Dogecoin price decline in March has not restored optimistic speculation

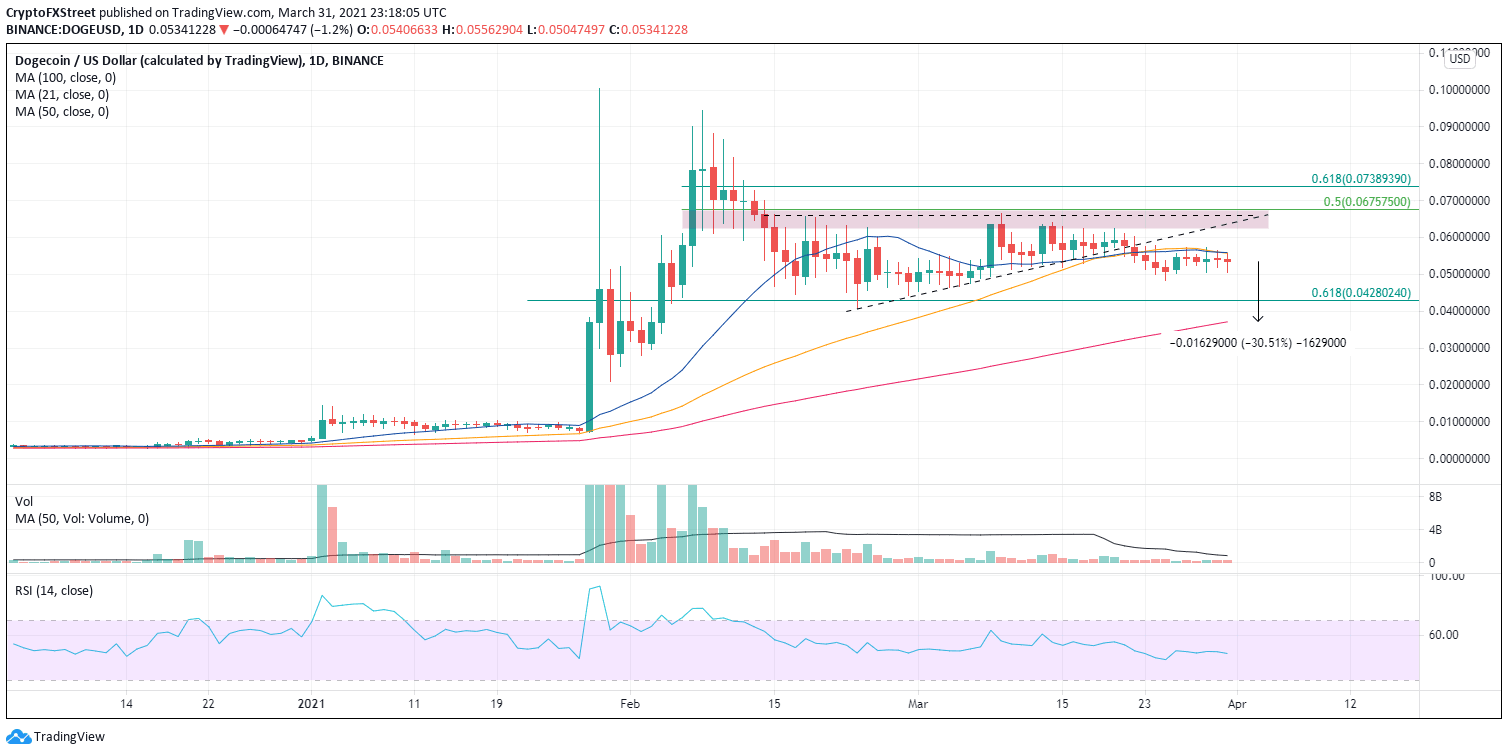

- Dogecoin price being pressured by two declining moving averages.

- Daily Relative Strength Index (RSI) showing temporary equilibrium between buyers and sellers.

- Traders should not lose sight of the deteriorating technical backdrop.

Dogecoin price is failing to capture any buying interest after the 7% spike on March 26. Instead, the altcoin has drifted sideways below two declining moving averages, the 20-day SMA and the 50-day SMA. For now, a conservative mindset is appropriate in this trading environment.

Dogecoin price ignoring improved sentiment in the cryptocurrency market

The decline below the ascending triangle on March 22 was a decisive technical event for DOGE and revealed to traders that media hype could only sustain a trend for so long. Such tranquil price action is not always a precursor to explosive gains.

With the bias tilted to the downside, no credible support emerges for DOGE until the 0.618 Fibonacci retracement at $0.043, followed closely by the February low at $0.040. The next reliable support does not appear until the 100-day SMA at $0.037, which represents a 30% loss to traders from the current price.

DOGE/USD daily chart

A daily close above the 20-day SMA and 50-day SMA would flip DOGE’s bearish outlook to neutral and raise the odds of a rally in the coming weeks to the price range between $0.063 and $0.068. If bulls have the stamina, the 0.618 Fibonacci retracement of the February plunge at $0.074 is a potential target.

Author

Sheldon McIntyre, CMT

Independent Analyst

Sheldon has 24 years of investment experience holding various positions in companies based in the United States and Chile. His core competencies include BRIC and G-10 equity markets, swing and position trading and technical analysis.