Ethereum Price Analysis: ETH/USD climbs above $220, bulls eye the $230 hurdle

- Ethereum price advances above the key $210 - $220 support zone.

- A break past a short term trendline is needed to pave the way for gains above $230 resistance zone.

Ethereum is making steps above a key support area between $210 and $220. The price teeters at $220 following a 1.93% recovery on the day. The Asian session has seen the bulls cement their position on the market while aiming for a comeback above $230 and $250 resistance zones.

The weekend session has been more or less lethargic where the upside remained capped at $230 while all downside movements protected at $210. A short-term descending trendline has continued to limit movement northwards since the drop on February 23.

ETH/USD is trading below the moving averages where the 50 SMA will hinder growth at $240 on the 4-hour chart while the 100 SMA holds the position at $253.95. A break above the trendline resistance is needed to pave the way for gains above $230. The RSI reflects the subtle bullish momentum at the time of writing, which means that rapid upward movements are not to be expected in the coming sessions. The drab bullish action is also supported by the momentum indicator’s horizontal movement at -12.87

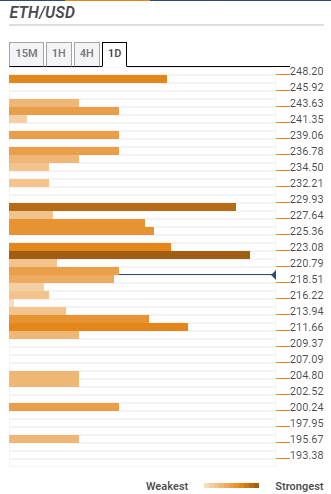

Confluence Detector support and resistance

Support one: $218 highlighted by the previous low 15-minutes and the previous high 1-hour.

Support two: $213 highlighted by the Bollinger Band 1-hour lower curve and previous low 4-hour.

Resistance one: $223 highlighted by the 61.8% Fibo one-month and the SMA ten 4-hour.

Resistance two: $229 highlighted by the previous high one-day.

ETH/USD 4-hour chart

-637187159585413825.png&w=1536&q=95)

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren