Dogecoin Price Prediction: DOGE targets massive rebound after holding key level

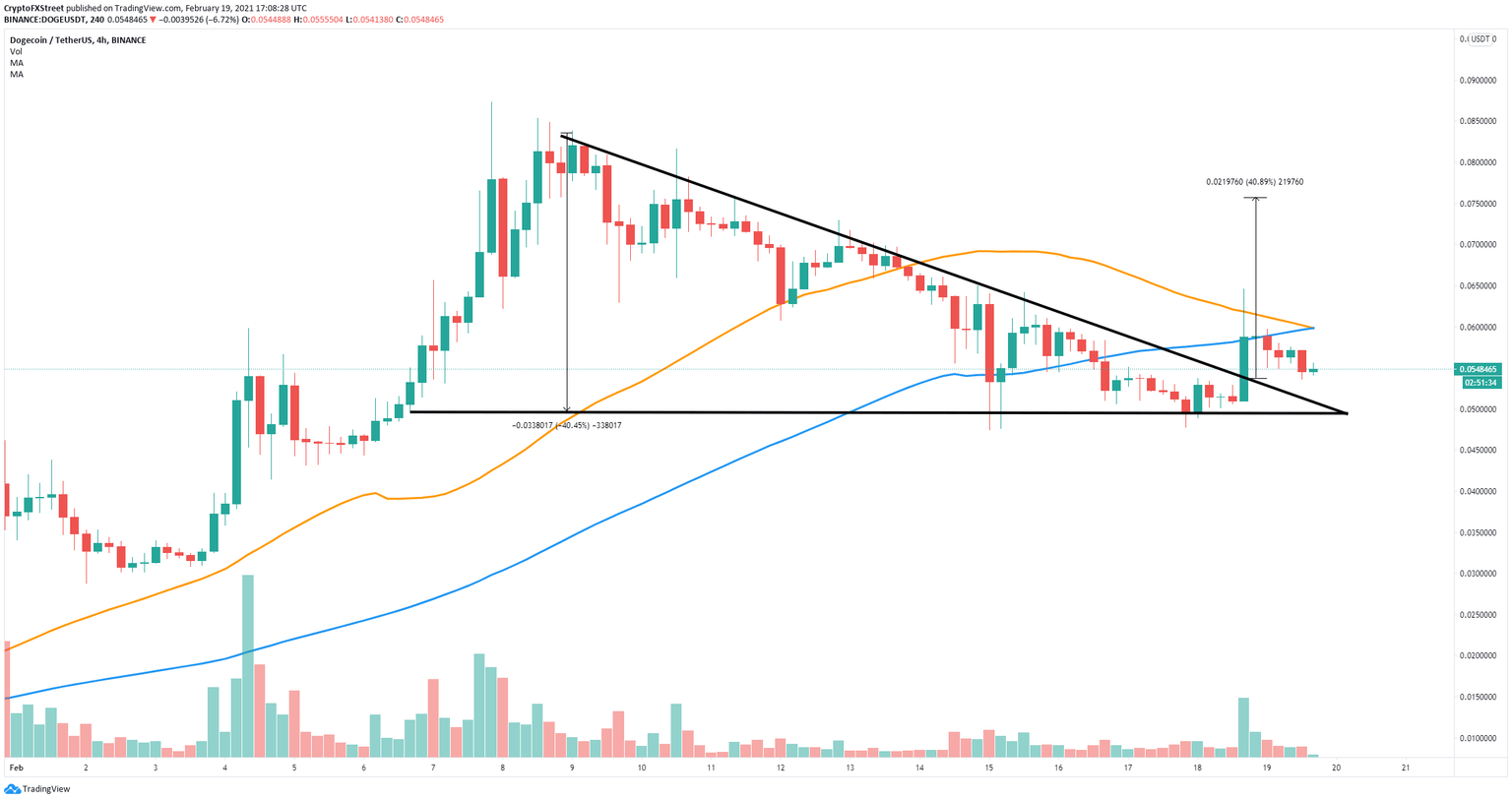

- Dogecoin price had a bullish breakout from a key pattern on the 4-hour chart.

- The digital asset has re-tested the previous resistance level and aims for a 40% rebound.

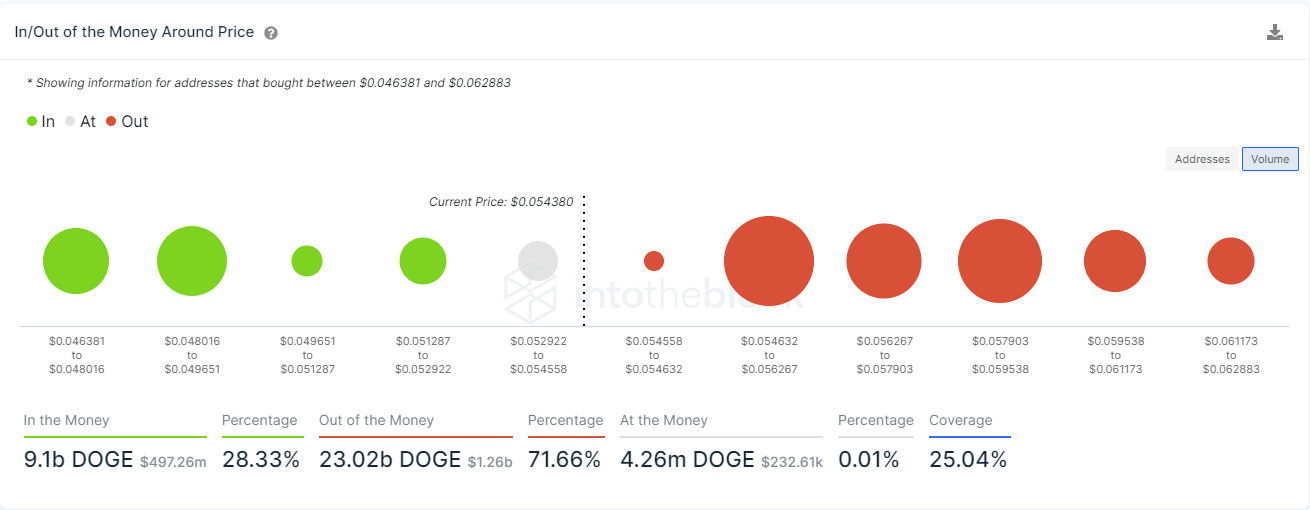

- However, on-chain metrics show that DOGE faces many barriers ahead.

Dogecoin price has been trading inside a downtrend since February 8 as the hype surrounding the project has faded away, especially after the last announcement from Elon Musk. Nonetheless, the digital asset seems ready for an excellent rebound towards $0.076.

Dogecoin price on the brink of a 40% move

On the 4-hour chart, Dogecoin price had a breakout above a descending triangle pattern with a target of 40% towards $0.076. After the initial spike to $0.064, the digital asset dropped to re-test the previous resistance level, now turned into support, which has held so far.

DOGE/USD 4-hour chart

There is a critical resistance level formed at $0.06, which coincides with the 50-SMA and the 100-SMA points. A clear breakout above this key level will quickly push Dogecoin price up to $0.076 in the short-term.

DOGE IOMAP chart

However, the In/Out of the Money Around Price (IOMAP) model shows steep resistance ahead above $0.054 until $0.06, which gives the upper hand to the bears. The most significant support area is located between $0.048 and $0.049, which means a fall towards this range is likely.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.