Ethereum Price Prediction: ETH bulls brace for a bumpy road towards $1400

- ETH buyers contemplating the next move higher.

- $1400 remains in sight so long as 21-SMA on 4H chart holds.

- Overbought conditions on 1D chart point to a brief bullish consolidation

ETH/USD seemingly lacks a clear directional bias while trading around $1200 so far this Saturday, having staged a strong bounce from Friday’s deep correction to sub-$1100 levels.

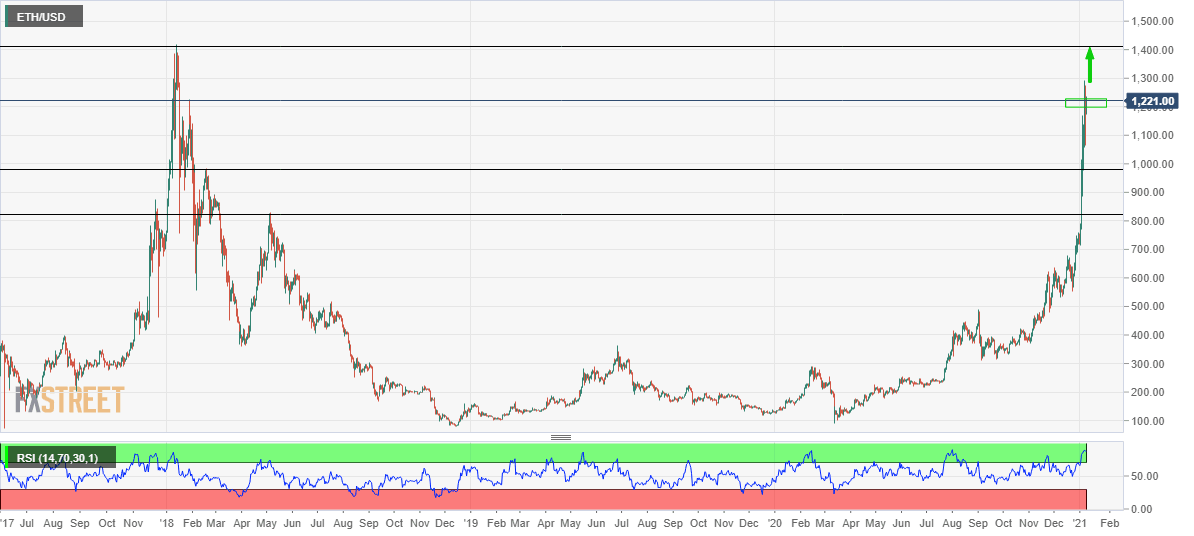

ETH/USD: Daily chart

As observed in the daily chart, Ethereum has additional room to the upside, with eyes set on the January 14 2018 high at $1419.

However, doji candlesticks formed for the third day in a row have left the buyers unnerved. Further, the 14-day Relative Strength Index (RSI) holds in the overbought region, around 88.0, flashing caution for the bulls.

Therefore, the price could enter a period of consolidation around the current levels before the buyers gear up for re-entry. At the moment, there seems to be strong demand around the $12K mark.

Friday’s low of $1063 could be put to test if the corrective pressure mounts.

-637457855949214244.png&w=1536&q=95)

ETH/USD: Four-hour chart

Narrowing down to the four-hour chart structure, the further upside appears more compelling, as the no. 2 coin has once again managed to defend the critical 21-simple moving average (SMA), which is currently placed at $1194.

It’s worth noting that the price has not closed the candle below the 21-SMA since January 2 2021.

ETH/USD wavers within a potential rising wedge pattern. A breach of the abovementioned crucial support could expose the rising trendline support at $1139, below which Friday’s low remains in sight.

However, a run up towards the rising trendline resistance at $1348 and beyond looks likely, as the RSI points north above the midline, now standing firmer at 59.80.

ETH/USD: Additional levels to watch

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.