Ethereum price sits at make-or-break point while optimism grows around ETH 2.0 - Confluence Detector

- The audit results for the ETH 2.0 beacon chain is expected to be released this week.

- The 4-hour price is consolidating in an ascending triangle formation.

Ethereum’s next update, the ETH 2.0, is on the verge of its first major breakthrough. Developers announced that they are close to the long-awaited launch of the beacon chain. The delay has occurred due to an audit on a performance and security-focused signature library called blst. ConsenSys developer Ben Edgington believes that the results of the audit are expected this week.

On top of that, the Medalla Beacon Chain testnet is about to restart following a three-week pause due to validator inactivity. The total number of validators recently dropped to around 50%. It needs two-thirds to be online at all times for it to reach finality. According to Edington, the lack of validator participation is due to general testnet fatigue.

Ethereum on the verge of a breakthrough

After reaching a high of $417.30 on October 22, the premier smart contract platform dropped to $378 over the next week. After that, it went back up to $399.60 on November 2, before plummeting down to $384.50 within a session. Ethereum is currently trading for $382.65.

The four-hour chart of ETH/USD is currently consolidating in an ascending triangle formation. As per technical analysis, if the buyers take control, they should push the price up to $475. More important, it will be able to flip 50-bar SMA and 100-bar SMA ($390) from resistance to support.

ETH/USD 4-hour chart

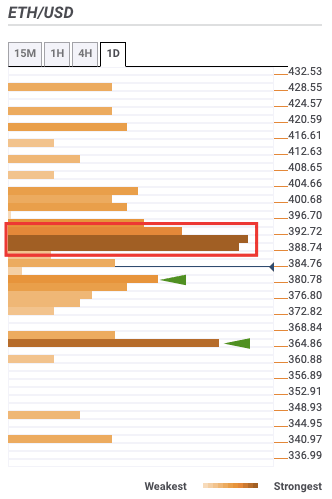

The confluence detector is a handy tool that helps us visualize strong levels of resistance and support. Upon crossing the 50-bar and 100-bar SMAs, the price lacks strong resistance till $475. After that, the buyers have the license to push the price up to $500.

Ethereum confluence detector

Another interesting metric that adds to our bullish outlook is the "miner balance." This chart shows us the total number of Ethereum tokens held by miners. After dipping from 1.13 million on October 20 to 1.11 million on October 24. Since then, the balance has gone up to 1.12 million. This is a bullish sign as it shows that the miners are not selling off their tokens and choosing to hold on to it instead.

Ethereum miner balance

How can the bears take back control?

Ethereum bears can take back control by dropping the price below the ascending triangle. If this does happen, then it will be devastating for the price. The downside target for the price is near $300. The only support level of note lies at the 200-bar SMA ($375) and the $385 support wall. If the sellers manage to break below these barriers, they should easily reach $300.

Key price levels to watch

Ethereum bulls will want to break above the 50-bar SMA and 100-bar SMA ($390) to reach the $500 zone.

On the downside, the sellers will want to take the price below the 200-bar SMA ($375) and the $385 support wall to reach $300.

Author

Rajarshi Mitra

Independent Analyst

Rajarshi entered the blockchain space in 2016. He is a blockchain researcher who has worked for Blockgeeks and has done research work for several ICOs. He gets regularly invited to give talks on the blockchain technology and cryptocurrencies.

-637399626818813134.png&w=1536&q=95)

%20%5B05.51.59%2C%2003%20Nov%2C%202020%5D-637399627527181584.png&w=1536&q=95)