Dogecoin price treads water, knocking investor confidence, DOGE sells

- Dogecoin price, even on May 23, failed to note any recovery despite Bitcoin and Ethereum both marking a green candlestick.

- Investors seem to be losing their faith in recovery as DOGE holders' pessimism is at a two-month high.

- Consequently, in the last week, mid-term holders have dumped nearly 8% of their supply, which was picked up by short-term holders.

Dogecoin price has stood its ground over the last 24 hours while the cryptocurrency leaders Bitcoin and Ethereum made gains. The overall lackluster performance of the meme coin has pushed DOGE holders to the brink of losing their confidence in an asset that was once hailed as "the next big thing".

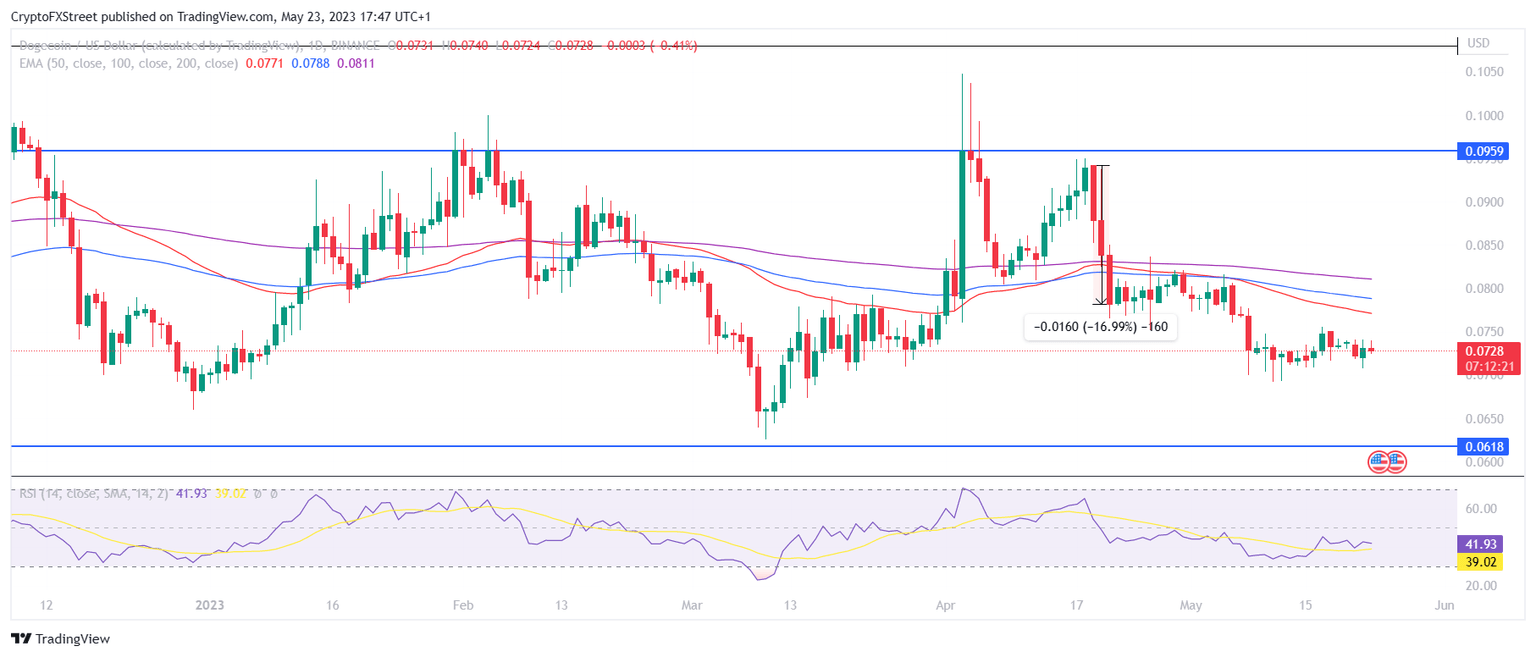

Dogecoin price remains unchanged

Dogecoin price has made virtually no attempt whatsoever to initiate a recovery over the last two weeks. Trading at $0.078, the meme coin has been moving under the 50-day Exponential Moving Average (EMA) since the 17% crash of mid-April, which now acts as the next key barrier. The weak macroeconomic conditions are certainly impacting, but DOGE holders' pessimism has been growing since the last month.

DOGE/USD 1-day chart

Investors are rapidly losing their confidence in the meme coin. The lack of green candlesticks has resulted in Dogecoin holders' weighted sentiment slipping below the neutral mark, suggesting a bearish outlook toward the digital asset.

Although Dogecoin investors have exhibited such pessimism in the past, this particular instance is the longest stretch of growing bearishness in their behavior. This has led to the investors offloading their holdings in order to minimize their losses. The biggest chunk of this selling came from one of the most influential cohorts at that.

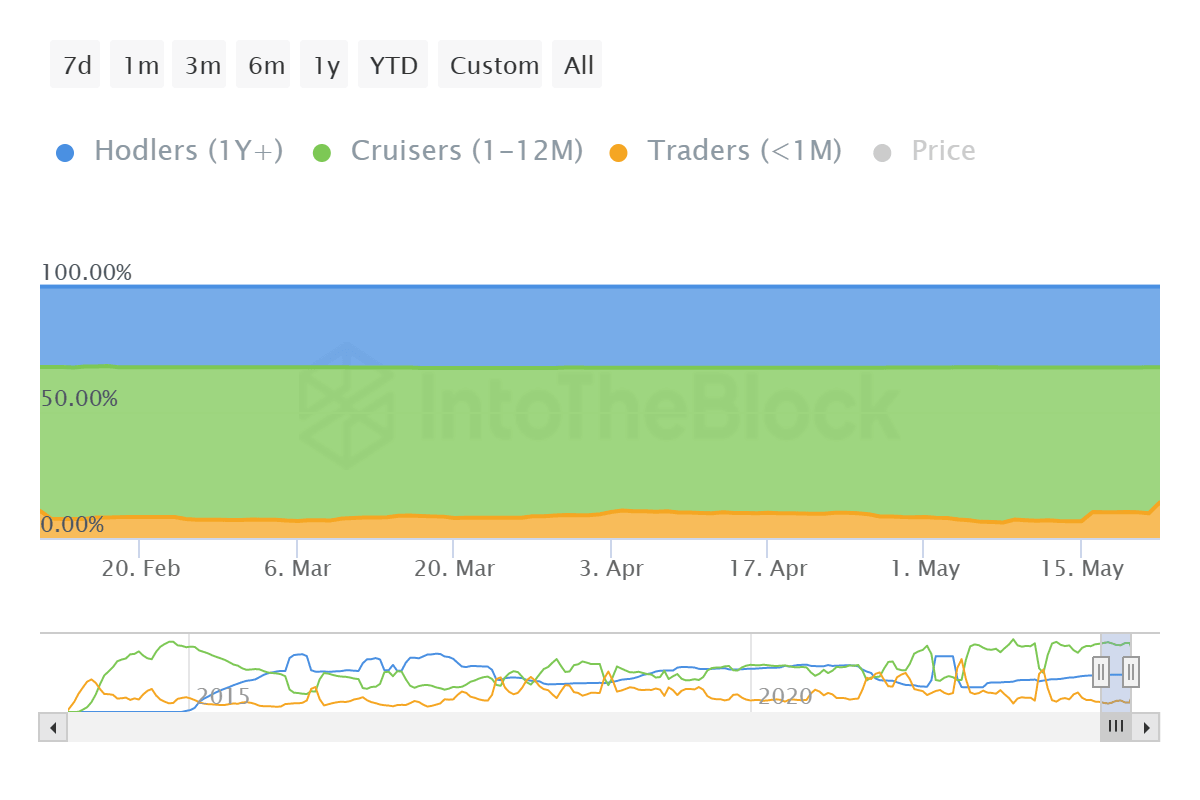

Dogecoin sentiment

The mid-term holders or "Cruisers" are the group of investors that have held onto their supply for a period longer than a month and less than a year. Their actions, in a way, impact the price since these 1.2 million addresses collectively own over 53% of the entire circulating supply.

Their holdings used to be much larger, around 61%, up until a week ago, but since the Dogecoin price stopped showing signs of recovery, these investors decided to offset their losses. As a result, 7% of their supply was dumped, which was then picked up by short-term holders who represent supply younger than a month.

Dogecoin supply distribution by time held

Thus, loss of conviction from such holders does leave a bearish impact on not just the price but the investors' outlook as well. And if Dogecoin price fails to recover soon and instead continues to trail around $0.078, this selling could go up a notch.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.

%2520%5B22.18.24%2C%252023%2520May%2C%25202023%5D-638204584237018881.png&w=1536&q=95)