Dogecoin price remains at risk of crash to $0.18

- Dogecoin price on a knife’s edge, significant drop forecasted if buyers dry up.

- Bullish fundamental data regarding the Dogecoin-funded DOGE-1 satellite fails to entice buying.

- The threshold to keep Dogecoin from falling becomes increasingly difficult to overcome.

Dogecoin price has, like the majority of the cryptocurrency market, faced strong selling over the past few days. But unlike most altcoins, Dogecoin is positioned against an imminent price collapse.

Dogecoin price at risk of dropping to $0.18, could drop over 75% to $0.08

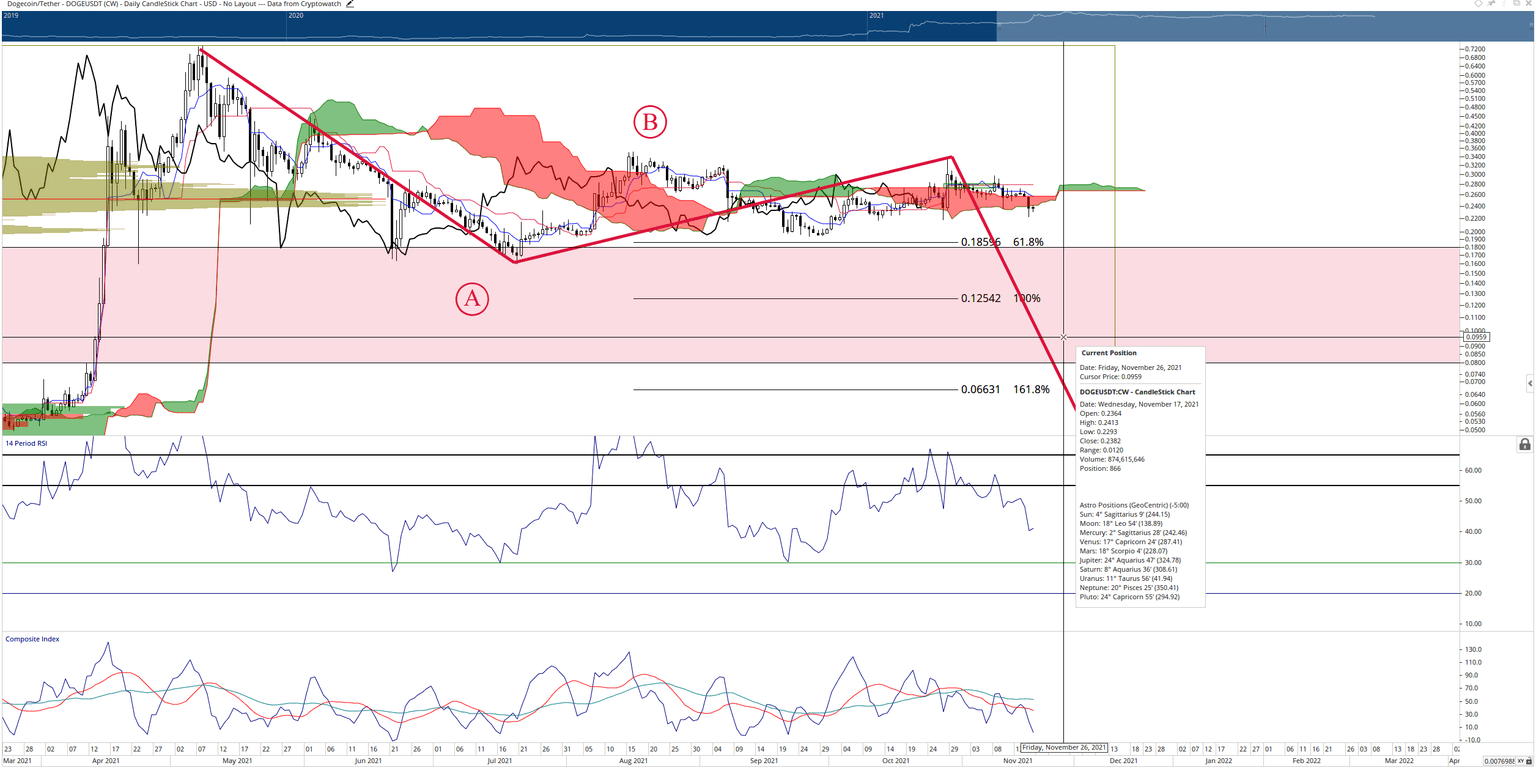

Dogecoin price is at a tipping point. A close at or below the $0.23 value area would likely create a fast move to the $0.18 level. From there, Dogecoin is at its greatest risk of a downside move.

A look at the 2021 Volume Profile shows an extremely thin traded range between $0.18 and $0.08 – almost no trading has occurred between those price levels. This is concerning because price treats those low volume levels like a vacuum. In other words, if Dogecoin price were to drop below $0.18, then it is likely to get ‘sucked’ into a vacuum of vacant volume to the next high volume node. The following high-volume node doesn’t appear until $0.08 - $0.09.

Despite the bullish news about an upcoming moon satellite entirely funded by Dogecoin and christened DOGE-1, there has been little interest to support Dogecoin price. This can be observed by looking at the oscillators. The Composite Index is at an angle where it will cross below its moving averages very soon. Additionally, the Relative Strength Index is rejected against the first overbought level in a bear market at 55.

DOGE/USDT Daily Ichimoku Chart

Dogecoin price has a difficult path to invalidate any near-term bearish outlook. Because of the Volume Profile, it is easier for Dogecoin to move lower than it is to move higher. Dogecoin also needs to close above all of its Ichimoku levels on the weekly chart to return to a clear bull market. That will only happen if Dogecoin can rally and close to at least $0.38.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.