- EOS/USD has recovered strongly on Monday.

- The coin stopped on approach to critical $4.0.

EOS gained over 4% of its value in recent 24 hours. Despite a rather slow movement during early Asian hours, the coin remains one of the best-performing altcoins out of top-20. At the time of writing, EOS/USD is changing hands at $3.89, off the recent high reached at $3.96.

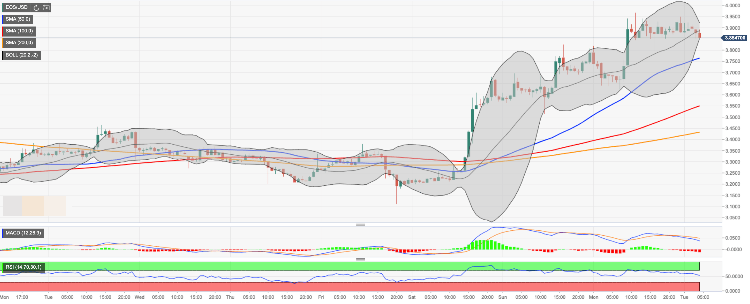

EOS/USD, the technical picture

EOS/USD managed to settle above critical $3.80, however, the further upside movement is capped by psychological $4.00. Once it is out of the way, the bullish momentum may gain traction with the next focus on $4.57 (the highest level since the beginning of August) and $5.00 with a confluence of SMA100 (Simple Moving Average) and SMA200 daily located on approach. The next strong barrier awaits us on approach to psychological $6.00.

On the downside, the initial support comes on approach to $3.75. It is created by SMA50 1-hour. This area may slow down the sell-off and trigger the recovery within the current range. However, if it is broken, the sell-off may be extended towards $3.50 strengthened by the middle line of 1-day Bollinger Band and SMA100 1-hour.

Note, that the Relative Strength Index (RSI) on intraday timeframes points downwards, which makes the short-term bearish scenario more likely.

EOS/USD, 1-hour chart

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Bitcoin is showing rising correlation with the S&P 500

Bitcoin and the crypto market have been in an uptrend since Wednesday following the Federal Reserve's decision to cut interest rates by 50 basis points. Bitcoin is up nearly 3% in the past 24 hours, rising briefly above the $63,000 level for the first time in three weeks.

Ethereum rallies over 6% following decision to split Pectra upgrade into two phases

In its Consensus Layer Call on Thursday, Ethereum developers decided to split the upcoming Pectra upgrade into two batches. The decision follows concerns about potential risks in shipping the previously approved series of Ethereum improvement proposals.

Consensys case against SEC over Ethereum dismissed by Texas court

Consensys announced dismissal of a case it filed against the SEC in April about the agency's alleged actions against Ethereum. Judge Reed O'Connor of the Northern District of Texas dismissed the case on Thursday. Consensys claims that the court failed to examine the "merits" of its claim against the SEC.

XRP eyes gains as Ripple gears up for stablecoin launch, Grayscale XRP Trust notes rising NAV

Ripple (XRP) gained 2.3% since the start of the week. The altcoin’s gains are likely powered by key market movers that include Ripple USD stablecoin, Grayscale XRP Trust performance and the demand for the altcoin among institutional investors.

Bitcoin: On the road to $60,000

Bitcoin price retested and bounced off from the daily support level of $56,000 this week. US spot Bitcoin ETFs posted $140.7 million in inflows until Thursday and on-chain data supports a bullish outlook.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.