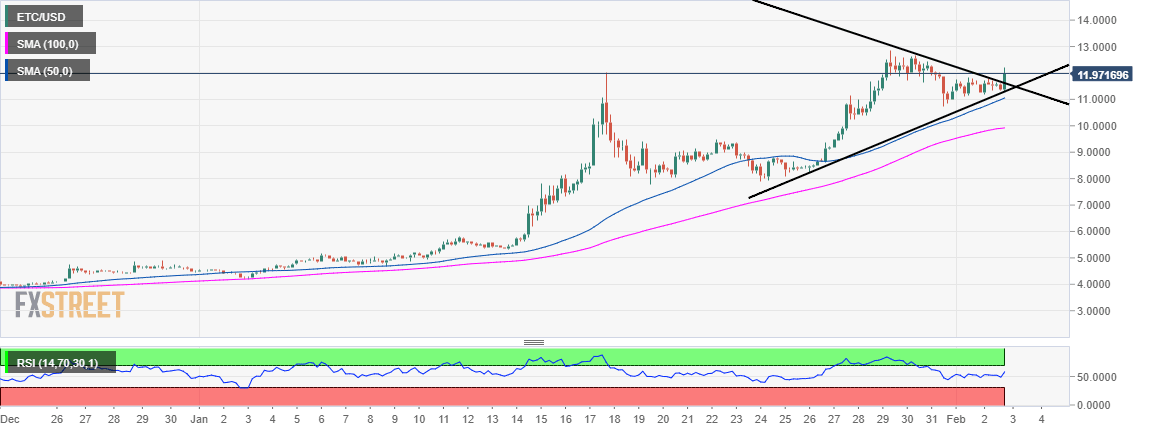

Ethereum Classic Overview Market: ETC/USD pushes symmetrical triangle breakout towards $13.00

- Ethereum Classic bulls struggle to sustain the recent triangle resistance breakout towards $13.00.

- Ethereum Classic network anticipates two significant upgrades by May 2020.

Ethereum Classic is among the biggest single-digit gainers on Monday towards the end of the Asian session. The price is 4.71% higher after the correction from $11.3732 (opening value) to $11.90 (market value). The intraday cryptocurrency live rates show ETC trading in a strong bullish trend and high volatility levels.

Ethereum Classic community gears up for two confirmed updates

The Ethereum Classic network is moving towards a couple of key confirmed upgrades; the Phoenix and Aztlan upgrades. Phoenix is more or less a correction update in preparation for the Aztlan upgrade. However, Phoenix’s implementation has to be supported by the majority of community members. Following, Phoenix, Aztlan is scheduled to take place in May 2020.

Ethereum Classic technical picture

ETC/USD was among the best performing cryptocurrency in January. After starting the year around $4.50, ETC soared to highs around $12.86. Downward corrections have been endued but contained mainly above $8.00.

The most prominent move in the last seven days is Ethereum Classic breakout above a key symmetrical triangle resistance. The breakthrough is still making attempts to reverse the negative correction since the surge took a breather at $12.86.

For now, the trend is bullish and the bulls seem to be focused on the recovery towards $13.00. The RSI confirms the presence of the bulls following the bounce upwards from the average (50). $12.00 is the stubborn resistance, giving the bulls a hard time. As for lower corrections, the 50 SMA at $11.00 on the 4-hour is established as a short term support area in addition to the 100 SMA at $10.00 and the main support at $8.00.

ETC/USD 4-hour chart

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren