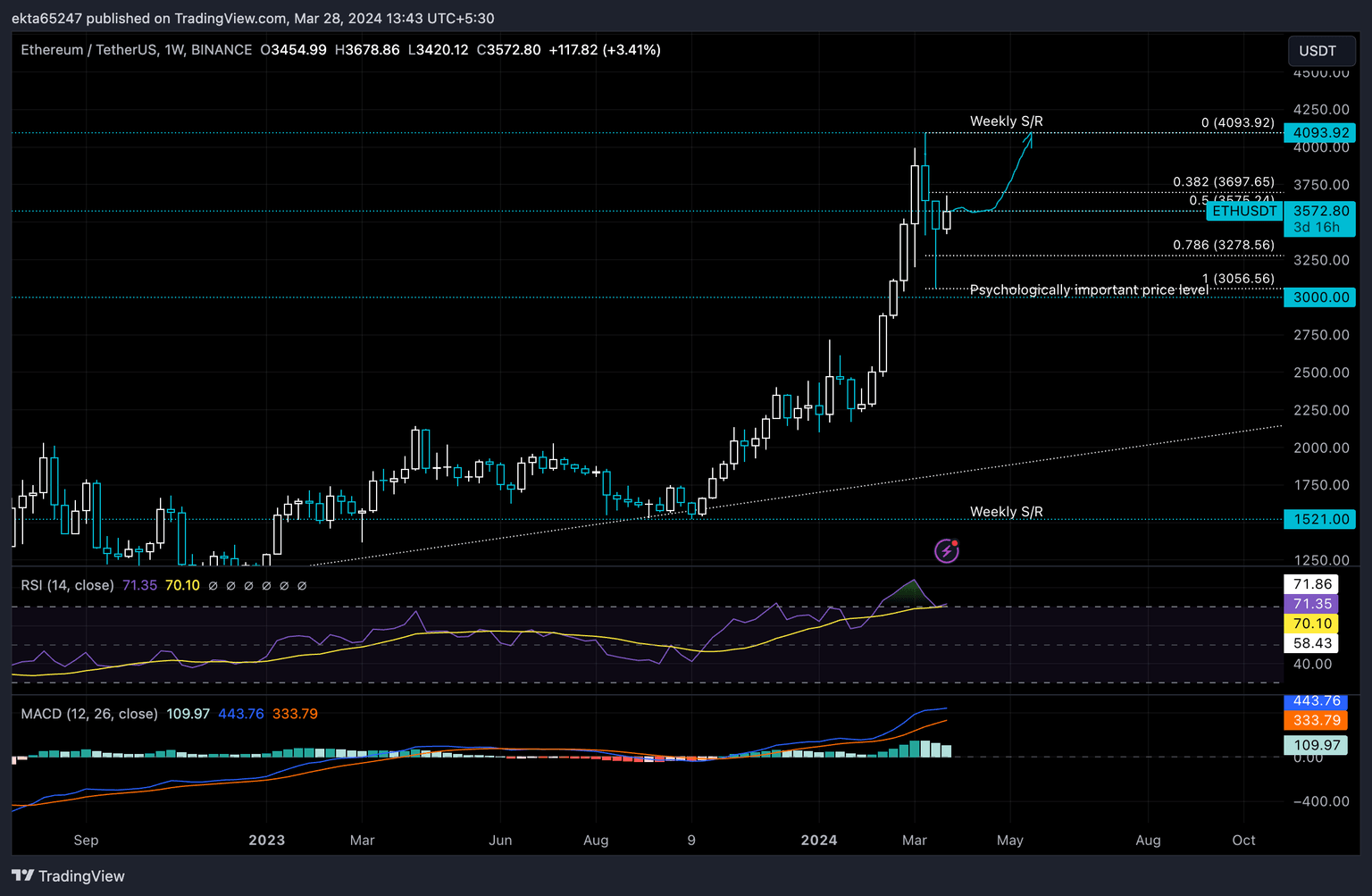

In the medium term, Ethereum price hinges on the Securities and Exchange Commission’s (SEC) decision on the Spot Ether ETF, alongside the rising utility of the chain for inscriptions. ETH is currently testing resistance at $3,697, the 38.2% Fibonacci placeholder of the decline from March 11 top of $4,093 to March 18 low of $3,056.

While the Relative Strength Index (RSI) is flashing sell signals in the overbought zone above 70, the green bars above the zero line in the Moving Average Convergence/ Divergence (MACD) still support a bullish thesis for Ether. There is a likelihood that Ethereum price resumes its climb towards the weekly resistance and the year-to-date peak of $4,093.92.

The altcoin needs to flip resistance at $3,697 into support in its rally towards the year-to-date (YTD) target.

ETH/USDT 1-day chart

In the event of a daily candlestick close below support at $3,278 (the 78.6% Fibonacci placeholder), the bullish thesis could be invalidated. In this case, ETH price could sweep the March 18 low of $3,056.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.