Dogecoin price readies for a sell-off as $0.25 support appears at risk

- Dogecoin price kicks off the weekend on the wrong footing.

- Rejection at higher levels opens up DOGE’s downside potential.

- RSI stays bearish, $0.25 is the level to beat for DOGE bears.

Dogecoin price is extending the previous bearish momentum, kicking off the weekend on the wrong footing, although remains within Wednesday’s trading range.

Having witnessed good two-way businesses, Dogecoin price settled in the red on Friday, as bears refused to give up control after a temporary reversal seen on Thursday.

DOGE sellers returned after Binance, the world’s largest crypto exchange by trading volume, announced that it has temporarily suspended withdrawals of DOGE following an upgrade.

On the contrary, Binance users said that the crypto exchange is not allowing them to make any withdrawals until they return the DOGE. The conflicting reports weighed negatively on sentiment around the canine-themed coin.

Dogecoin price needs to crack this key level to kickstart a downtrend

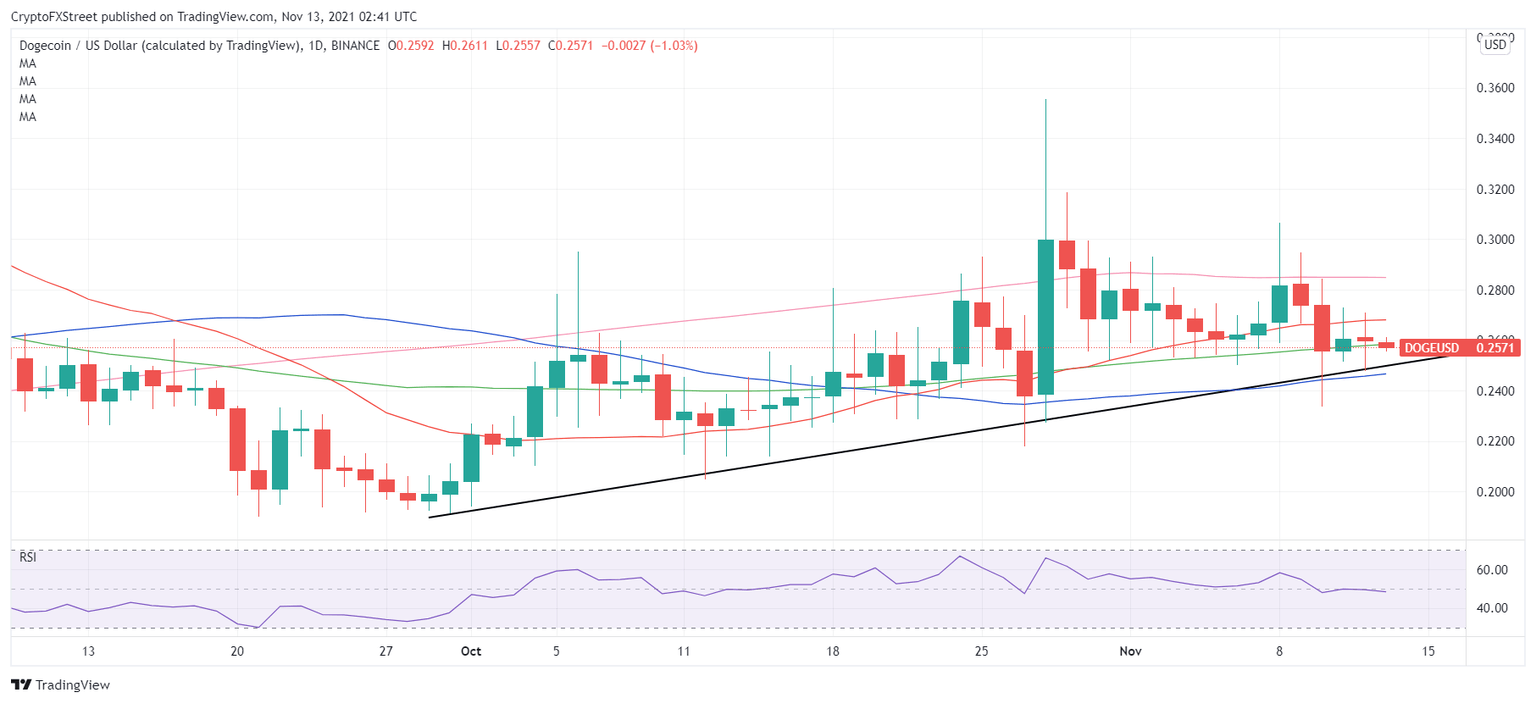

Dogecoin’s daily chart shows that DOGE price is hovering below the upward-sloping 100-DMA at $0.2588, having failed to find acceptance above the immediate upside hurdle, placed at the horizontal 21-DMA, now at $0.2680.

DOGE bears are likely to retain control so long as the price holds below the latter.

Meanwhile, the 14-day Relative Strength Index (RSI) is inching slightly lower while below the 50.00 level, suggesting that bearish bias is likely to remain intact in the near term.

DOGE sellers now target powerful support around $0.25 to unleash the additional downside. That level is the confluence of the rising trendline support and the rising 50-DMA.

A daily closing below that critical support is needed to initiate a fresh downswing towards Wednesday’s low of $0.2337.

Further south, the October 28 low of $0.2272 could come to the rescue of the DOGE buyers, below which the October 27 low of $0.2179 will be the last line of defense for them.

DOGE/USD: Daily chart

On the upside, acceptance above 21-DMA could offer extra legs to the recovery in DOGE price, calling for a test of the critical horizontal 200-DMA at $0.2848.

Note that DOGE price failed to resist above the 200-DMA earlier this week, triggering the renewed downside momentum in the meme coin.

The $0.30 round figure will be back on the DOGE bulls’ radars if the 200-DMA barrier is taken out on a sustained basis.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.