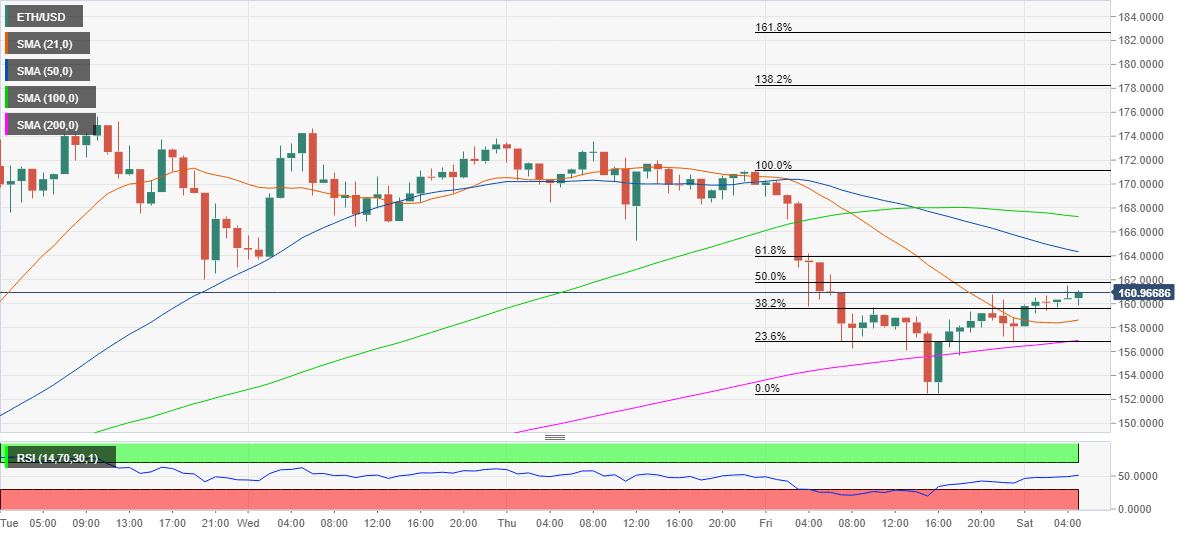

Ethereum Price Prediction: Recovery to gain traction only above $164

- ETH/USD consolidates the bounce from four-day lows on Saturday.

- $164 is the level to beat for the ETH bulls.

- RSI on hourly sticks trades flat at the midline.

Having witnessed a steep sell-off on Friday, Ethereum (ETH/USD) is consolidating the recovery from a four-day low of 152.48 so far this Saturday’s quiet trading. The spot remains stuck in a $5 range, as the bulls await a fresh impetus to extend the recent leg higher. The second-most traded cryptocurrency eroded almost $12 a day before, having rallied as high as $170.29 before settling at $158.10. The coin did manage to reverse a part of the previous losses but the rebound could likely gain traction only above the 164 level.

At the time of writing, Ethereum is up nearly 1.80% around 161.00, enjoying a market capitalization of about $ 17.70 billion.

Short-term technical outlook

As observed in the hourly chart, the no. 2 coin has recovered half the Friday’s decline, with the bulls now facing exhaustion at the 50% Fibonacci Retracement of the slump. The buying interest will pick up pace should the price break through the latter. The next resistance is aligned around 164.00 levels, the intersection of the critical 61.8% Fib and the bearish 5-hourly Simple Moving Average (HMA). A reversal from Friday’s troughs will likely resume only on an hourly closing above the abovementioned supply area, opening doors for a test of the horizontal 100-HMA barrier at 167.27.

At the moment, the hourly Relative Strength Index (RSI) is trading neutral at the midline, suggesting a lack of clear directional bias. A breach of the immediate support of the 38.2% Fib at 159.55, will pave the way for a test of the flatter 21-HMA at 158.60 and through that the daily low of 158.05. The next support awaits the confluence of the upward sloping 200-HMA and 23.6% Fib around 156.90

ETH/USD 1–hour chart

ETH/USD key levels to consider

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.