Dogecoin Price Prediction: Bulls target $0.40 rally as Trump officially launches Elon Musk’s DOGE

- Dogecoin price rose 5% on Wednesday to reclaim $0.38 as Donald Trump signed an executive order creating the DOGE department.

- The newly launched DOGE website featured the Dogecoin logo, sparking intense speculation and excitement among DOGE traders.

- In the derivative markets, DOGE bull traders mounted $140 million leveraged long positions betting on further upside.

Dogecoin price rose 5% on Wednesday to reclaim $0.38 as Donald Trump signed the DOGE department into law. Media reports linking the Dogecoin logo to the official DOGE website sparked bullish speculations that a $0.50 breakout could be imminent.

Why is Dogecoin price going up?

Dogecoin price sees muted gains as Trump officially signs DOGE into law.

On Tuesday, President Donald Trump signed an executive order creating the Department of Government Efficiency (DOGE), a groundbreaking initiative tasked with modernizing federal IT systems.

The new department, informally dubbed DOGE, will be led by Elon Musk, who brings his technological expertise to the helm.

In his announcement, Trump underscored the department's mission to enhance government efficiency, with a focus on overhauling outdated IT infrastructure.

Adding to the intrigue, the newly launched DOGE website prominently displays the Dogecoin logo, sparking widespread speculation among cryptocurrency enthusiasts.

However, neither Elon Musk nor the department's official X account has confirmed any formal connection between Dogecoin and the initiative.

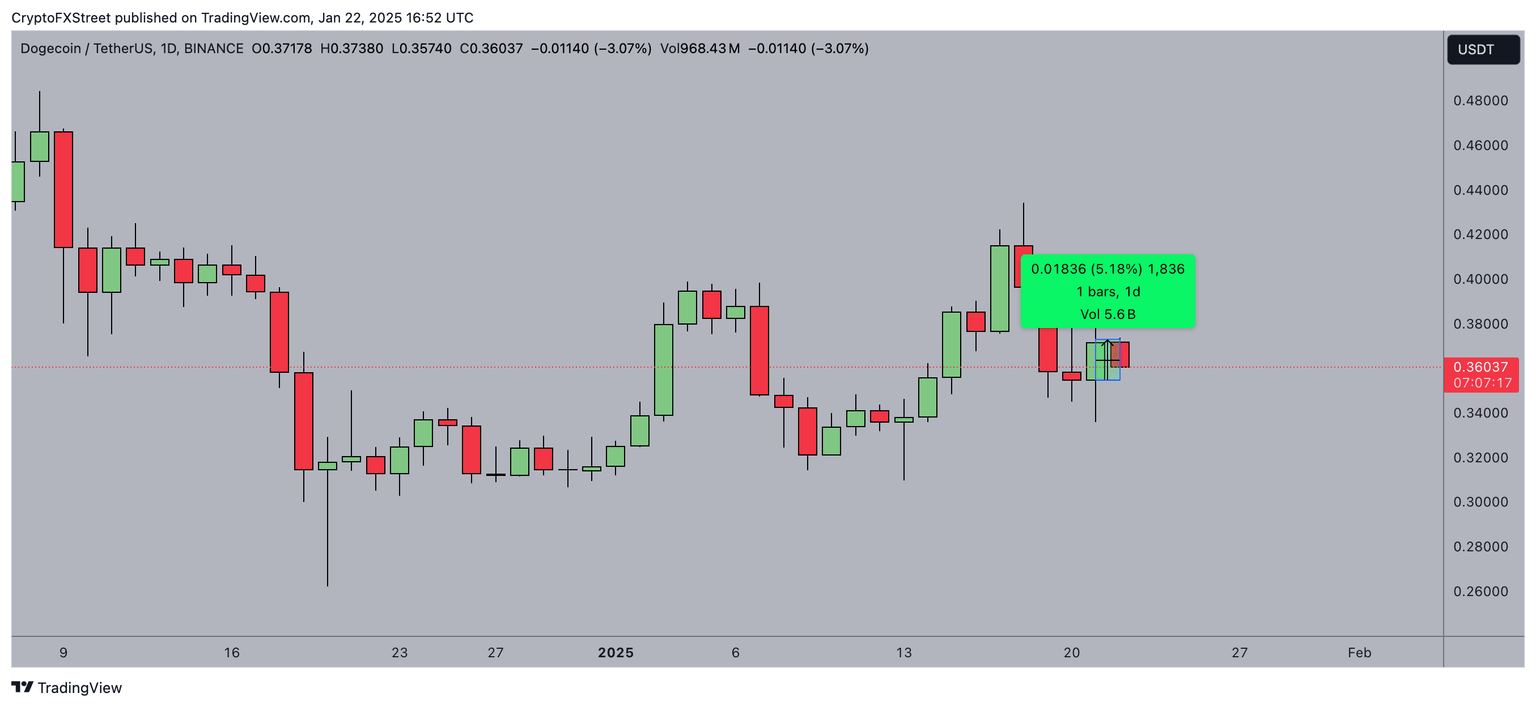

Dogecoin’s price saw a modest rise following the announcement, climbing 5.2% within 24 hours of the executive order’s signing.

While the gains reflected initial market enthusiasm, the rally remained tempered as investors awaited further clarity on the potential link between Dogecoin and the newly established department.

Sell-the-news triggers, Vivek Ramaswamy’s exit dampening DOGE price momentum

Dogecoin (DOGE) price performance on the day was notably subdued at 5%, compared to other assets like Tornado Cash (TORN) and Monero (XMR), which both registered double-digit gains.

Several factors contributed to the subdued performance. One significant issue was the announcement of the DOGE unit months ago, which led many investors to already price the development.

This early anticipation prevented DOGE from successfully breaking above the crucial $0.40 level, which many traders had closely watched.

Additionally, some existing holders executed a typical “sell-the-news” strategy, opting to take profits rather than hold, further dampening the DOGE market momentum.

Moreover, the market sentiment surrounding DOGE was also affected by the recent exit of Vivek Ramaswamy, who stepped down from his role in the cryptocurrency space to pursue his campaign for Ohio governor.

This unexpected move introduced an element of controversy that tempered investor enthusiasm.

Despite the challenges, the broader memecoin market continues to show resilience.

New tokens like TRUMP and MELANIA have generated significant interest, providing a glimmer of hope for DOGE holders.

If key support levels hold, Dogecoin could potentially extend its gains in the days ahead, as market participants remain engaged in the memecoin sector.

DOGE Price Forecast: A $0.40 breakout could validate bullish dominance

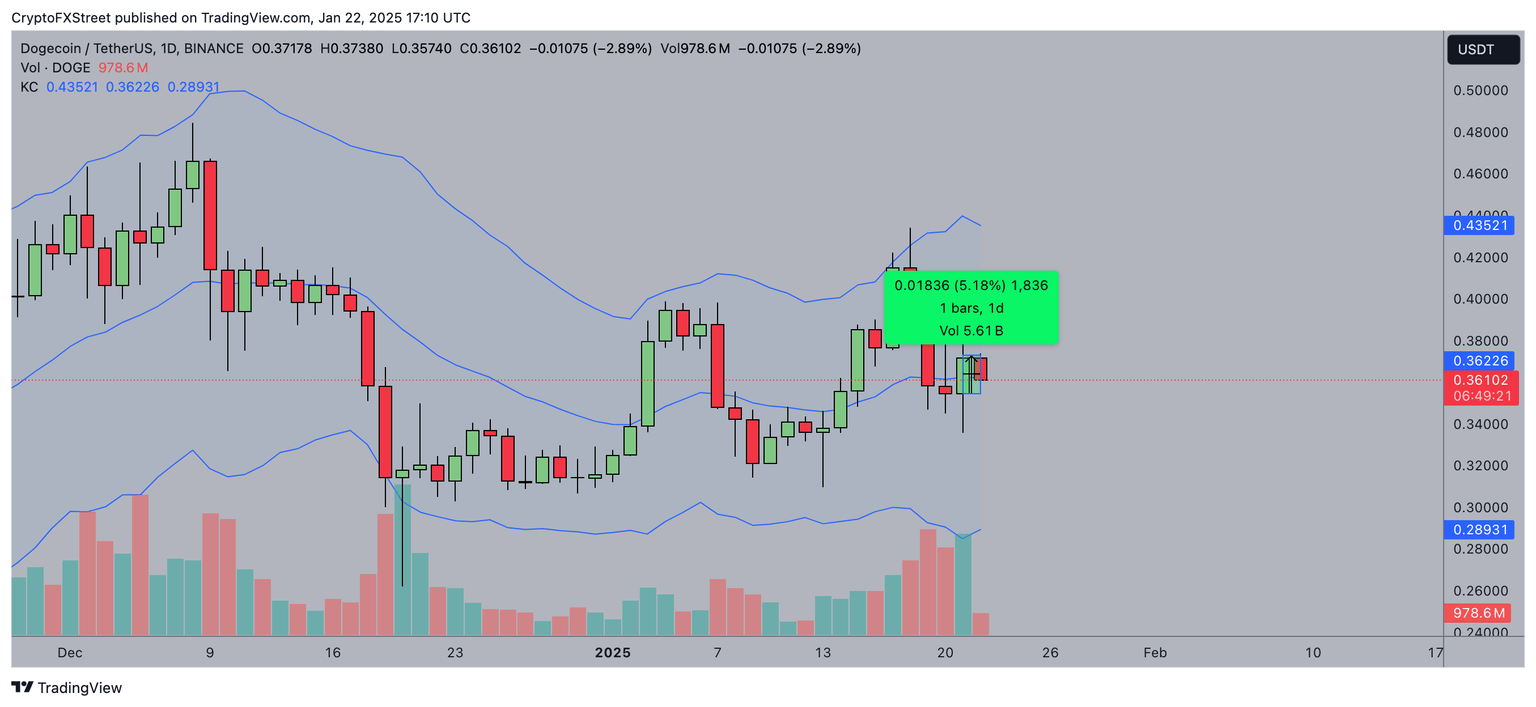

Dogecoin price action hints at a potential bullish breakout near $0.40, supported by the technical indicators.

The Keltner Channel (KC), visible in the chart, shows a contracting volatility range, with the midline at $0.36226 acting as immediate support. DOGE is currently trading at $0.36102, just below this key level, following a mild -2.89% daily dip.

The recent surge to $0.40 (5.18% higher) shows that buying pressure remains strong, evidenced by a substantial daily volume spike of 5.61B DOGE.

This high volume and the upper KC breach on Monday suggest bulls are aggressively testing resistance.

A close above $0.36226 could revalidate bullish dominance, targeting $0.43521, the upper KC limit.

However, bearish risks persist. The failure to reclaim $0.36226 convincingly might lead to a retracement toward $0.28931, the KC lower boundary.

This would confirm that bears have regained short-term control, invalidating the upward scenario.

Traders should monitor a daily close above $0.36226 or below $0.28931 for clearer directional cues.

A decisive move toward $0.40 will likely define DOGE’s next trend phase.

Author

Ibrahim Ajibade

FXStreet

Ibrahim Ajibade is an accomplished Crypto markets Reporter who began his career in commercial banking. He holds a BSc, Economics, from University of Ibadan.