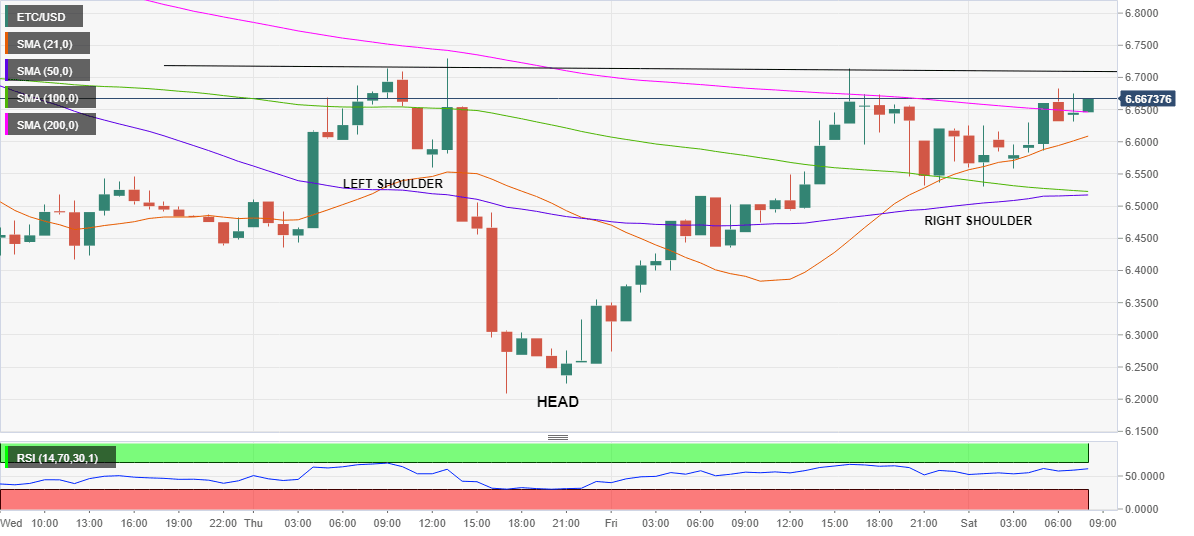

Ethereum Classic Chart Analysis: ETC/USD looks north, inverse head-and-shoulders in play

- ETC/USD consolidates Friday’s recovery below $6.70 on Saturday.

- Bulls carve out inverse head-and-shoulders pattern on the hourly chart.

- The coin eyes a sustained break above 200-HMA at $6.6478.

Ethereum Classic (ETC/USD) is in a consolidative mode so far this Saturday, having stalled a robust recovery just above the $6.6800 level.

Over the last hours, the spot is seen struggling to hold ground above the 200-hourly Simple Moving Averages (HMA), now placed at $6.6478.

The ETC bulls are awaiting a sustained break above the latter to challenge the horizontal trendline barrier at $6.7094, which is the neckline of the potential inverse head-and-shoulders formation carved over the past three trading sessions.

Should the pattern get confirmed, a test of the $7.00 mark looks inevitable in the coming days. The hourly Relative Strength Index (RSI) stays bullish at 61.98, backing the bullish case.

Alternatively, the upside bias would weakness if the price closes the day below the 21-HMA at $6.6079.

The bears will then target the $6.5200 support zone, where the intraday low, 50 and 100-HMAs coincide.

Friday’s low of $6.2745 could be the last resort for the ETC bulls.

ETC/USD: Hourly chart

ETC/USD: Additional levels to consider

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.