Ethereum price reclaims $2,000, but it will likely fail to breach a seven-month-old barrier

- Ethereum price is unable to find enough support from investors to push the altcoin beyond $2,142.

- Institutional investors did pour money into ETH this past month, but year to date, they are still noting $55 million worth of outflows.

- Whales, too, are booking profits on the short-term scale, selling nearly $1 billion worth of ETH in two days.

Ethereum price is back to trading above one of the most important psychological support levels, but it seems like this rally might not stick this time around either. The altcoin leader is facing resistance on the one hand and a lack of support from the investors on the other, making it rather difficult to break this seven-month-old curse.

Ethereum price reclaims key support

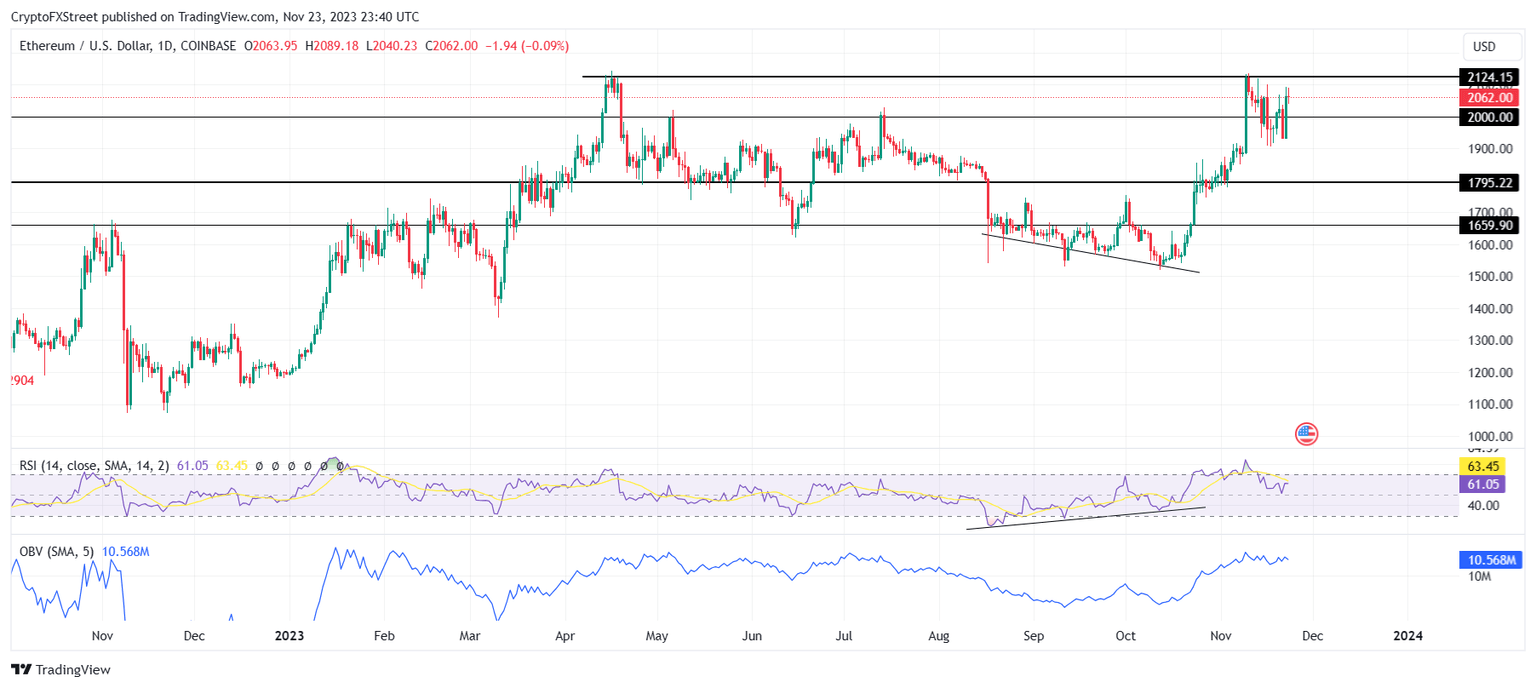

Ethereum price is trading at $2,062 after charting a 6.75% growth over the past 24 hours. The $2,000 support line is crucial not only for ETH to rally further but also acts as a key psychological support level.

The recent bullish divergence observed on the RSI confirmed that the demand for the asset was high at the beginning of Q4 but faltered as soon as ETH hit $2,124. This line has been acting as a resistance since April, and Ethereum has been unable to breach it for the second time.

The last time this level was successfully breached was back in April 2021. The potential of the same this time around is rather low, too, given the Relative Strength Index (RSI) does seem to be in the bullish zone, but the On Balance Volume (OBV) has not been rising in accordance with the price action.

Theoretically, when both price and OBV are making lower peaks and lower troughs, the downward trend is likely to continue. This means that ETH breaking out of the downtrend line is most likely a fakeout, and the altcoin will fall back down to lose the support of $2,000. This would send it back towards $1,900 or $1,795.

ETH/USD 1-day chart

On the off chance that investors push through, Ethereum could manage to test $2,124 as resistance again. Breaching it would invalidate the bearish thesis and open ETH to reaching $2,200.

Big wallet holders are still wary

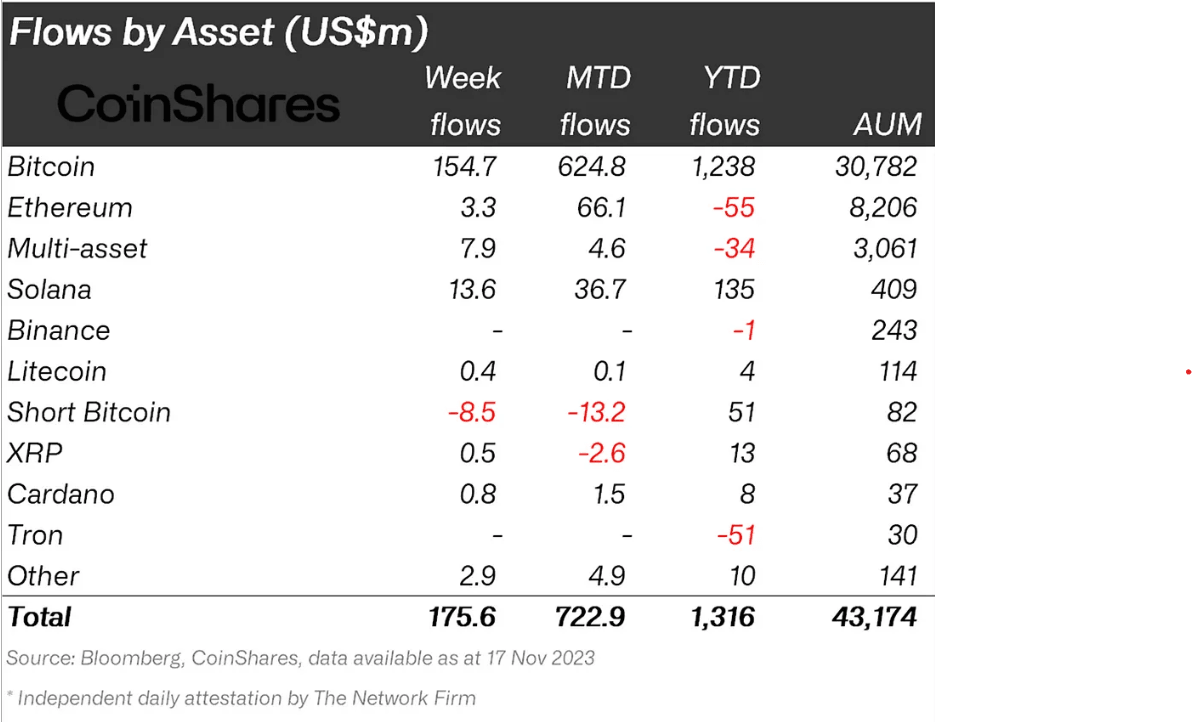

One of the key causes of Ethereum being unable to breach $2,124 is the lack of support it is receiving from large wallet investors such as whales and institutions. For the week ending November 17, ETH managed to bring in only $3.3 million from institutions, which is lower than even Solana’s $13.6 million.

While the month-to-date flows have seemingly improved, year to date, ETH is still noting outflows amounting to $55 million.

Ethereum institutional flows

Similarly, the whale addresses holding between 100,000 and 1 million ETH, which have been key drivers of the price action. Even they seem to be skeptical at the moment, as they sold nearly over $948 million worth of 460,000 ETH in the span of two days to book profits and offset losses, bringing their holding to 20.06 million ETH.

Ethereum whale holdings

Thus, as long as Ethereum fails to gain the conviction of these key cohorts, the price action will most likely continue to falter.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.

%2520%5B05.10.26%2C%252024%2520Nov%2C%25202023%5D-638363826790486388.png&w=1536&q=95)