Ethereum 2.0 becomes 6th largest proof-of-stake network ahead of its mainnet launch

- ETH 2.0 has over 21,000 validators with more than 700,000 tokens staked.

- The growing adoption may result in a massive bullish run after a short-term correction.

The Ethereum 2.0 staking is gaining traction. The dedicated smart-contract deposit has already received the number of coins required for the developers to start rolling out Beacon Chain, the critical component of the new version of Ethereum protocol, also known as Serenity. However, investors continue pouring money into the project even though their coins will be frozen for an indefinite time.

As FXStreet detailed in a recent publication, to become a validator and start earning passive income at around 7% per anum, once the network is launched, network participants have to stake at least 32 ETH (over $18,000 at the current exchange rate). These coins will be unavailable and unretrievable for at least two years until the transition progresses to Phase 2.

This condition discouraged many people at the initial stages, as the staking process was painfully slow and gathered pace only during the last week before the deadline.

ETH 2.0 has become the sixth-largest PoS blockchain

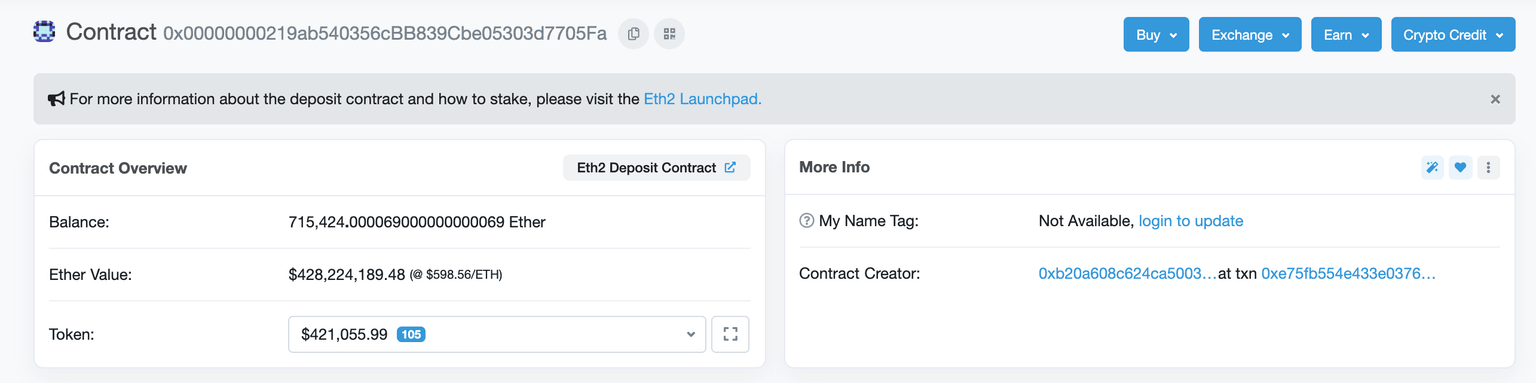

The deposit smart contract currently contains over 700,000 ETH, exceeding the required amount by 33%. Moreover, now Ethereum 2.0 is one of the largest proof-of-stake blockchains even before launch.

ETH 2.0 deposit smart contract address

Moreover, the number of unique depositors to the smart contract surpassed 2,000, while the number of validators exceeded 21,000, meaning that the network has already beaten some well-established PoS chains, including Tezos, Cosmos and Polkadot.

The genesis block is now set :)

— Justin Ðrake (@drakefjustin) November 24, 2020

genesis time: 2020-12-01 12:00:23 GMT

validator count: 21,063

The migration to ETH 2.0 means that the network will be supported by validators staking their coins instead of miners providing their computing power to ensure the network operations. As the industry insider Cooper Turley noted in the latest Defiant newsletter, the rapid increase of deposit is a strong positive signal for the community;

With more than 50% of the staked balance deposited in the last 48 hours, this milestone marks a major vote of confidence in Ethereum's most grueling upgrade to date taking place throughout at least four phases in what is expected to last at least two years according to developer estimates.

In the long-run, the transition to ETH 2.0 has the potential to become a strong bullish catalyst for the second-largest coin.

Ethereum price forecast

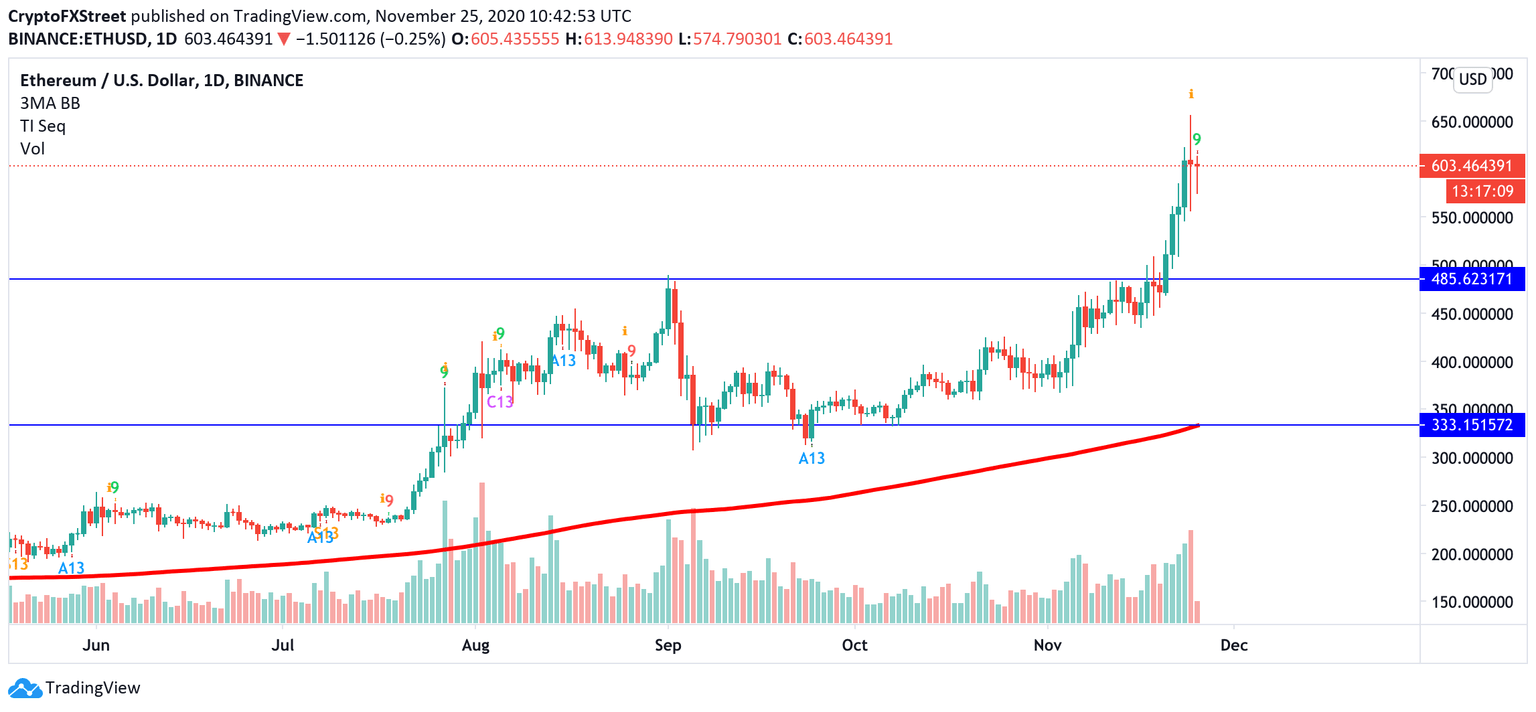

Ethereum price is hovering around $600 at the time of writing. The price has been gaining ground steadily since the beginning of November, while the bullish momentum gathered pace on November 20, after the price broke above the critical $500.

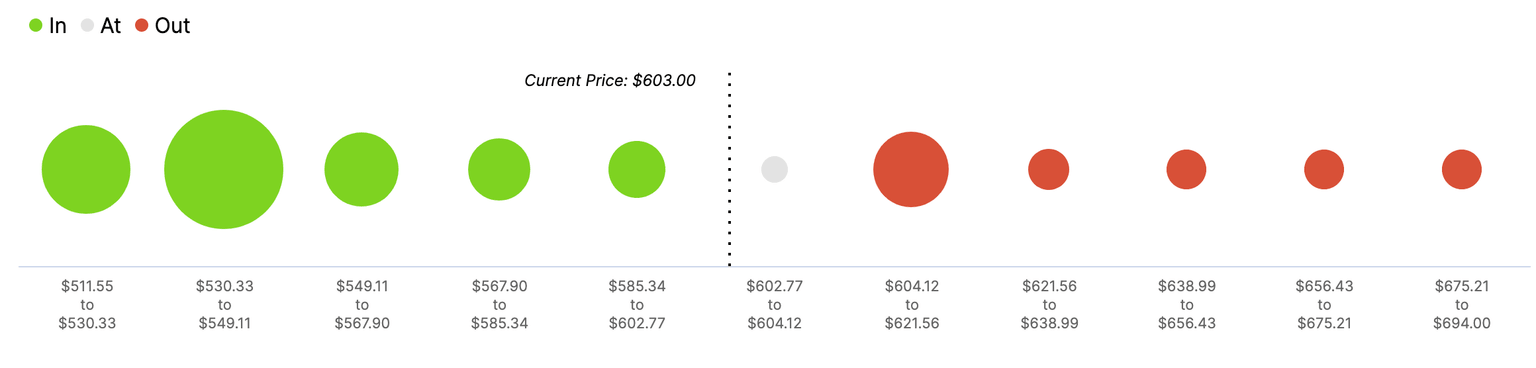

As Ethereum 2.0 rollout goes according to the plan so far, the price may easily reach $800, the highest level since April 2018. According to In/Out of the Money Around Price data, the minor resistance comes at $620 as over 400,000 addresses purchased 1.8 million ETH around that price. Once it is out of the way, the upside is likely to gain traction with the next focus on the psychological barrier of $700, followed by $800 and eventually $1,000.

ETH In/Out of the Money Around Price data

On the other hand, the TD Sequential indicator presented a sell signal in the form of a green nine candlestick on ETH daily chart. The bearish formation estimates that a spike in selling pressure for Ethereum may see it fall for one to four daily candlesticks. But if the bearish pressure is strong enough, the smart-contract giant might start a new downside countdown.

ETH/USD daily chart

The first critical support comes at $480 as this barrier served as resistance during the September recovery attempt. Also, this area slowed down the recent rally at the beginning of November. A sustainable move below this line will increase the selling pressure and open up the way to $330, the lower line of the previous consolidation channel, reinforced by the daily EMA200.

Author

Tanya Abrosimova

Independent Analyst