ETH grand rally to $500 is imminent as long as this critical support level holds

- Ethereum price is $383 right above a critical support level.

- If the support level at $370 holds, ETH will target $500 as the next stop.

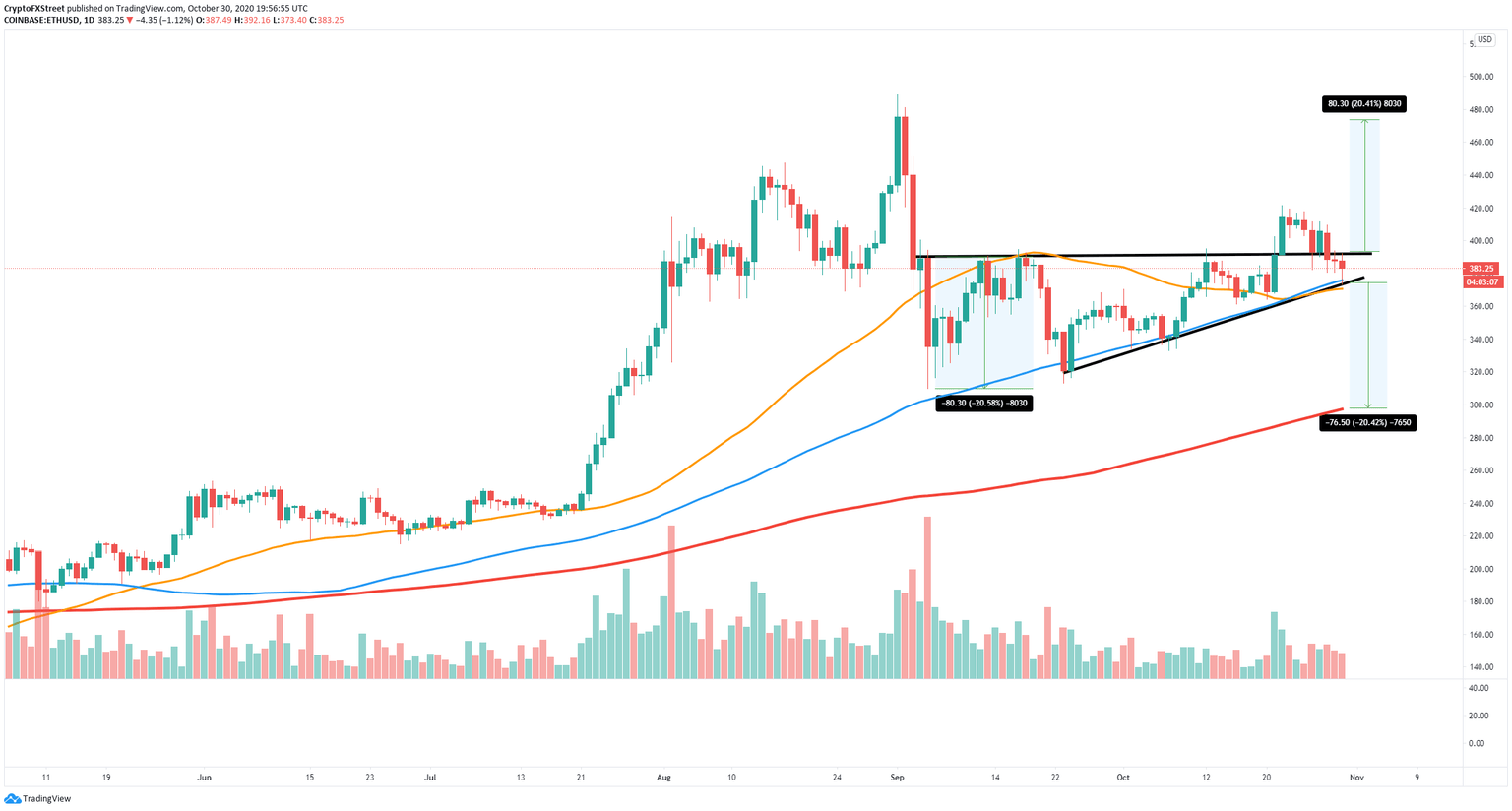

Ethereum was bounded inside an ascending triangle on the daily chart. On October 22, the digital asset had a significant breakout towards a high of $421. Around four days later, ETH re-tested the previous resistance level as support and finally lost it on October 28.

The lower boundary of the ascending triangle is now used as a support level which coincides with the 50-SMA and the 100-SMA creating a robust support point at $370. Bulls desperately need to hold this level to avoid slipping further.

Ethereum targets $500 as the next stop

As mentioned above, the $370 support level is critical. Successfully holding this point can easily drive the price of ETH to the last high at $421 and as high as $500 as there isn’t a lot of resistance on the way up.

ETH/USD daily chart

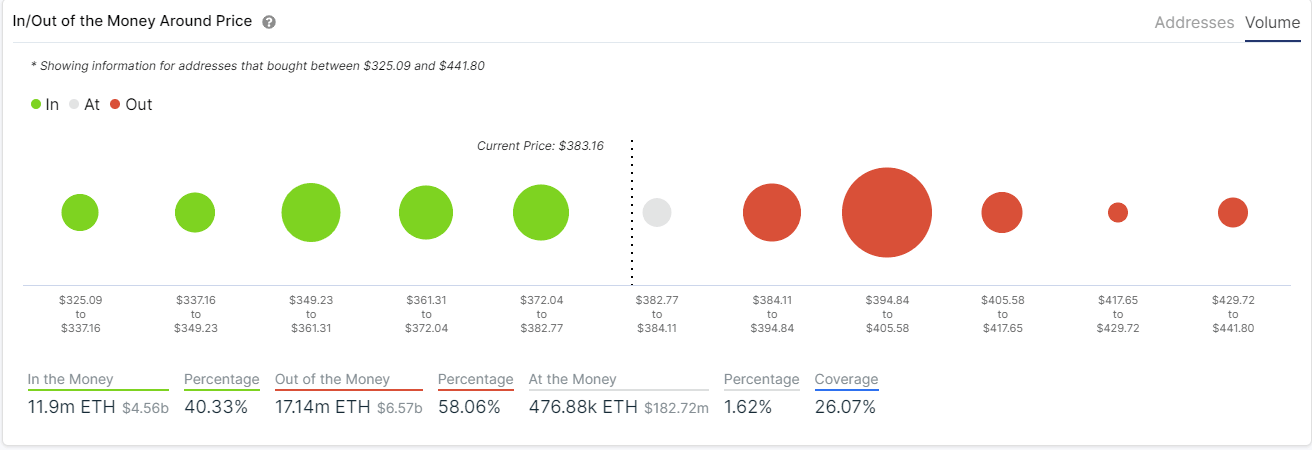

The In/Out of the Money Around Price chart shows a similar picture with a strong resistance area between $394 and $405 where 918,000 addresses bought 11.6 million ETH. This range represents the break-even point of the investors and it’s considered resistance. However, above this point, there seems to be close to no opposition.

ETH IOMAP chart

On the other hand, the same IOMAP chart shows very little support on the way down, which means that a breakdown of the $370 support level can easily drive the price of Ethereum towards $300 which coincides with the daily 200-SMA.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.