Ethereum Price Forecast: Buyers aim for $3,000 as more than $52 billion worth of ETH locked away

- Ethereum price aims for new all-time highs with weak resistance ahead.

- Around $52.2 billion worth of Ethereum is locked in DeFi currently.

- Several indicators show that ETH bulls have the upper hand in the short and long terms.

Ethereum price has been under consolidation for the past week after a run to its new all-time high of $2,151. The digital asset faces weak resistance ahead according to various on-chain metrics while bulls target $3,000.

Ethereum price becomes scarcer and targets $3,000

One of the main strengths of Ethereum is the significant number of coins locked away from exchanges. At current prices, there is over $52 billion worth of Ethereum locked in DeFi protocols.

ETH locked in DeFi

Additionally, the ETH2 deposit contract also holds 3.75 million ETH worth around $7.7 billion, which means that close to $60 billion worth of Ethereum is out of exchanges.

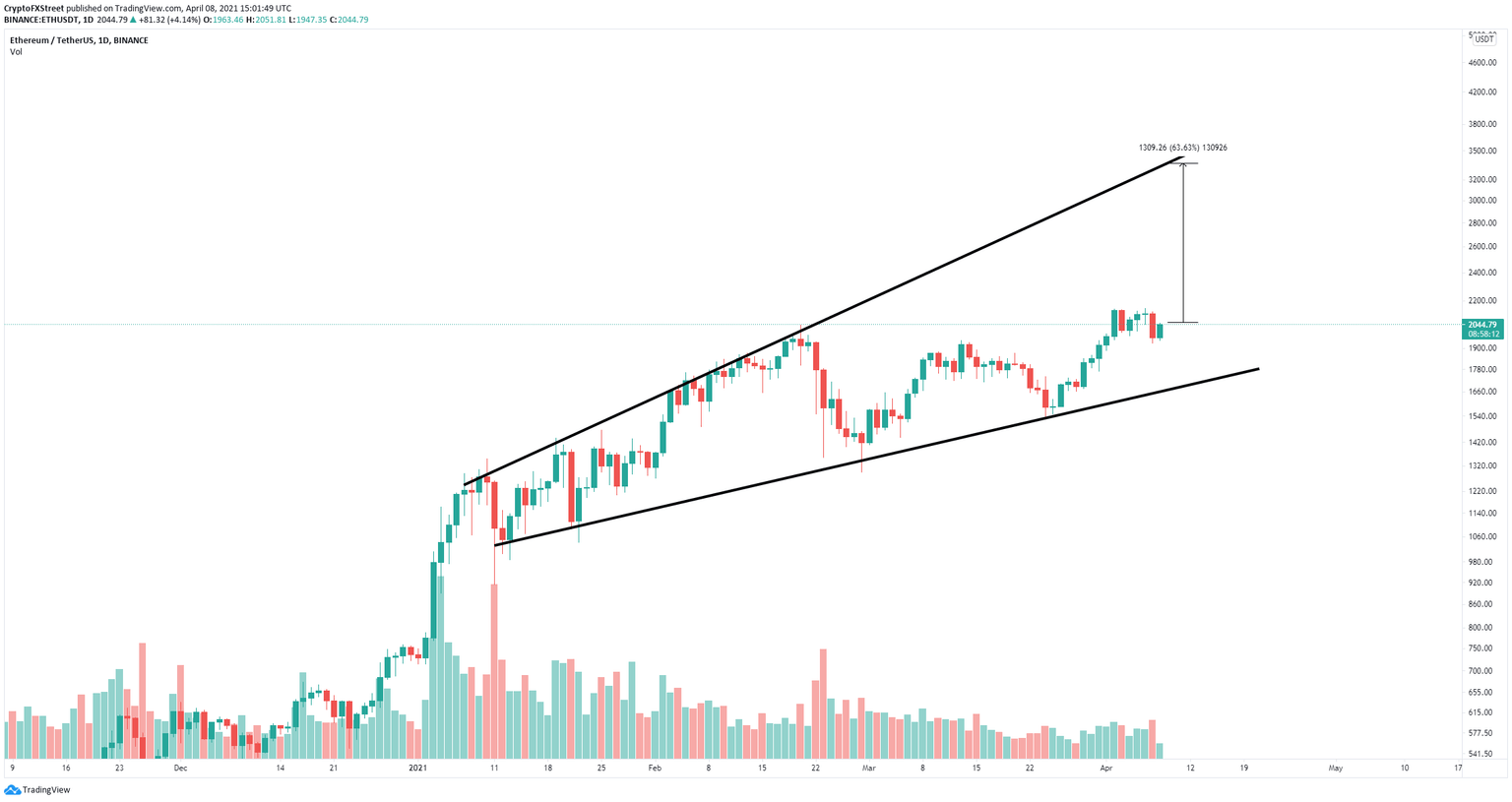

ETH/USD daily chart

Ethereum has formed an ascending broadening wedge pattern on the daily chart. This pattern can be drawn connecting the higher highs and higher lows with two trendlines. A breakout above the previous all-time high has a price target of $3,000 at the top of the pattern.

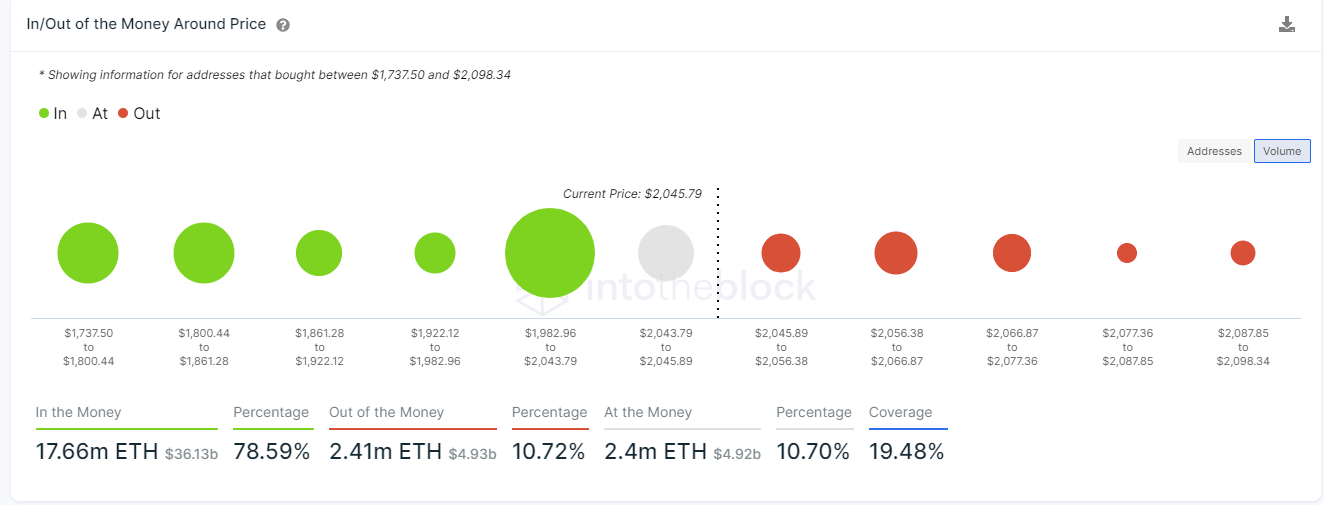

ETH IOMAP chart

The In/Out of the Money Around Price (IOMAP) chart indicates practically no resistance above $2,000. The strongest area is between $2,056 and $2,066 where 143,000 addresses purchased almost 1 million ETH.

However, losing a critical support area between $1,982 and $2,043 where 332,000 addresses bought over 9.2 million ETH would be devastating for the bulls. This breakdown can easily lead Ethereum price towards the lower boundary of the pattern at $1,700.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B17.03.51%2C%252008%2520Apr%2C%25202021%5D-637534975562179848.png&w=1536&q=95)