Ethereum Price Prediction: ETH on the cusp of further losses, $1,500 probes sellers

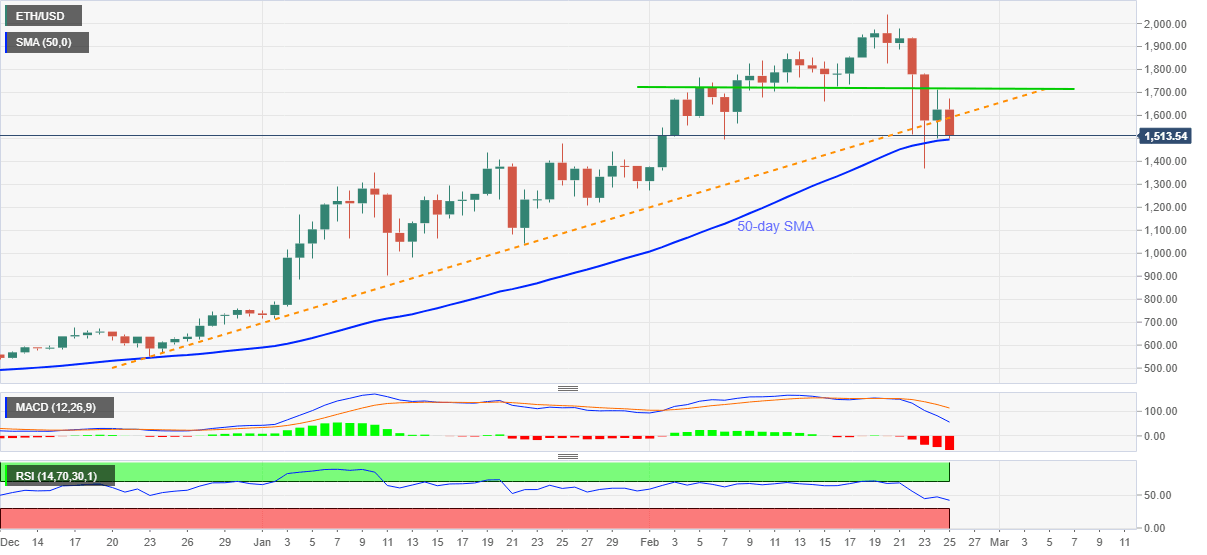

- ETH/USD bounces off 50-day SMA, keeps trend line breakdown amid bearish MACD.

- Descending RSI exerts additional downside pressure, bears await confirmation.

- Multiple upside hurdles around $1,720 stand tall to test recovery moves.

Having conquered a two-month-old support line, now resistance, Ethererum bears are catching breather around $1,520 during the early Friday’s trading. In doing so, the ETH/USD pair bounces off 50-day SMA.

Even so, bearish MACD and downward sloping RSI line favor the sellers targeting $1,200. Though, a sustained break below the 50-day SMA level of $1,495 becomes necessary for the ETH/USD sellers.

In a case where the altcoin fall extends below $1,200, the late January lows near $1,040 and the $1,000 psychological magnet will be the key to watch.

Meanwhile, corrective pullback beyond the previous support line, at $1,590 now, will have to cross a horizontal area comprising multiple levels marked since February 05, near $1,710, to recall the ETH/USD buyers.

Following that the mid-month high around $1,880 and the $2,000 round-figure can off intermediate halts before directing the bulls to the record top of $2,041.

ETH/USD daily chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.