Ethereum price briefly touches $3,000 for third time in a week

- Ethereum price revisited its local top of $3,000 as market participants turned euphoric on Thursday.

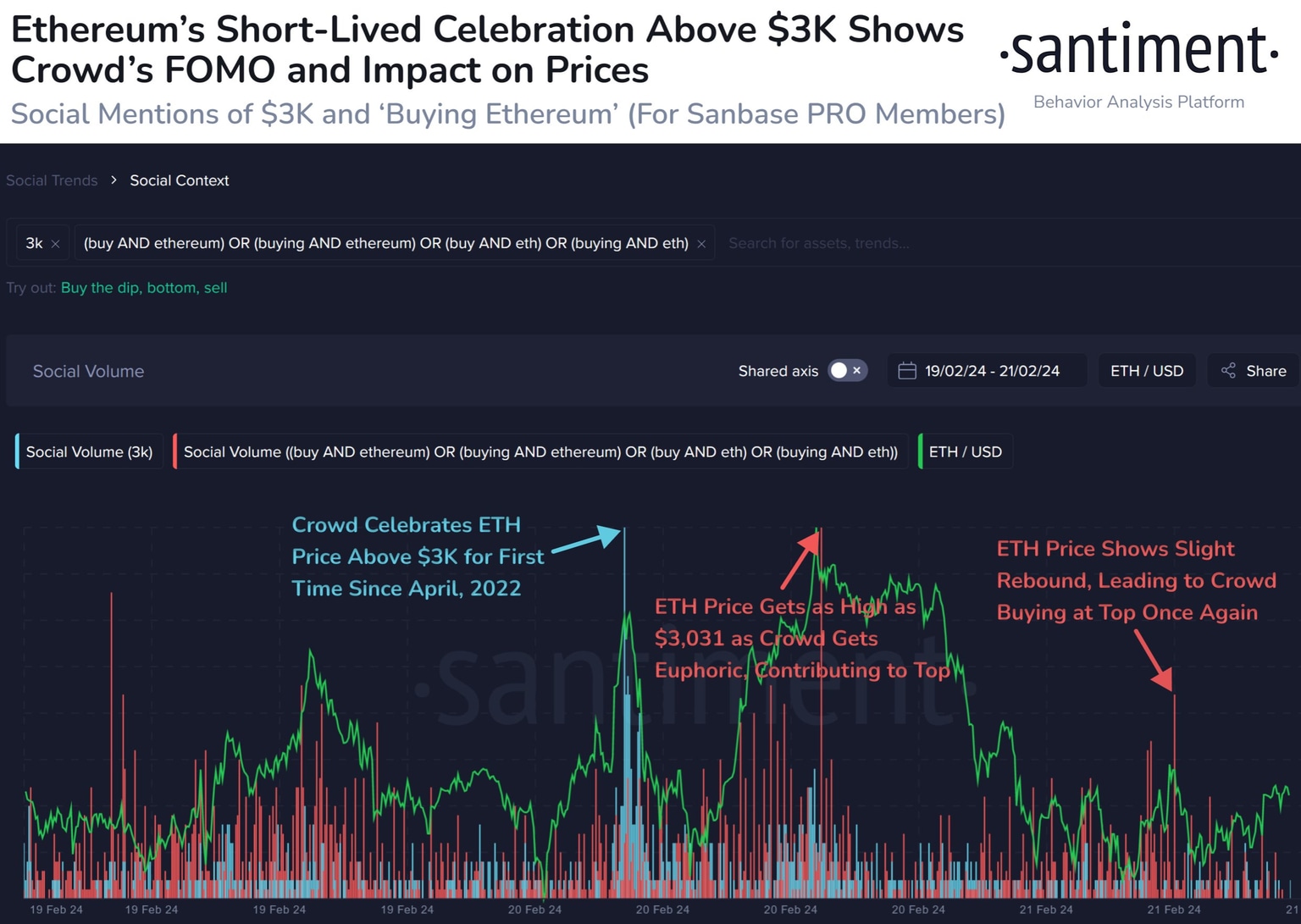

- Social media mentions of buying Ethereum and $3,000 peaked on Wednesday.

- ETH price could revisit its support at $2,601 before retesting its 2024 peak.

Ethereum price crossed $3,000 for the third time this week, resulting in euphoria among crypto market participants. On-chain intelligence firm Santiment noted that traders bought Ethereum at the local top, above $3,000, out of the Fear Of Missing Out (FOMO).

Also read: XRP price suffers pullback with latest update in SEC v. Ripple lawsuit

Ethereum price crosses $3,000 yet again

Ethereum price has crossed the psychologically important $3,000 level several times this week, with no sustained continuation of the uptrend. ETH price has corrected briefly each time the altcoin revisits the $3,000 mark.

On-chain intelligence tracker Santiment identified the likely driver of the price rally to $3,000. Each time Ethereum price hit its local top, there was an increase in the mention of “$3K,” “buy,” or “buying Ethereum” in relation to ETH. This indicates there was an increase in FOMO among market participants and this resulted in traders buying ETH at the local top, above $3,000.

This also explains why Ethereum’s run to $3,000 has been a short-lived trip each time.

Ethereum rallies to $3,000 yet again. Source: Santiment

Other factors influencing Ethereum price are Bitcoin price trend, which is currently sideways below the $52,000 level and the anticipation surrounding the approval of a Spot Ethereum ETF. Bitcoin’s price trend and the next move, a rally towards $53,000 or a correction towards the psychologically important $50,000 level, could determine where Ethereum price is headed next.

Additionally, the anticipation surrounding the Spot Ethereum ETF could die down soon and ETH price fails to sustain its recent gains.

Ethereum price could revisit 2024 peak on one condition

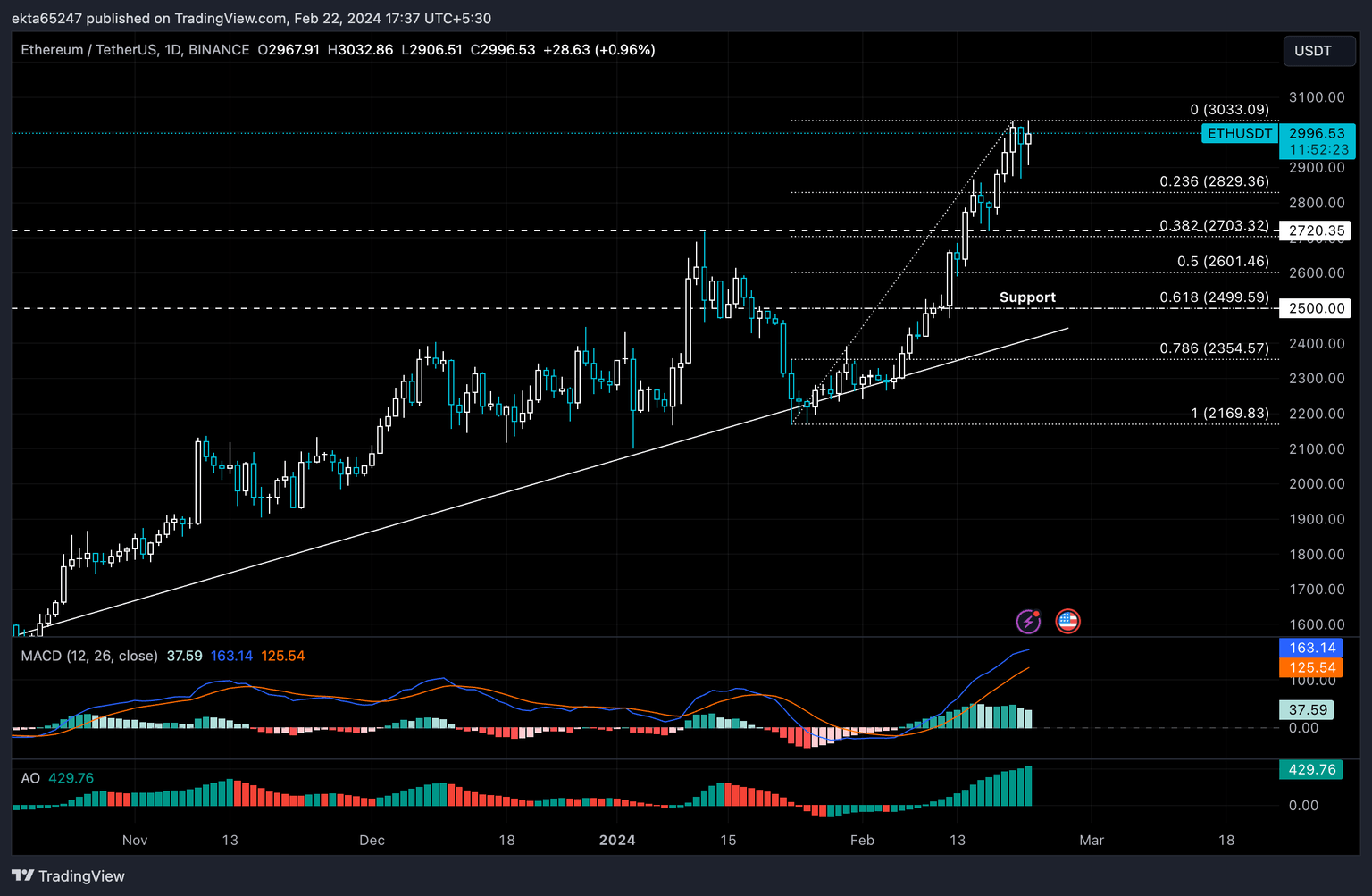

Ethereum price is in uptrend and the altcoin is currently trading close to the 23.6% Fibonacci retracement level of its rally to the 2024 top of $3.033.09, at $2,829.36. Ethereum price needs to hold steady above support to attempt another rally towards its yearly high.

Sustained buying pressure and positive momentum can help Ethereum price rally higher. The green bars on the Moving Average Convergence/ Divergence (MACD) and the Awesome Oscillator (AO) suggest that there is positive momentum and Ethereum’s uptrend is intact.

ETH/USDT 1-day chart

If Ethereum price closes below $2,829.36, it could result in a sweep of support at 38.2% Fibonacci retracement of $2,703.32 and even the 50% Fib retracement at $2,601.46 if the correction is steep. ETH price is likely to recoup its losses, rallying towards the $3,033.09 target post the correction.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.