Dogecoin price has one chance of recovering upon breaking $0.16

- Dogecoin price continues its ten-month downtrend as it slices through the $0.127 support level.

- DOGE is likely to crash by 35% to $0.075 if the selling pressure continues to build up.

- A daily candlestick close above $0.163 will invalidate the bearish thesis and promote the possibility of an uptrend.

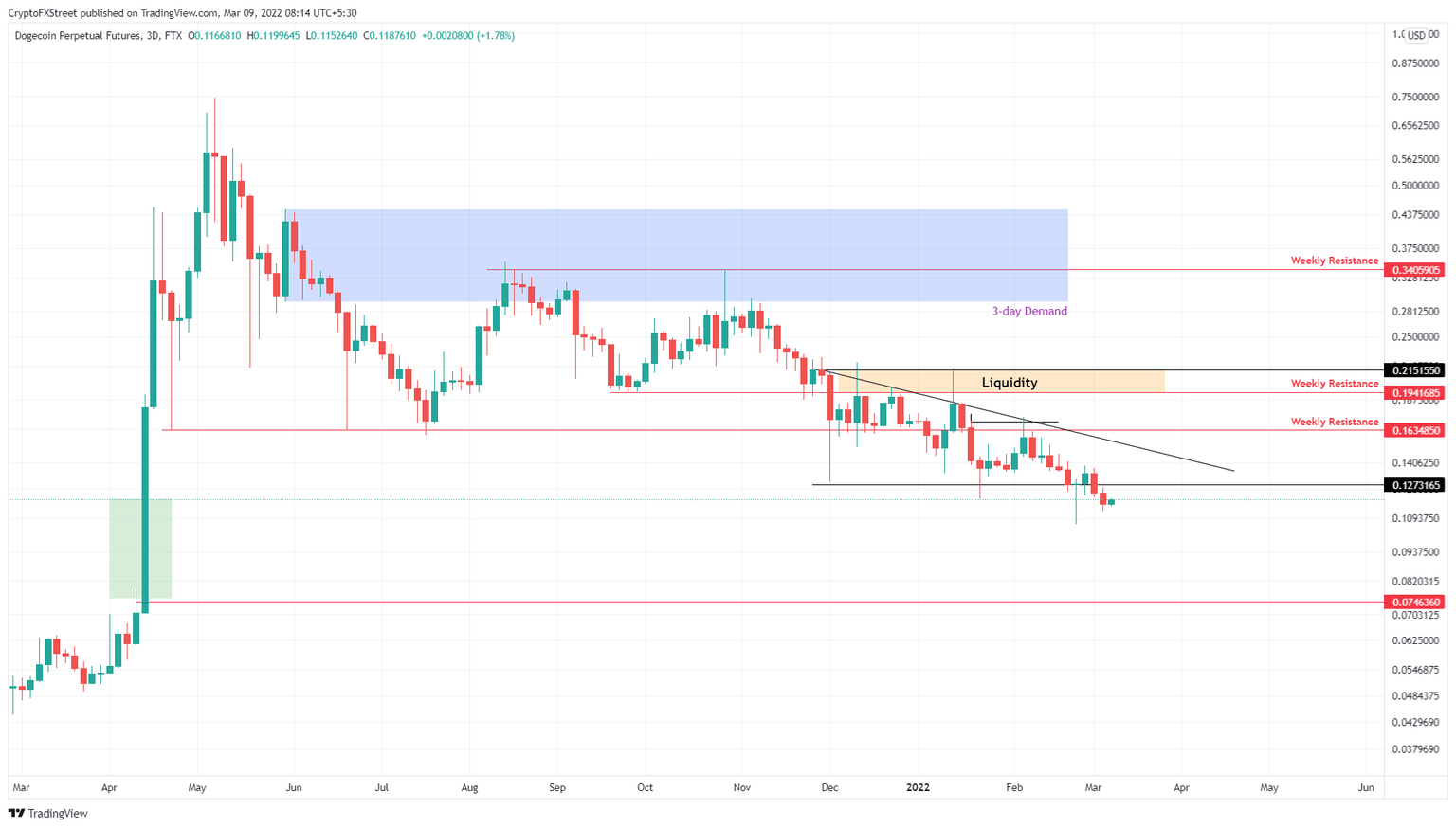

Dogecoin price shows no signs of stalling the downswing that has been ongoing since its all-time high in May 2021. The resulting crash seems to be reaching for a fair value gap (FVG), adding credence to this incoming downswing.

Dogecoin price faces the threat of a crash

Dogecoin price set up an all-time high at $0.744 on May 7, 2021, and has been on a downtrend ever since. This ten-month bear rally has knocked the market value of DOGE by 84% to where it currently trades - $0.118.

The recent crash, pushed the meme coin to shatter the immediate support level at $0.127, pushing the odds in the bears’ favor. Going forward, investors can expect the Dogecoin price to continue its descent to $0.074 due to the presence of the FVG, ranging from $0.0075 to $0.119.

The total move would constitute a 35% crash and is likely where a local bottom will form for DOGE.

DOGE/USDT 3-day chart

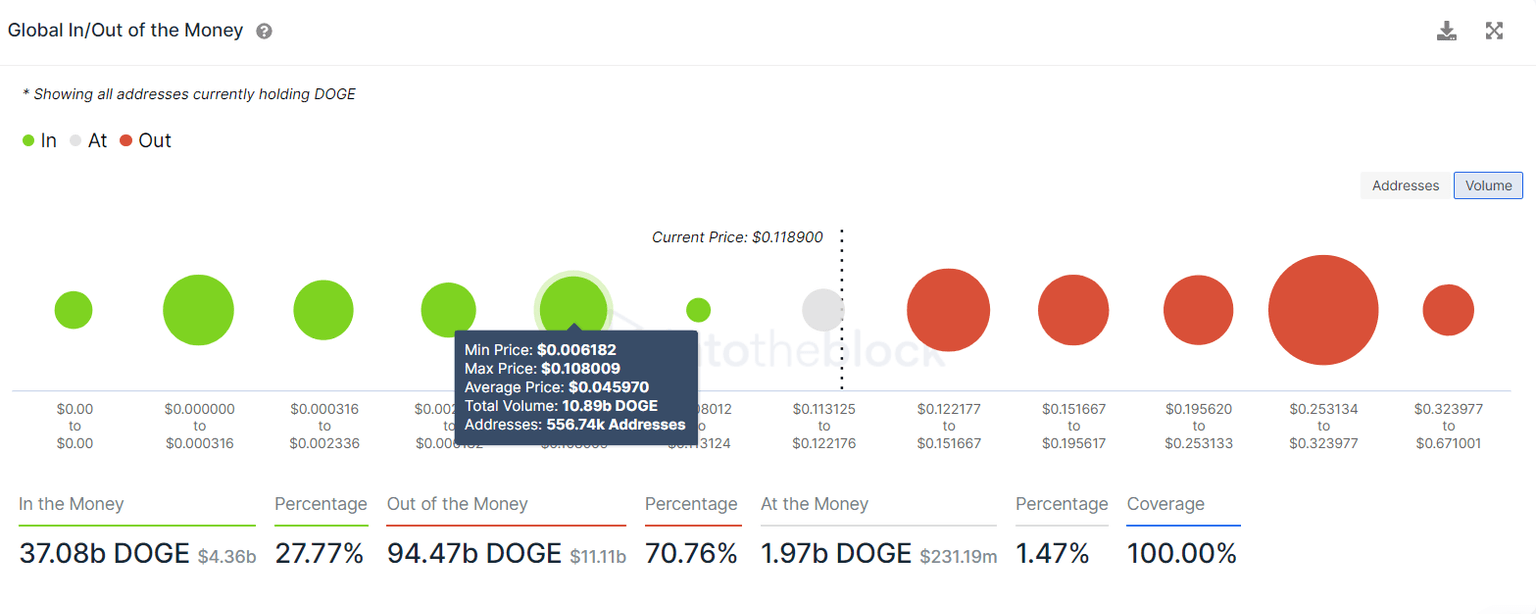

Supporting this downswing is IntoTheBlock’s Global In/Out of the Money (GIOM) model. This index shows that the immediate support floor at $0.111 is non-existent and will likely be breached easily by a short-term spike in selling pressure.

Therefore, the Dogecoin price is likely to head lower to $0.045, where roughly 556,740 addresses purchased roughly 10.89 billion DOGE tokens. This barrier coincides closely with the target obtained from a technical perspective and is the only stable support that should be able to absorb the incoming selling pressure.

DOGE GIOM

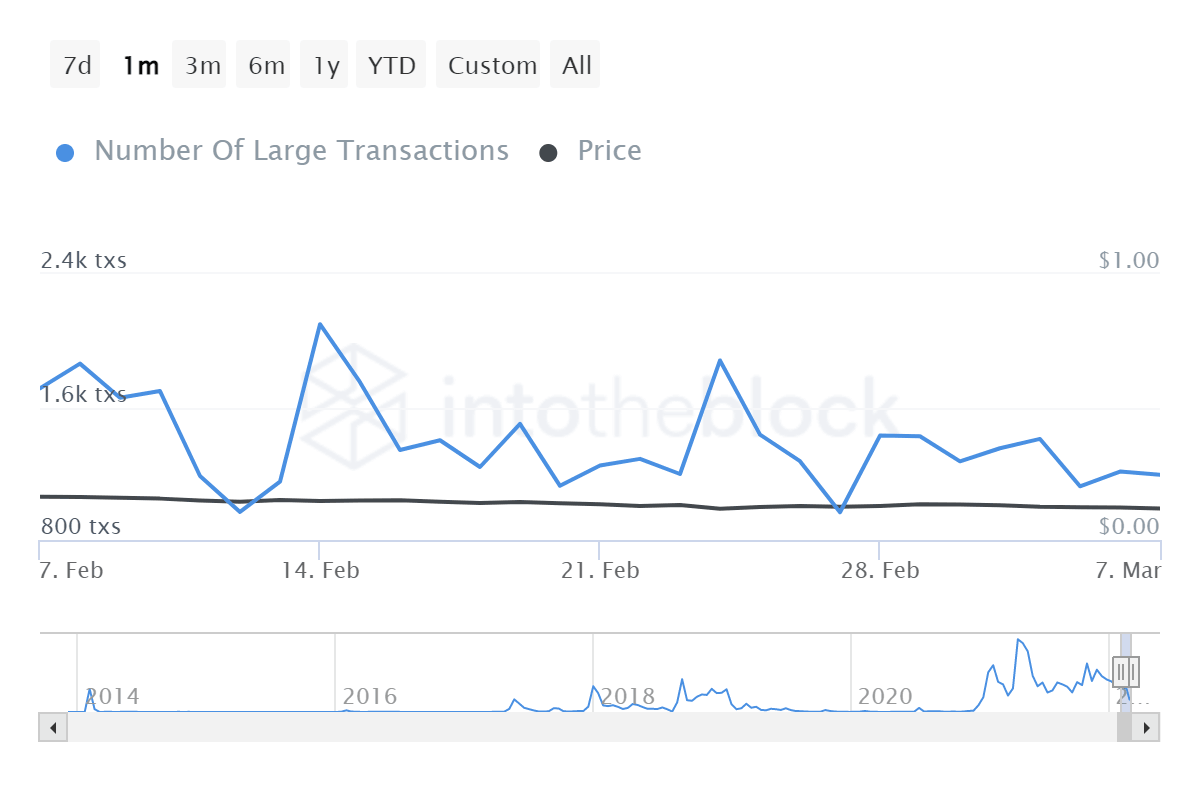

Further signaling the bearish nature of Dogecoin price is the decline in the number of large transactions worth $100,000 or more from 1,710 to 1,190. This 30% drop in transfers that serve as a proxy of whales’ investment thesis indicates that these investors are not interested in DOGE at the current price levels.

DOGE large transactions

While things are looking bleak for Dogecoin price, a quick surge in buying pressure that pushes DOGE to produce a daily candlestick close above $0.163 will create a higher high, hinting at an uptrend. Such a move will invalidate the bearish thesis for Dogecoin price.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.