Dogecoin price gains traction after 1,800 ATM locations in the U.S. started accepting it

- Dogecoin is now available in 1,800 different ATM locations in the U.S.

- Users will be able to purchase the digital asset using cash across the network of CoinFlip, which provides the ATMs.

- Dogecoin price is on the verge of a significant 27% breakout.

CoinFlip, one of the largest Bitcoin and cryptocurrency ATMs provider in the world has announced the support of Dogecoin across its 1,800 locations. Users can currently utilize the discount code 'DOGE' for 15% off on all transaction fees.

We're excited to announce that we are listing #dogecoin on CoinFlip ATMs!

— CoinFlip Bitcoin ATM (@CoinFlipATM) March 1, 2021

You can now buy $DOGE with cash at any of our 1,800 locations nationwide!

Find a CoinFlip ATM to buy $DOGE and use discount code "DOGE" for 15% off all transaction fees https://t.co/Bf4180qiAz pic.twitter.com/8A01jtY9je

Dogecoin price needs to climb above key level

It seems that the interest in Dogecoin remains high despite the recent sell-off. On the 4-hour chart, the digital asset has established a symmetrical triangle pattern. A breakout above $0.054 would quickly drive Dogecoin price towards $0.07.

DOGE/USD 4-hour chart

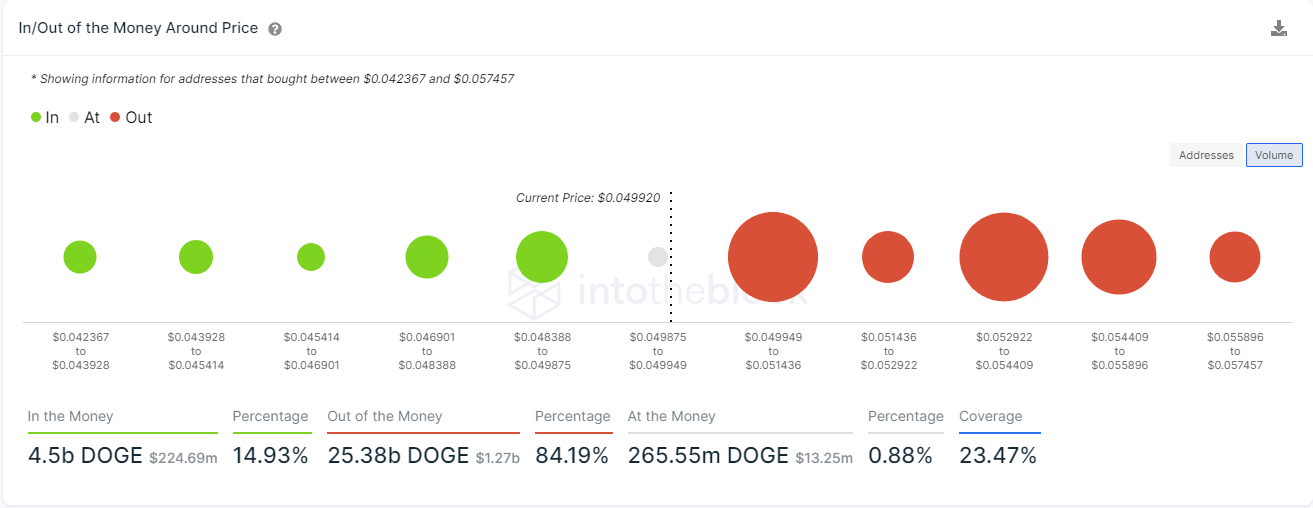

However, the In/Out of the Money Around Price (IOMAP) chart shows stiff resistance ahead above $0.05. There are several significant resistance areas between $0.05 and $0.055, which coincide with the key resistance level stated above.

DOGE IOMAP chart

If DOGE bulls can't push the digital asset above $0.055, Dogecoin price will get pushed down to $0.04 as there is weak support on the way down.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.