Dogecoin price to dip lower as DOGE attempts to find support

- Dogecoin price is down more than 21% from the January 14 swing highs.

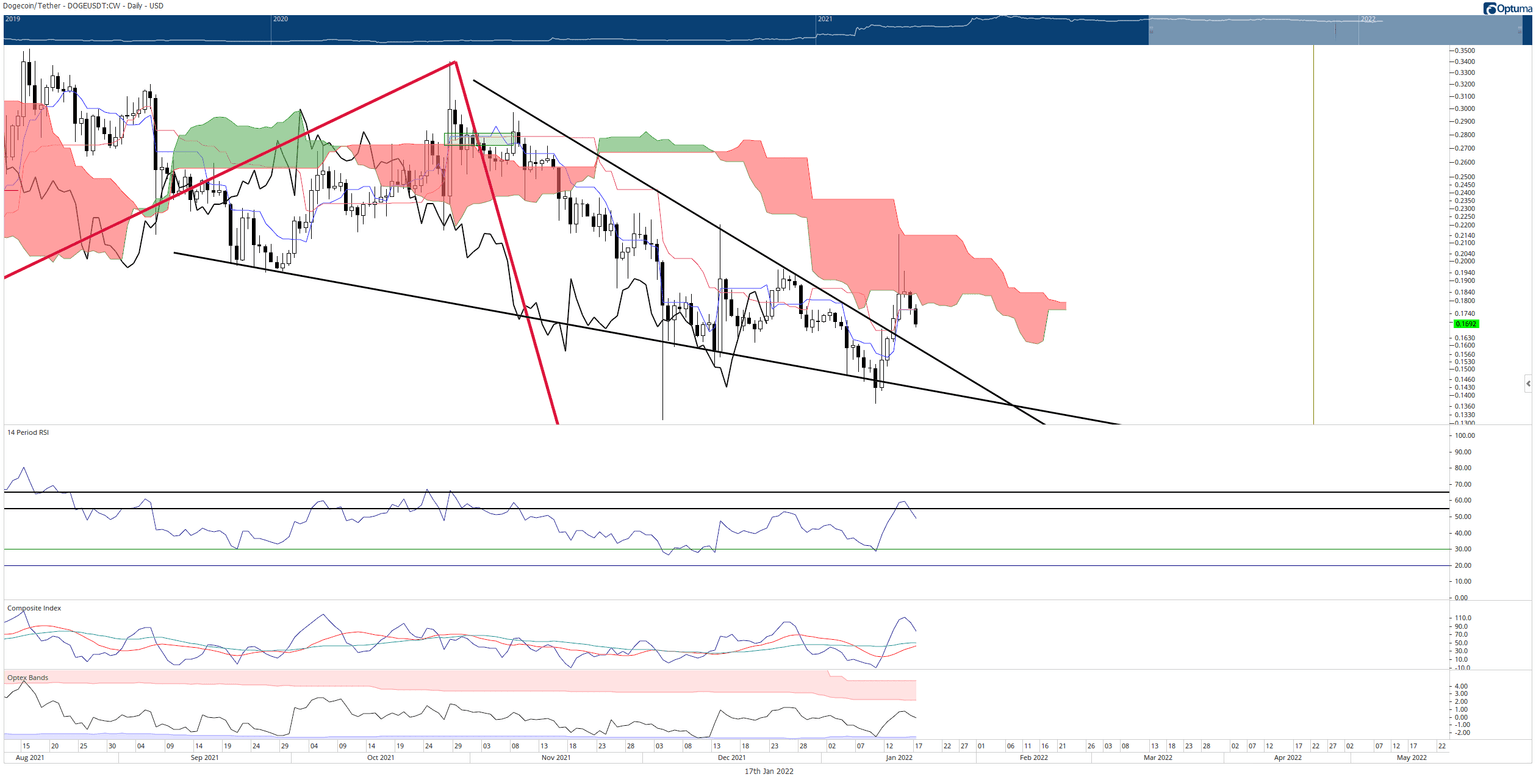

- Bulls failed to keep DOGE inside the Cloud or above the Kijun-Sen.

- A retest of the falling wedge is likely.

Dogecoin price rallied more than 50% from last Tuesday to last Friday, moving from the Tuesday open of $0.143 to the Friday high at $0.215. However, bulls could not maintain the gains on Friday as Dogecoin lost the majority of its Friday gains, closing up 7% instead of the 25% increase it had.

Dogecoin price sees sellers continue to push Dogecoin lower, retest fo the falling wedge incoming

Dogecoin price action continues to be a source of frustration and disappointment for long-term DOGE hodlers. The 50% rally that Dogecoin experienced from the Tuesday open to the Friday high has been cut by more than half. Dogecoin price is currently up 19% from last Tuesday’s open.

Adding to the frustration is the inability of Dogecoin price to hold and support within the Ichimoku Kinko Hyo system. As a result, Dogecoin failed to stay above the bottom of the Cloud (Senkou Span A), failed to hold above the Kijun-Sen, and may not hold above the Tenkan-Sen.

Failure to hold the Tenkan-Sen as support would likely generate a return to test the breakout above the upper falling wedge trendline at $0.16. However, if Dogecoin price can hold the Tenkan-Sen as support, solid initial support could push higher and return to the $0.20 value area.

DOGE/USDT Daily Ichimoku Kinko Hyo Chart

Despite the breakout above the rising wedge, Dogecoin remains extremely bearish within the Ichimoku Kinko Hyo system as long as the Chikou Span remains below the candlesticks and in open space. The threat of an imminent collapse to the $0.09 price level remains very high if Dogecoin price can’t stay above the $0.16 zone.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.