Dwindling DeFi hype could send Compound’s COMP price to…

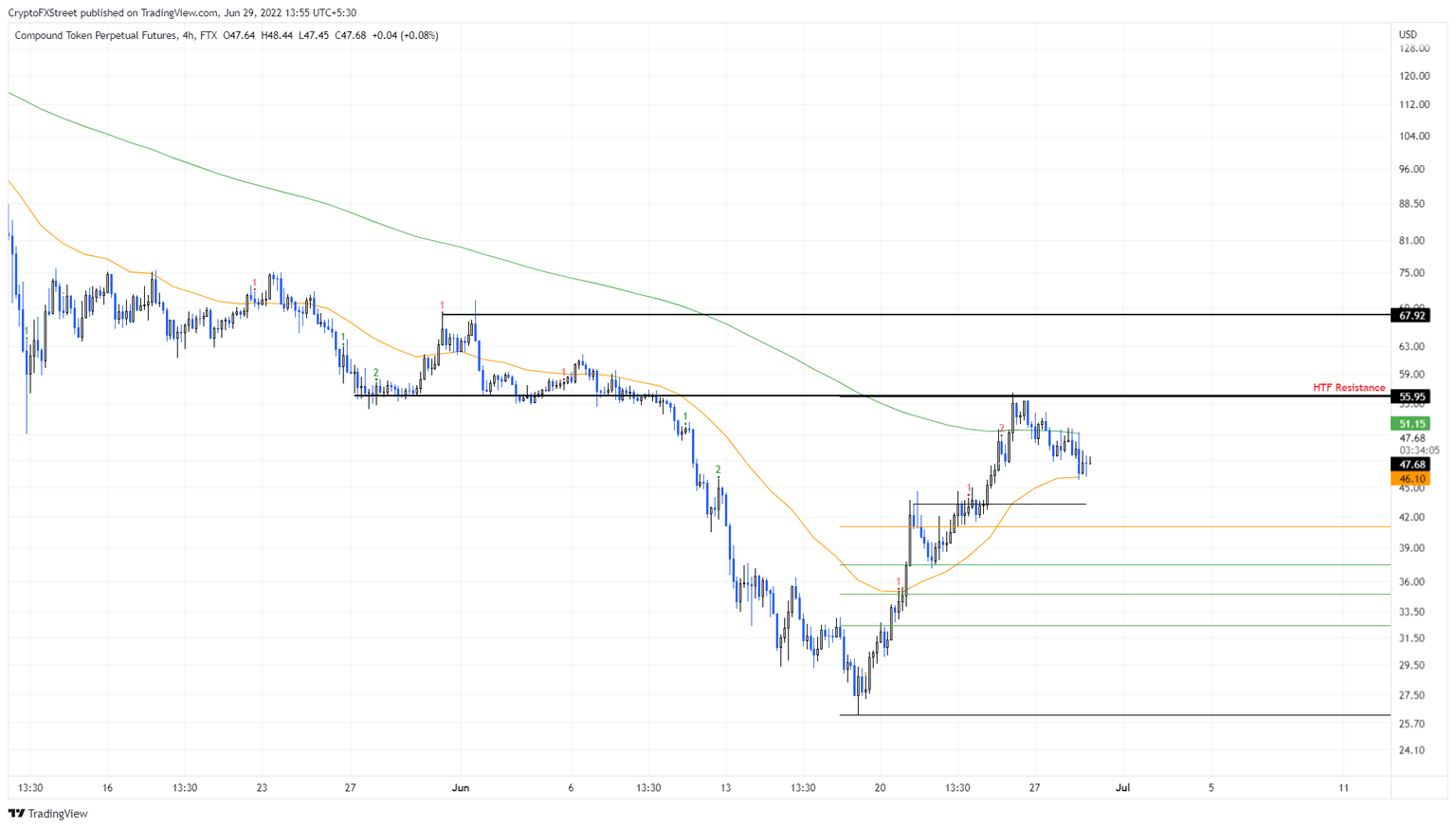

- COMP price gets knocked by the high-time-frame resistance barrier at $55.95.

- This retracement could push the Compound token as low as $35 or the 70.5% retracement level.

- A four-hour candlestick close above $55.95 that flips this hurdle into a support floor will invalidate the bullish thesis.

COMP price has been on a vertical ascent since the collective crypto market bottomed out on June 19. This uptrend faced a significant hurdle, however, which has caused Compound bulls to evaluate their momentum.

COMP price slows down

COMP price rose 115% in just a week, starting on June 19 and set a swing high at $56.34. This impressive climb paused around $43.28, retraced 13% and continued its second leg-up, doubling the value seen on June 19.

However, the ascent faced intense sell pressure around the high-time-frame resistance level at $55.95. As a result, COMP price has pulled back roughly 18% and is currently hovering around $47.63.

Going forward, investors can expect COMP price to continue its descent, at least until Bitcoin finds a stable support floor. A breakdown of the 8-day Exponential Moving Average (EMA) will signal the start of the next leg down.

In such a case, COMP price is likely to revisit $41.02 or the range’s midpoint. A sweep below the 62% retracement level at $37.46 seems plausible in cases where BTC tags the $18,514 level.

All in all, Compound token seems to be ready for another 20% decline from its current position.

COMP/USDT 4-hour chart

While things are looking incredibly bearish for the entire market, some altcoins are holding up relatively better than other tokens and Compound is one of them.

If buyers make a comeback and propel COMP price to produce a four-hour candlestick close above $55.95, it will signal that sellers are weak. If this development flips the said level into a support floor, it will invalidate the bearish thesis and potentially extend COMP price to $67.92.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.