EOS price wakes up and surges to $3.77, but technicals point to a steep correction

- EOS price had a massive 43% breakout in the past week reaching $3.77.

- The digital asset is still down 31% from its 2020-high set in February.

EOS has traded relatively flat in November despite the entire crypto market turning bullish. Finally, EOS price woke up, jumping from a low of $2.63 on November 20 to a current peak at $3.77. Unfortunately, some indicators are showing that the digital asset is poised for a pullback in the short-term.

EOS facing a potential massive correction

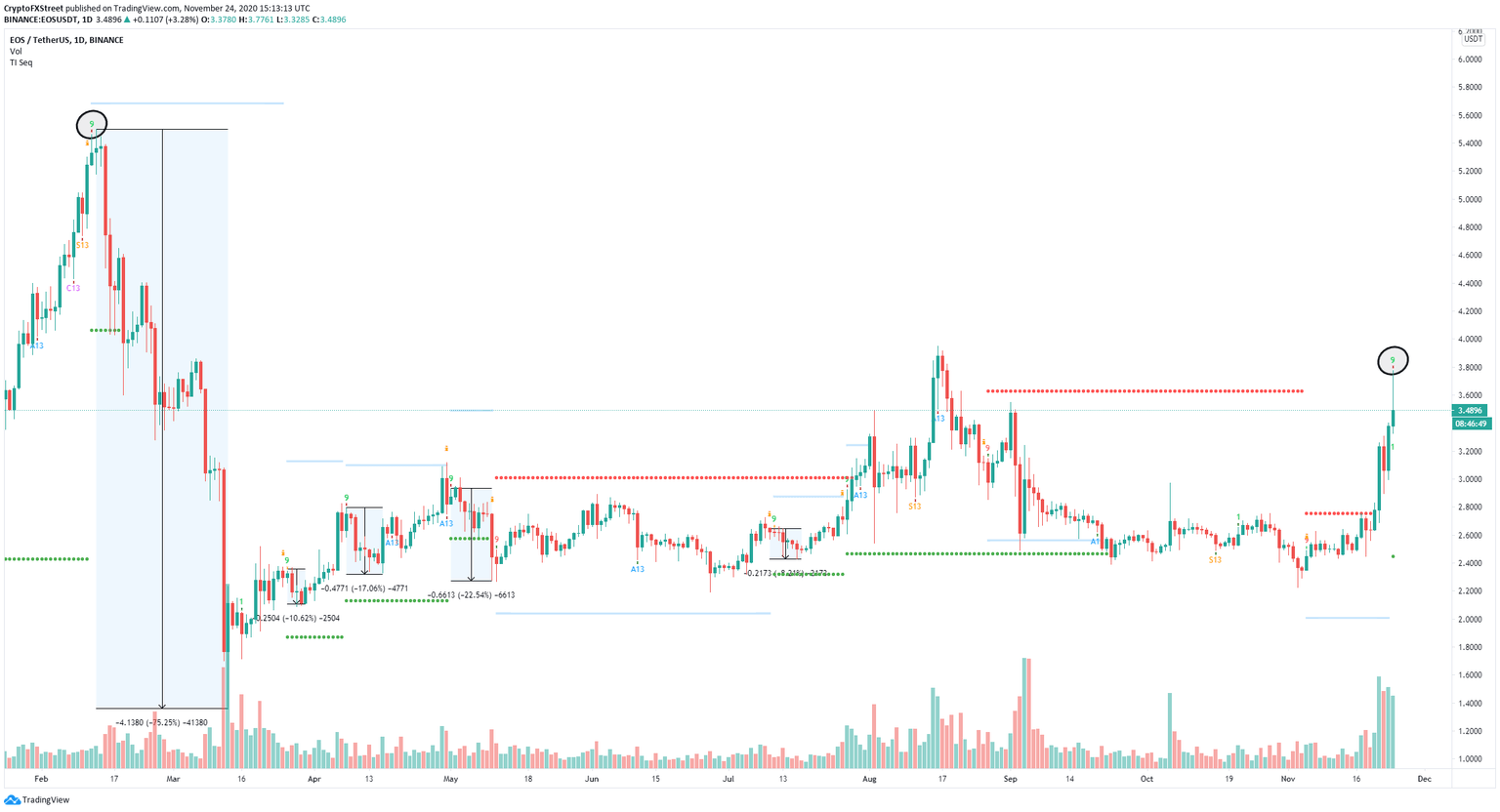

On the daily chart, the TD Sequential indicator has just presented a sell signal – in the form of a green nine candle – after EOS price reached $3.77. The same call was created on February 12, right at the 2020-high at $5.499. Considering the fast rally seen in the past week, there is very little support on the way down for EOS.

EOS/USD daily chart

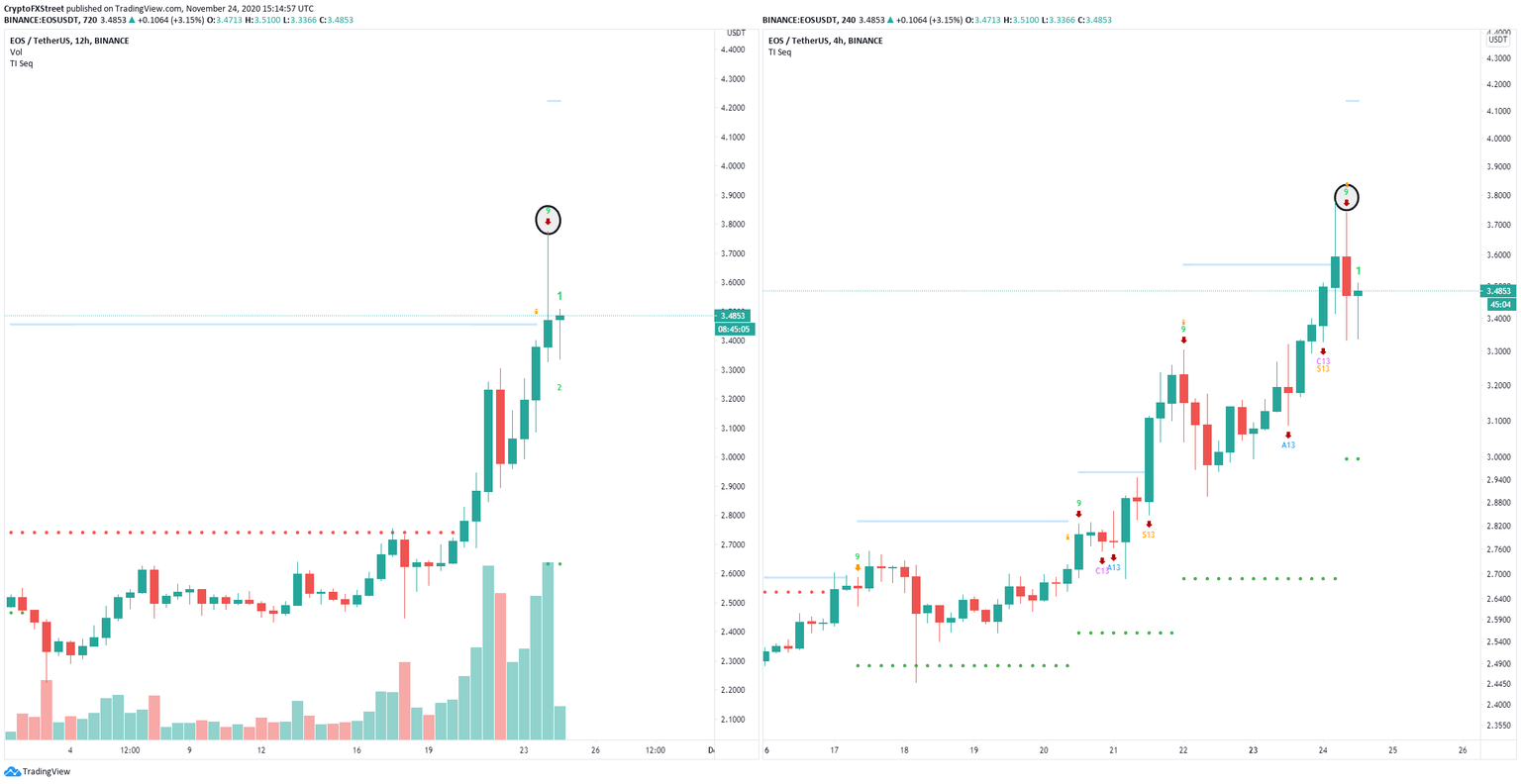

Additionally, it seems that all sell signals presented by this indicator since February have been validated. On the 12-hour chart, the TD Sequential has just also posted a sell signal in addition to another on the 4-hour chart.

EOS/USD 12/4-hour charts

The validation of all three signals could quickly send EOS price towards the psychological level at $3 and as low as $2.8, where the 50-SMA is established on the daily chart. On the other hand, climbing above the last high at $3.77 would drive EOS price to the 2020-high at $5.499 as the market remains heavily bullish.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.