Dogecoin price maintains key support as investors' activity rises by 450%

- Dogecoin price nearly slipped below $0.070 about two days ago before recovering to trade at $0.073.

- Retail investors and small wallet holders' accumulation could prove to be a boon for the altcoin.

- The rate at which DOGE changes hands since the last week has risen by over 450%.

Dogecoin price is holding above an important price point after noting a consistent decline for nearly a month. The meme coin leader falling to a two-month low triggered significant activity among a particular cohort, however, their impact on the bigger picture remains rather insignificant.

Dogecoin price bounces back

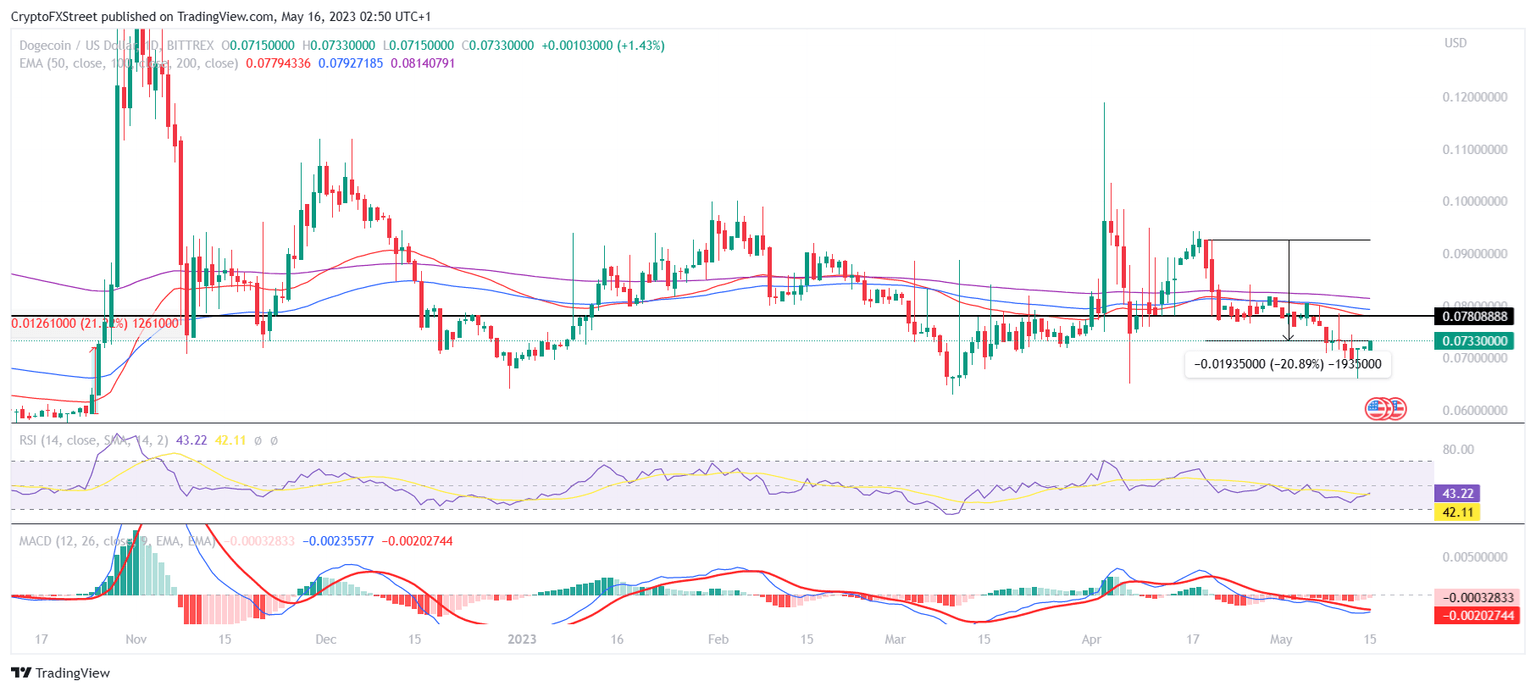

Dogecoin price, after a 20.89% decline since April 19, marked a swing low to $0.070 over the last four days. The meme coin grazed a two-month low before recovering slightly to trade at $0.073 at the time of writing.

DOGE/USD 1-day chart

This recovery came after a sudden surge in the velocity of the altcoin, which is the rate at which DOGE changes hands. High velocity is usually suggestive of an active user base, which in the case of Dogecoin is significantly higher. Since May 11, the change in addresses has increased by 477%, from 3.2 to 20.8.

Dogecoin velocity

Most of this is the result of the increased activity among smaller wallet holders, which consists of a large number of investors. Addresses with a balance between 0.1 to 1 DOGE, 1 to 10 DOGE and 10 to 100 DOGE are three of the largest groups of addresses, collectively representing close to 2 million addresses.

These sets of wallets have noted an increase in their balance that suggests they have been accumulating, collectively adding over 600,000 DOGE in the last week. However, in regard to the meme coin, this is relatively insignificant. The accumulation is worth a little over $42,000 and bears no impact on the price action whatsoever.

Dogecoin supply distribution

Change in Dogecoin price can be expected when large transactions worth more than $100,000 observe fluctuation, as that would be a sign of whale activity. As for what can be expected from price action going forward, investors should observe some caution since clear signs of recovery are not apparent.

The Moving Average Convergence Divergence (MACD) appears to be on the verge of a bullish crossover as the MACD line (blue) is nearing a cross over the signal line (red). But the Relative Strength Index (RSI) is still in the bearish zone below the neutral mark at 50.0.

Thus for the short term, a rise to $0.078 should be the next target. Coinciding with the 50-day Exponential Moving Average (EMA), flipping this level into a support floor could provide some strength to potential recovery.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.

%2520%5B06.16.11%2C%252016%2520May%2C%25202023%5D-638198005979391889.png&w=1536&q=95)

%2520%5B06.16.46%2C%252016%2520May%2C%25202023%5D-638198006234674155.png&w=1536&q=95)