Dogecoin traders jittery as Elon Musk’s DOGE faces possibility of lawsuit with Trump’s inauguration

- Dogecoin could erase weekly gains and risk decline as Washington Post uncovers lawsuit likely to be filed against DOGE.

- The lawsuit alleges Elon Musk’s DOGE is a federal advisory committee and is in violation of a 1972 law.

- DOGE price has previously jumped in response to updates on DOGE, an initiative led by Elon Musk and Vivek Ramaswamy.

- DOGE holds steady above $0.3707, posting nearly 5% gains on Monday.

Dogecoin (DOGE) rallies nearly 5% on Monday as crypto tokens gain momentum ahead of Donald Trump’s inauguration event. The Washington Post uncovered a lawsuit likely to be filed against Elon Musk’s Department of Government Efficiency (DOGE) as soon as the President-elect takes office.

Updates about DOGE have previously influenced the meme coin’s price and if the pattern repeats, traders could note a decline in the largest meme token.

DOGE could face a lawsuit within minutes of Trump’s inauguration

Post the results of the November 2024 Presidential election, President-elect Donald Trump tapped Tesla CEO Elon Musk and biotech entrepreneur Vivek Ramaswamy to lead a department to identify government regulations and reduce the overall spending of the White House.

In an unconventional manner, the group went about hiring staff and put together a list of recommendations to execute in the new administration.

The Washington Post obtained the 30-page complaint, which alleges that DOGE qualifies as a “federal advisory committee.” FACAs are legal entities regulated by the US government that offer transparent and balanced advice to the administration. FACAs are required to have “fairly balanced” representation, keep regular minutes of meetings, and allow the public to attend and file a charter with Congress, among other key steps that DOGE may have skipped.

The lawsuit therefore alleges a violation of a 1972 law. Kel McClanahan, executive director of National Security Counselors, says in the lawsuit:

“DOGE is not exempted from FACA’s requirements. All meetings of DOGE, including those conducted through an electronic medium, must be open to the public.”

Dogecoin derivatives traders jittery

Data from crypto derivatives data tracker Coinglass shows that the Open Interest (OI) and Options volume in DOGE have declined in the last 24 hours. OI dropped by 6.53%, down to $5.25 billion, and options volume slipped nearly 13% in the past day.

Over $43 million in long positions in DOGE have been liquidated in the past 24 hours, against $5.12 million in shorts. Derivatives data points to an expectation of a price correction in spot markets.

DOGE price forecast

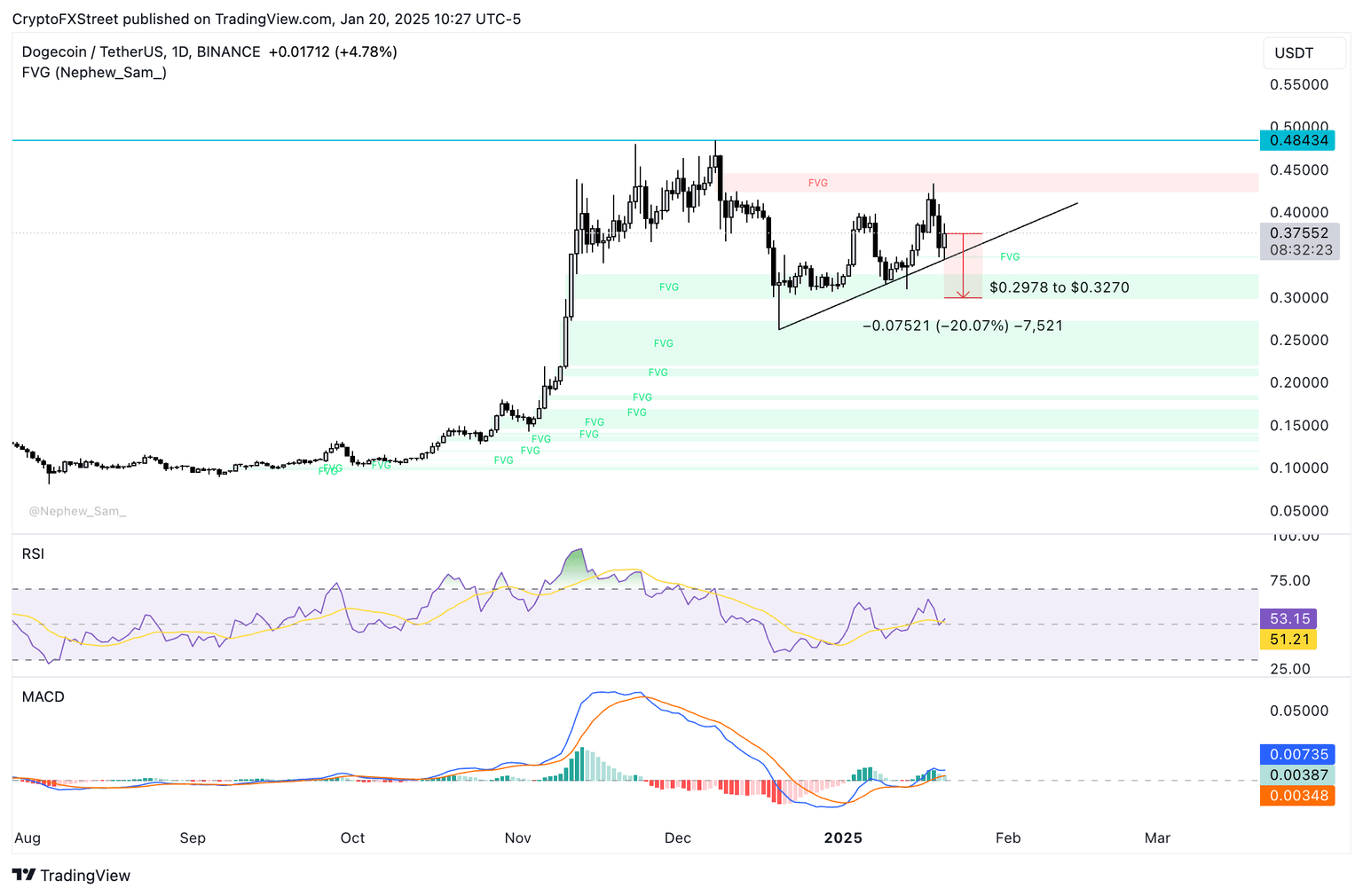

Dogecoin is in an upward trend and key technical indicators, the Relative Strength Index

(RSI) and Moving Average Convergence Divergence (MACD), support further gains in the meme coin. However, a decline in DOGE could push the meme coin to the nearest imbalance zone formed between $0.2978 and $0.3270.

A drop to the lower boundary of the imbalance zone marks a 20% correction in DOGE price.

DOGE trades at $0.3755 at the time of writing. The RSI reads 53 and is sloping upwards, while MACD is flashing green histogram bars above the neutral line.

DOGE/USDT daily price chart

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.