Ethereum Layer 2 transaction volume surges driven by system upgrades, increasing partnerships

- Ethereum Layer 2 chains have seen a spike in the total value of assets locked in the past thirty days.

- The upcoming Dencun upgrade includes EIP-4844, which is key to cost reduction for Layer 2 chains.

- Partnerships and Ethereum ecosystem upgrades are likely drivers of the Layer 2 narrative in Q1 2024.

Ethereum ecosystem’s scaling solutions, Layer 2 chains, have observed a steady increase in their transaction volume since the beginning of the year. The rising relevance and utility of these Layer 2 chains can be attributed to the upcoming transaction cost decline with the Ethereum ecosystem upgrade and the rising number of relevant partnerships.

Also read: Polygon unveils AggLayer: A solution to long-standing Ethereum Layer 2 challenges

Ethereum Layer 2 chains see spikes in transaction volume and TVL

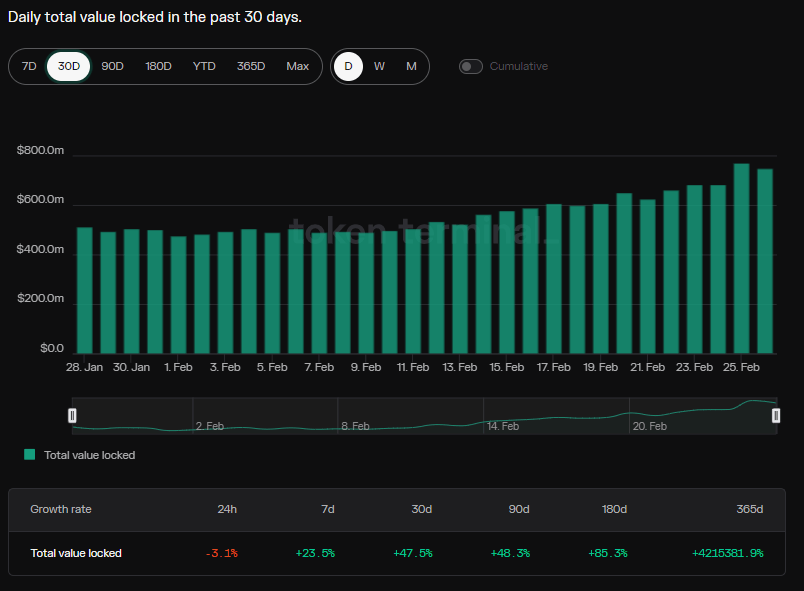

The Total Value Locked (TVL) of assets in zkSync, an Ethereum Layer 2 chain, is approaching 750 million. The metric has been in an uptrend in the past 30 days and despite a small decrease in the past 24 hours, the uptrend is consistent.

Other Layer 2 chains, including Polygon, Arbitrum and Optimism, among others, have observed a similar trend of TVL increase in the same timeframe.

zkSync Daily TVL. Source: TokenTerminal

The rising TVL is a sign of higher adoption and utility of the Layer 2 chains. The likely driver of these gains is the upcoming Ethereum upgrade, Dencun. The upgrade is packed with various Ethereum Improvement Proposals (EIPS), of which EIP-4844 (also known as proto-danksharding) is key to Layer 2 protocols.

EIP-4844 is expected to introduce “blobs” that reduce the storage burden on the Ethereum mainnet and make fees cheaper for rollups and Layer 2 chains. Dencun upgrade goes live on March 13.

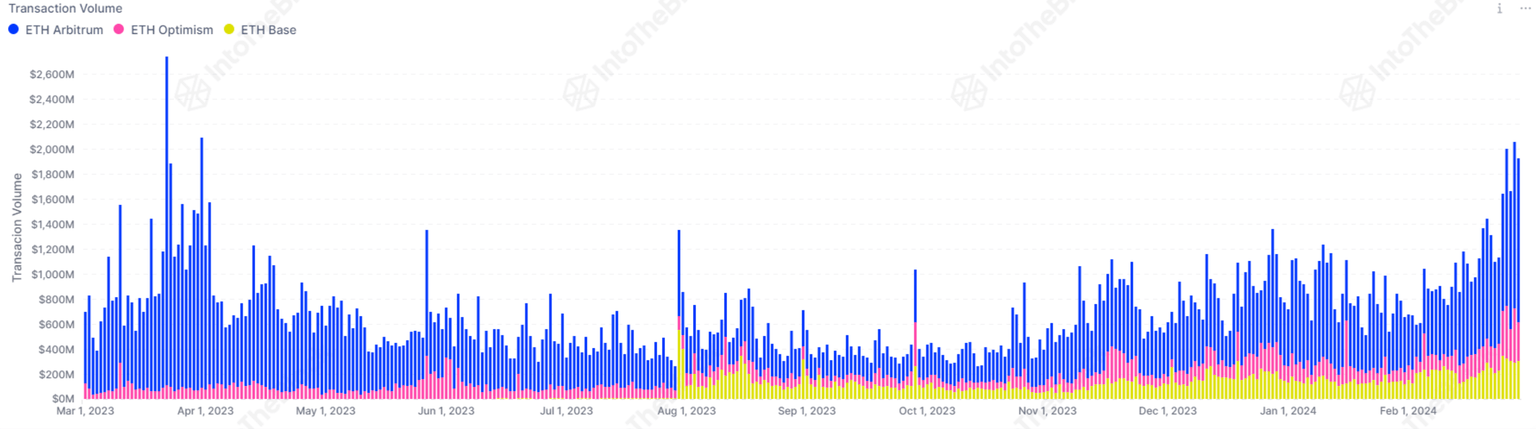

The second catalyst that has sparked the 91% increase in Layer 2 transaction volumes is the partnerships by L2 projects.

Ethereum Layer 2 transaction volumes. Source: IntoTheBlock

Arbitrum recently announced a long-term partnership with Robinhood. This is expected to broaden ARB users’ access to the Web3 ecosystem and onboard Robinhood users, offering them a feature to swap their tokens on Arbitrum-based DEXes.

We’re very excited to announce a long-term collaboration with @RobinhoodApp that will encompass features dedicated to lowering the barrier for onboarding new users into Web3 through #RobinhoodWallet https://t.co/m4s1cjWbKt

— Arbitrum (,) (@arbitrum) February 29, 2024

Another key L2, Metis has announced its strategic partnerships with Chainlink, Eigen Layer, Renzo Protocol and DeFi Kingdoms. These partnerships are focused on making Metis a self-sustainable Layer 2 chain.

We’re very excited to announce a long-term collaboration with @RobinhoodApp that will encompass features dedicated to lowering the barrier for onboarding new users into Web3 through #RobinhoodWallet https://t.co/m4s1cjWbKt

— Arbitrum (,) (@arbitrum) February 29, 2024

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.