Ethereum Price Prediction: ETH could soon see $3,800

- Ethereum price pumps over 10% hitting new twelve-day highs, but halted against crucial resistance.

- Buyers eye a breakout above the Cloud to confirm a future bull run.

- The Chikou Span remains the final lynchpin to confirm any further upside potential.

Ethereum price catches the same rally as Bitcoin and the broader market. However, it is now approaching three key resistance zones that must be broken to move higher.

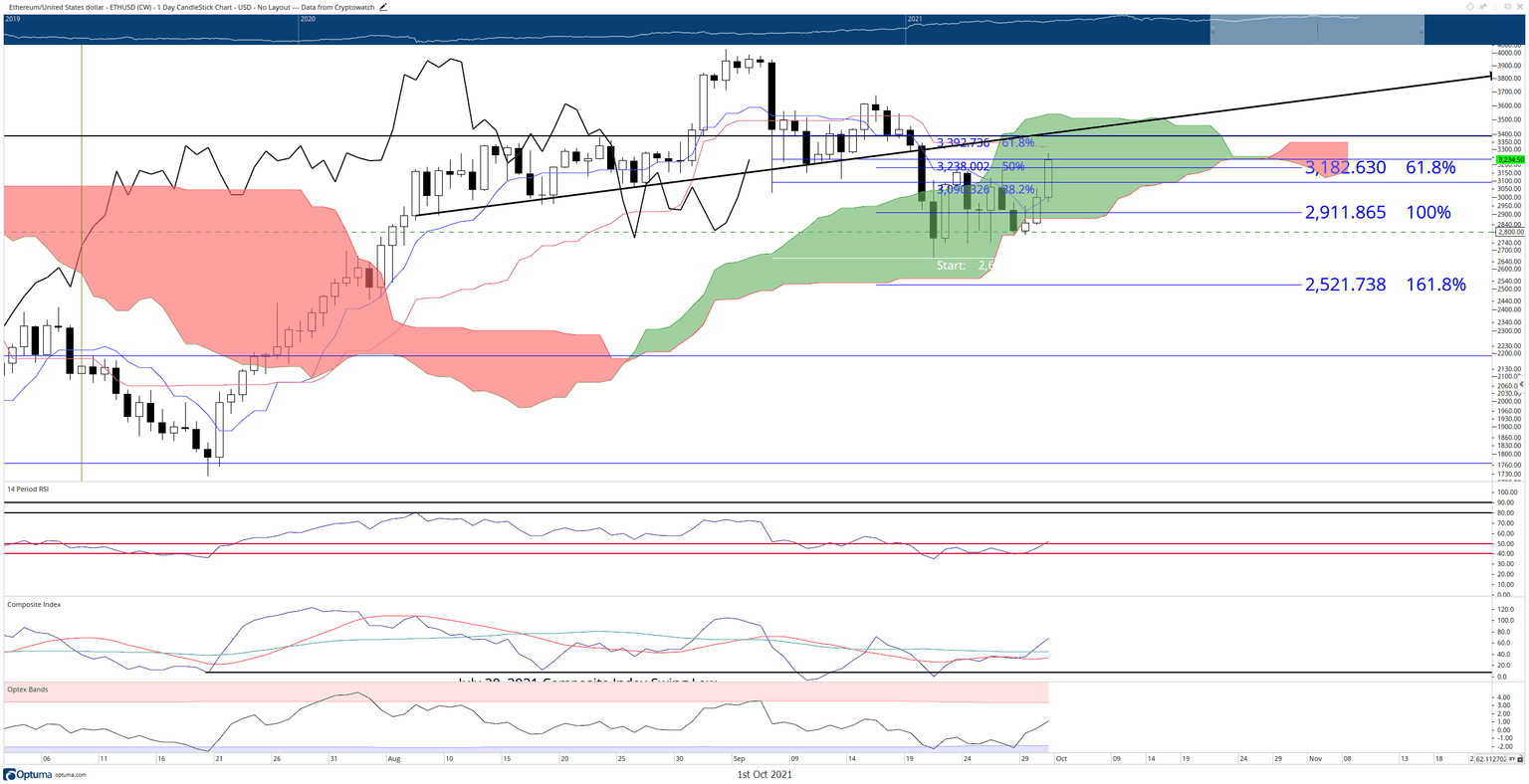

Ethereum price looks to $3,800 to initiate a run towards new all-time highs

Ethereum price, like many high market cap cryptocurrencies, is inside the Cloud. The Cloud is a particularly volatile and indecisive environment and one where people should not be comfortable. Whipsaws of price action and sudden extreme moves are normal.

The Relative Strength Index found support against the last oversold condition in a bull market, 40, and is presently above the 50 level – indicating upside potential. However, Ethereum price has spent a reasonable amount of time between 40 and 50, so 55 should be watched as a resistance level.

There is a strong bounce off of the extreme lows in the Optex Bands, lending strength to any bullish move. Additionally, the Composite Index has crossed above both of its moving averages. Thus, the combination of the Composite Index and Optex Bands conditions are favorable for further upside potential for Ethereum price.

ETH/USDT Daily Ichimoku Chart

However, bulls have a massive roadblock ahead at the $3,400 value area. The neckline of the most recent head-and-shoulders pattern, 61.8% Fibonacci retracement, a high volume node in the volume profile, Senkou Span A (top of Cloud), and the Kijun-Sen all exist within the $3,400 value area. This resistance, while incredibly strong, will provide integrity to any Ethereum price move that breaks out above it.

Should $3,400 hold as resistance, then a return to $2,800 is likely.

Like this article? Help us with some feedback by answering this survey:

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.