Dogecoin Price Forecast: Traders move $380M as DOGE mirrors Bitcoin’s pullback

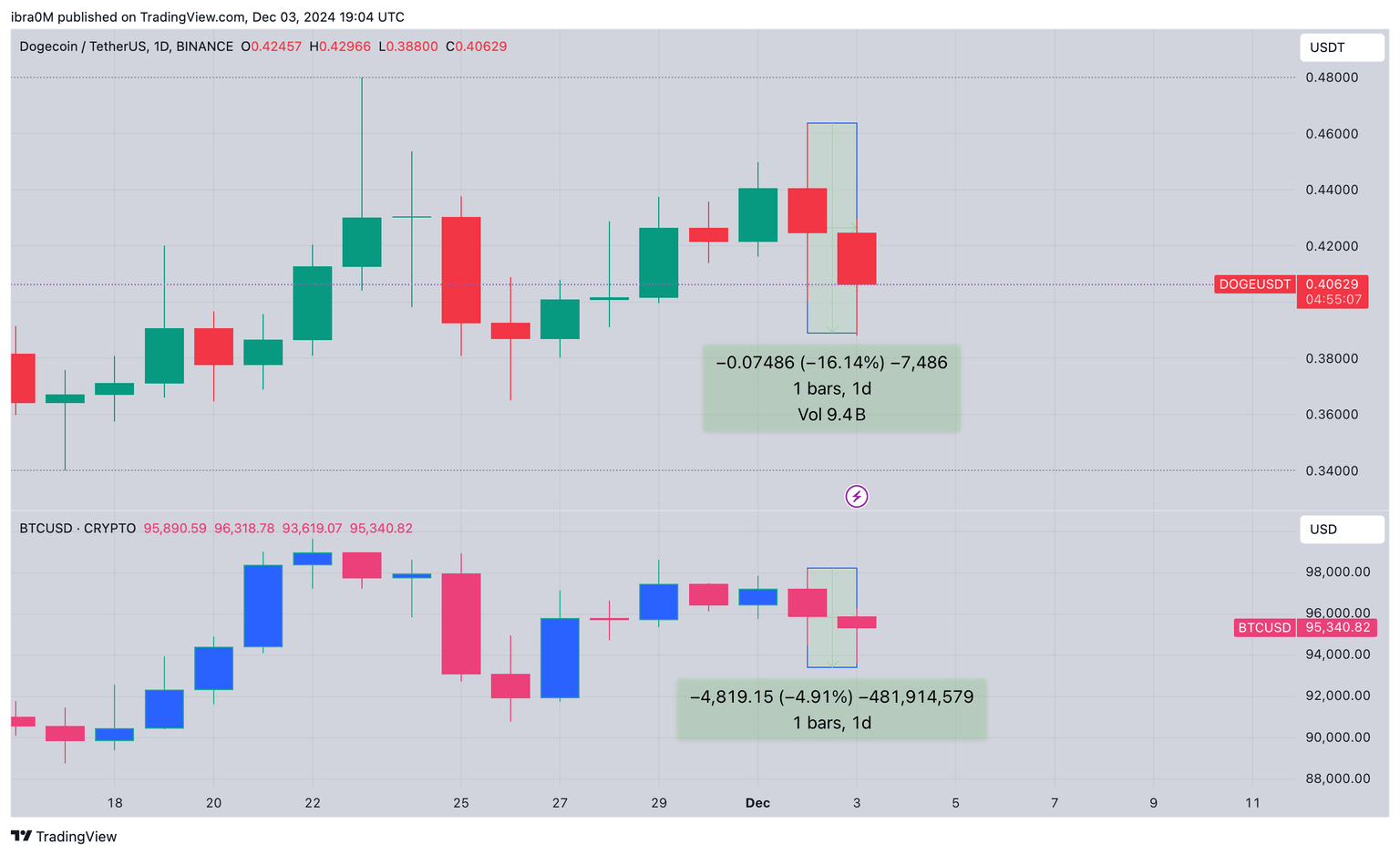

- Dogecoin price tumbled toward $0.40 on Tuesday, down 16% on the day.

- DOGE open interest dropped by $380 million as traders reacted to the failed $0.50 breakout on Monday.

- Technical indicators show DOGE price trending below its 20-day average, signaling a prolonged decline in market demand.

Dogecoin price continues to consolidate below the $0.40 level on Tuesday, down 16% within the daily timeframe.

After multiple failed attempts at breaching $0.50 over the past week, speculative traders have moved to scale down their DOGE positions.

Is Dogecoin price at risk of a major correction phase?

Dogecoin price tumbled $0.40 amid profit-taking frenzy

Closing the month with 175% gains, Dogecoin emerged one of the best performing mega-cap crypto assets in November.

After prices peaked at $0.45 around November 22, DOGE has struggled for traction as traders began locking in profits.

On Monday, the global crypto market received a major boost from several bullish catalysts ranging from Microstrategy’s $1.4 billion BTC purchase, and WisdomTree filing for Ripple (XRP) ETF.

However, while the likes of XRP, Monero (XMR) and Litecoin (LTC) led the top gainers’ charts, Dogecoin and Bitcoin prices remained subdued below the $0.50 and $100,000 milestones respectively.

Dogecoin price sharply retraced 16% to hit $0.40 at press time on Tuesday, after topping out at $0.45 during Monday's rally.

The chart above shows how Dogecoin mirrored Bitcoin’s 5% dip over the last 24 hours.

Dogecoin traders pulled $380M after failed $0.50 breakout

After reaching a 3-year peak of $0.48 on November 23, Dogecoin price has failed to advance further.

And after a week of stagnation, short-term traders are moving to cut down on their DOGE positions.

Lending credence to this narrative, Coinglass’ open interest chart below tracks the value of active Dogecoin futures contracts, to provide insights on traders’ reaction to key market events.

Dogecoin price vs. DOGE Open interest | Source: Coingecko

The chart above shows that DOGE open interest has dropped from $3.88 billion to $3.50 billion over the last 24 hours.

This $380 million outflow recorded represents a 10% decline in total capital stock, while Dogecoin price has dropped by more than 16% within the same period.

When the price of an asset falls faster than open interest, it often indicates that traders are closing long positions rapidly.

As bulls lose confidence in the DOGE’s short-term recovery potential, the $0.40 support could be at risk in the days ahead.

DOGE Price Forecast: $0.40 support at risk

Dogecoin continues to flash bearish signals as bulls struggle to hold the $0.40 support level.

The Donchian Channel (DC) DOGE currently trades below the midline ($0.41), signaling growing bearish momentum. A multi-day close below the $0.41 could trigger further downswings towards the next key support level at $0.34.

Volume Delta data shows a net negative figure of -89.44M, indicating stronger selling pressure compared to buying activity.

This imbalance reinforces the possibility of bearish continuation.A breakdown below $0.40 could trigger additional liquidations, accelerating losses toward the $0.34 support zone.

Conversely, if DOGE manages to hold $0.40 and climb above $0.45, bulls could attempt to force a retest of the $0.50 psychological resistance.

Author

Ibrahim Ajibade

FXStreet

Ibrahim Ajibade is an accomplished Crypto markets Reporter who began his career in commercial banking. He holds a BSc, Economics, from University of Ibadan.