Elon Musk's Dogecoin endorsement triggers short-lived pump as DOGE price technicals turn bearish

- Elon Musk pumps Dogecoin on Twitter, but the rally is short-lived.

- Technical indicators imply that the coin is ready for a bearish correction.

Dogecoin (DOGE) stormed into top-50 amid the FOMO triggered by Elon Musk's tweet. The message of Tesla's CEO contained only one word "DOGE"; however, that was enough for the coin's supporters to start buying it like there is no tomorrow.

DOGE gained over 30% in a matter of hours and touched $0.0055, the highest level since July 8, when the coin briefly reached $0.0056 before collapsing back below $0.004. At the time of writing, DOGE is changing hands at $0.0047. Despite the sell-off, the coin is still 12% higher on a day-to-day basis. The weekly gains exceeded 50%.

DOGE's market capitalization reached $627 million, while its average daily trading volume is registered at $689 million. The token is most actively traded at Binance, Huobi Global, and HBTC. This Litecoin fork was created in 2013 as a joke. However, the coin based he popular "doge" Internet meme quickly gained popularity. Now it is touted by numerous high-profile personas, including Elon Musk.

The correction is underway

A popular crypto Twitter analyst, aka IncomeSharks, warns his followers from investing in DOGE at this stage. He believes that the price is getting close to a strong resistance zone, and the sell-off risks are too high at this stage.

$DOGE - Be very careful with this one. Many will end up bagholding and taking a loss. Not worth the risk, 25 sats is where I'd sell if in it. pic.twitter.com/R2WKBNtA1b

— IncomeSharks (@IncomeSharks) December 21, 2020

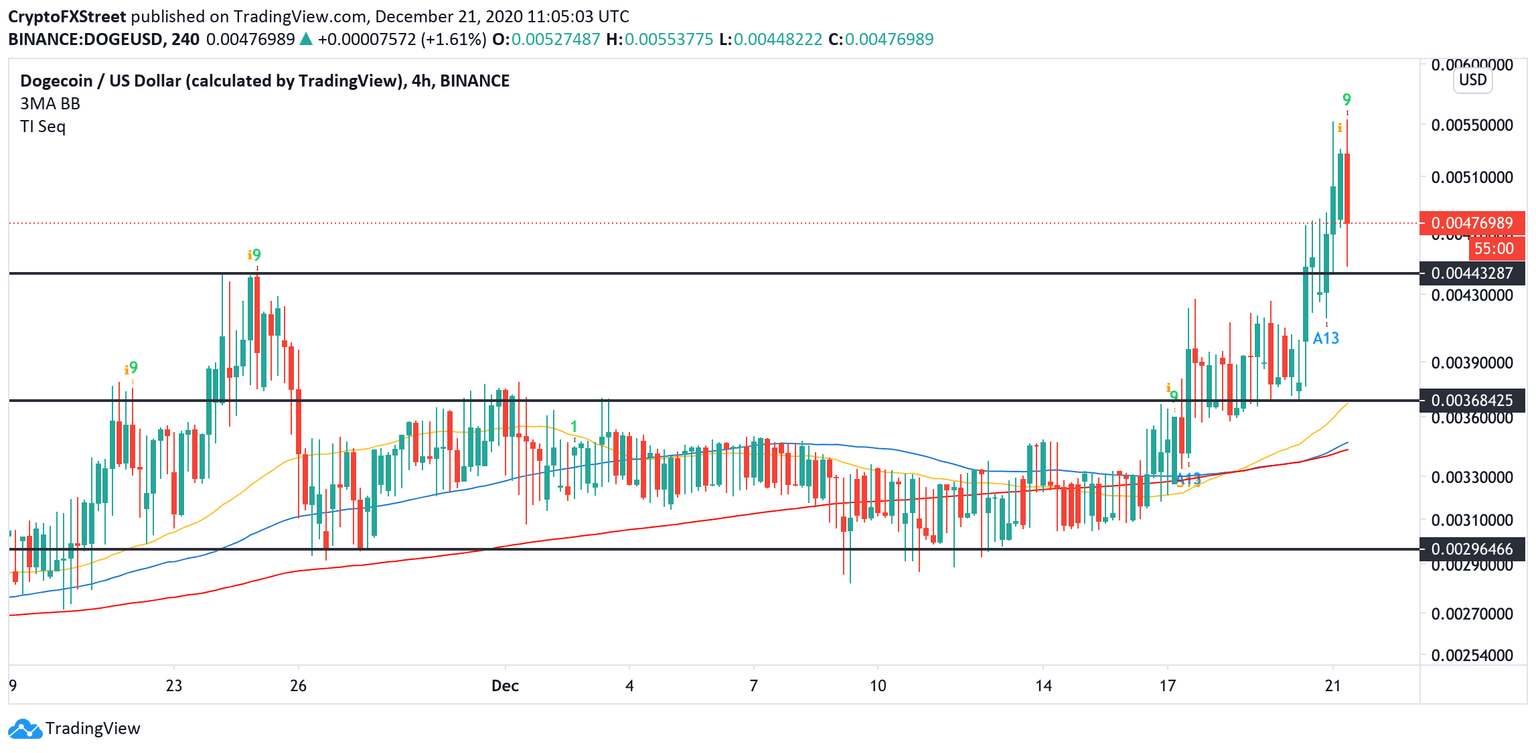

Meanwhile, the technical indicators also paint a grave picture for DOGE. Thus, TD Sequential indicator sends a sell signal in the form of a green nine candlestick on the 4-hour chart. If the bearish formation is confirmed, DOGE may continue the correction for one to four red candlesticks with the first bearish target at $0.0044. This area stopped the recovery at the end of November and triggered the sell-off to $0.003.

DOGE, 4-hour chart

A sustainable move below $0.044 will open up the way to the next local barrier of $0.036 reinforced by 4-hour EMA50. The ultimate bearish target is $0.03.

Author

Tanya Abrosimova

Independent Analyst