Ethereum price rally could extend, riding on bullish on-chain metrics

- Ethereum network’s 200 largest wallets hold $124.1 billion in Ether, after consistent accumulation in the past year.

- ETH supply on exchanges declined nearly 20% in the past six months, supporting Ethereum price gains.

- Ethereum price crossed the psychological barrier at $2,000, ETH targets the $2,200 level seen in May 2022.

Ethereum has noted a considerable increase in accumulation by large wallet investors. Large ETH wallets scooped up ETH tokens consistently over the past year, and the altcoin recorded the highest spike in new wallets created on Tuesday.

Ethereum price gains are supported by bullish on-chain metrics for the altcoin.

Also read: Grayscale meets SEC for spot Bitcoin ETF listing, markets await multiple approvals

Ethereum wallets engage in ETH accumulation

Based on data from crypto intelligence tracker, Santiment, the 200 largest wallet addresses holding Ether, added 62.76 million ETH tokens to their wallet. These Ether tokens are worth $124.1 billion and the wallets accumulated 30.3% more ETH since November 2022.

94,700 new Ethereum wallets were created on Tuesday, one of the highest spikes since July 2023.

New ETH wallet addresses and whale holdings

Ethereum supply on exchanges hits lowest level in six months

According to Santiment data, the ETH token supply on exchanges declined nearly 20% in the past six months. ETH supply on exchanges has hit its lowest level in six months, supporting a bullish thesis for the altcoin’s price gains. The selling pressure on the altcoin has consistently declined, leaving room for gains.

ETH supply on exchanges and price

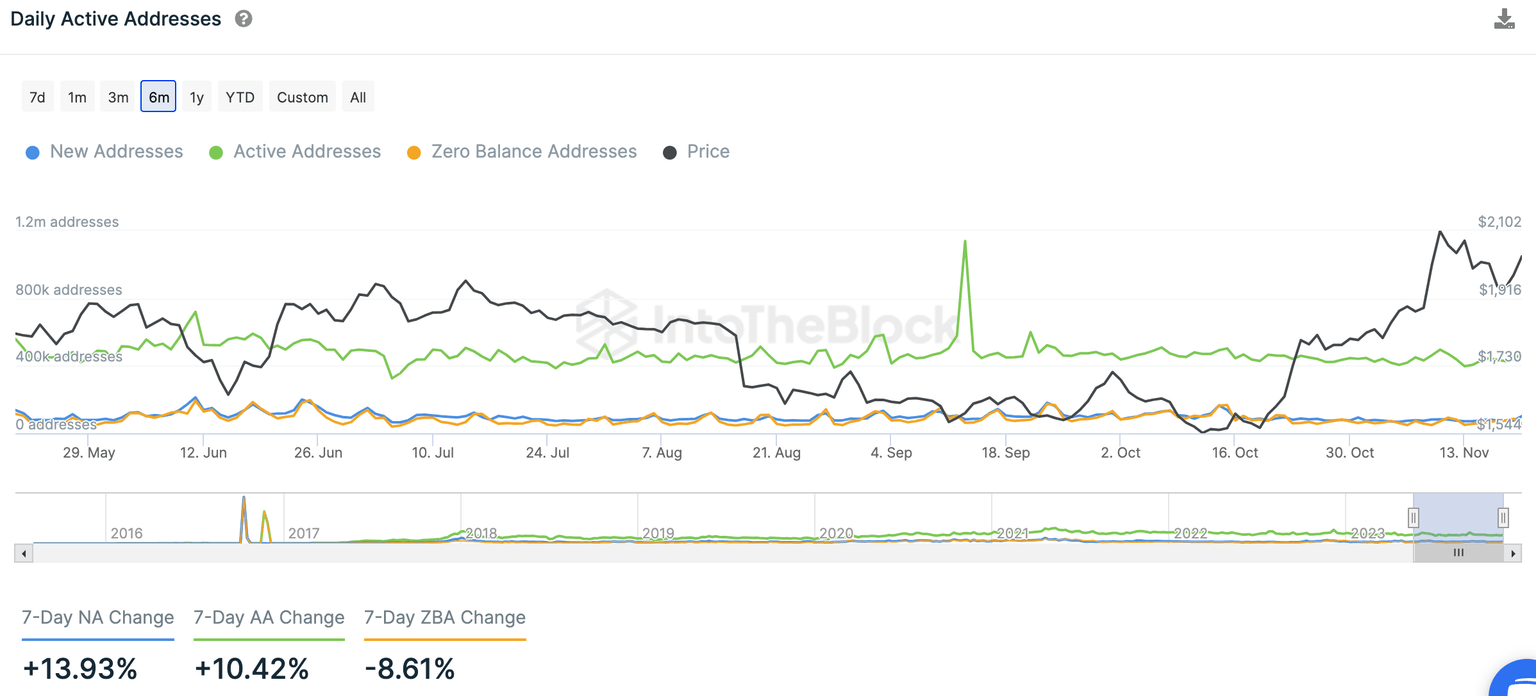

While supply declines, there is an increase in activity from ETH wallets. The following chart from crypto intelligence platform IntoTheBlock, points to the rise in Active Addresses and New Addresses in the Ethereum network, in the past week. This metric helps identify the demand for Ethereum among market participants and the activity in the ETH network. Higher activity and increase in new wallet creation during a price uptrend is typically considered bullish for the asset.

Active Addresses and New Addresses created in ETH

Ethereum price crossed the $2,000 psychological barrier, early on Tuesday, and the altcoin is likely to extend its gains. The next significant price level for Ethereum is $2,200, the last time the altcoin traded above $2,200 was in May 2022.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.

%2520%5B13.21.44%2C%252022%2520Nov%2C%25202023%5D-638362376964987637.png&w=1536&q=95)