Ethereum Classic Price Prediction: $18 or $25 - Traders forced to decide

- Ethereum Classic price fell by 5% last week.

- ETC shows potential for a 15% decline targeting the $18 zone

- The bulls will need to hurdle the $22.20 level to invalidate the bearish scenario

Ethereum Classic price is displaying bearish technicals that could be of concern. Key levels have been defined to gauge ETC's next potential move.

Ethereum Classic price shows bearish influence

Ethereum Classic price could be rewarding bears who jumped in early last week during the uptrend spike towards the $24 zone as the technicals are alluding to an imminent downswing. On February 27, the Ethereum Classic price hovers 5% below last week's opening price as bears maintain their stronghold near the $22 zone.

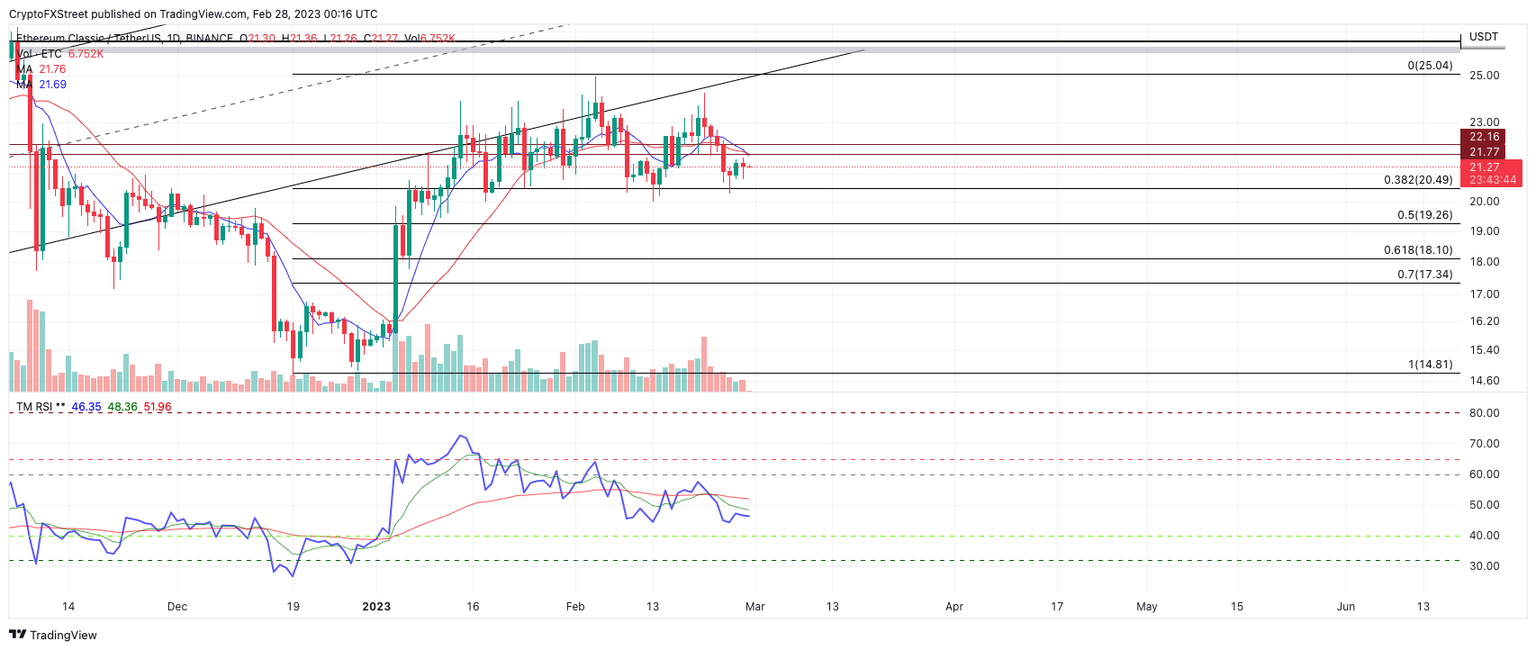

Ethereum Classic price currently auctions at $21.30. That time of riding the 8-day exponential and 21-day simple moving averages is coiling above the current trading range, suggesting a strong liquidation event could be on the way.

Fibonacci retracement tools surrounding the start of the winter rally, from the $14.81 swing low established on December 29 and the $25.04 swing high established on February 4, show the recent downswing having breached the 38.2% retracement level for the second time this month. A second attempt at the $20 boundary could be ETC's breaking point. If the breach occurs, the ETC prices will likely climb towards the 61% Fib level near $18, resulting in a 15% decline from the current market value.

ETC/USDT 1-day chart

Invalidation of the bearish thesis could arrive from a break above the coiling indicators near $22.20. If the bulls hurdle this level, then the winter rally Is likely to continue, with the first Target at the monthly high near $25. The bullish scenario would create the potential for a 50% increase from ETC's price today.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.