Ethereum investment funds saw record outflows of $50m

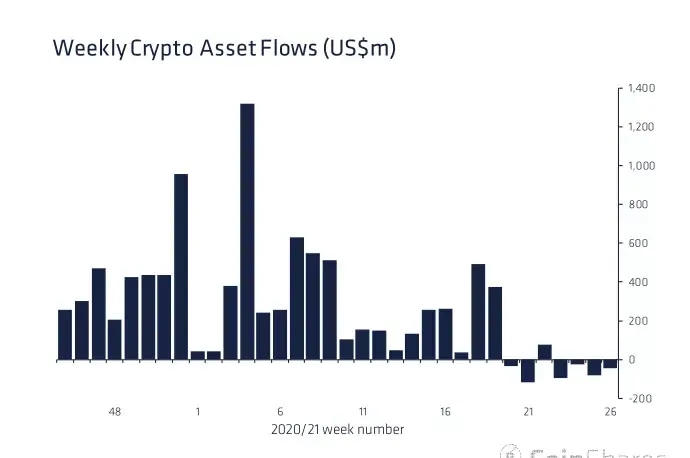

Net outflows from cryptocurrency funds totaled $44 million for the week ending June 25, marking the fourth consecutive week of redemptions.

Investors are exiting digital asset investment products, including funds focused on bitcoin (BTC, +6.26%) and ethereum (ETH, +16.57%), as a wave of negative sentiment weighs on cryptocurrencies.

Net outflows from cryptocurrency funds totaled $44 million for the week ending June 25, marking the fourth consecutive week of redemptions.

Ethereum products suffered net outflows of $50 million last week, the largest on record since 2015, according to a report by CoinShares published Monday. The movement marks a reversal from the trend so far in 2021, with Ethereum-focused products having garnered a net of $943 million for the year to date as investors diversified away from bitcoin.

- “Since mid-May, as negative sentiment has remained prevalent, net weekly outflows now total $313 million," representing 0.8% of total assets under management (AUM), according to CoinShares.

- On a relative basis, the total outflows of digital asset funds last week “remains small in comparison to the negative sentiment in early 2018, where outflows as a percentage of AUM totaled 4.9%.”

- Multi-asset digital investment products saw inflows of $6 million last week, suggesting that investors are seeking diversification across cryptocurrencies, beyond bitcoin and ethereum.

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.