Downward pressure mounts behind Bitcoin price as investors sell the PayPal news

- Bitcoin price dropped by 2% within the past hour despite positive news.

- PayPal just announced that eligible US customers can already purchase cryptocurrencies through the platform.

In October, PayPal, the giant payment provider, announced the support for cryptocurrencies enabling users to buy, sell, and hold digital assets. The initial launch was set for early 2021; however, due to the initial demand, the company decided to start as soon as possible. The company has just made public that eligible US customers can already purchase cryptocurrencies through the platform.

Unfortunately, it seems that the announcement was already priced in, and Bitcoin price is experiencing a classic case of ‘sell the news,’ plummeting 2% within the past hour to the $15,900 area after touching $16,199.

Bitcoin could be poised for a correction before resuming its uptrend

Although Bitcoin price did crack $16,000, it seems that bulls are having a tough time keeping the price above this level. A new resistance level, around $16,125, was established as the most critical barrier in the short-term.

BTC/USD 1-hour chart

Bitcoin price has pierced four different times through the $16,125 level but never managed to close above it on the 1-hour chart. The price and the RSI have formed a clear bearish divergence, which indicates the trend is weakening. The 50-SMA at $15,637 could be the next short-term price target.

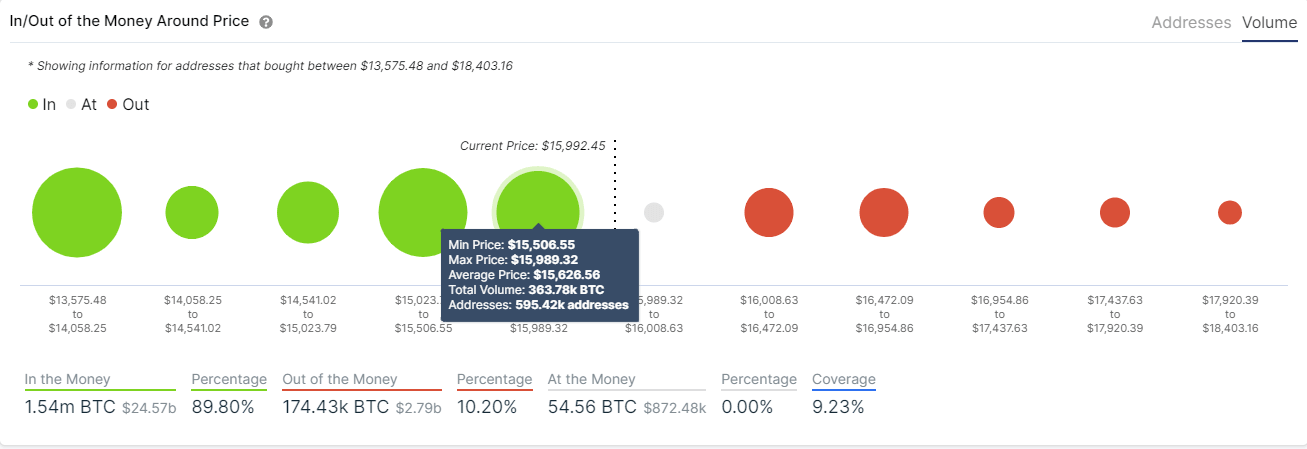

BTC IOMAP chart

However, despite the overextension of Bitcoin price, on-chain metrics suggest that there is very little resistance to the upside. The In/Out of the Money Around Price (IOMAP) chart shows there seems to be almost no opposition above $16,000, with the most significant area between $16,472 and $16,954. A breakout above this point could quickly drive Bitcoin price towards $18,403. On the other hand, according to the IOMAP chart, there are several strong support areas below $16,000.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.