Dogecoin price attempts recovery with a 25% rally

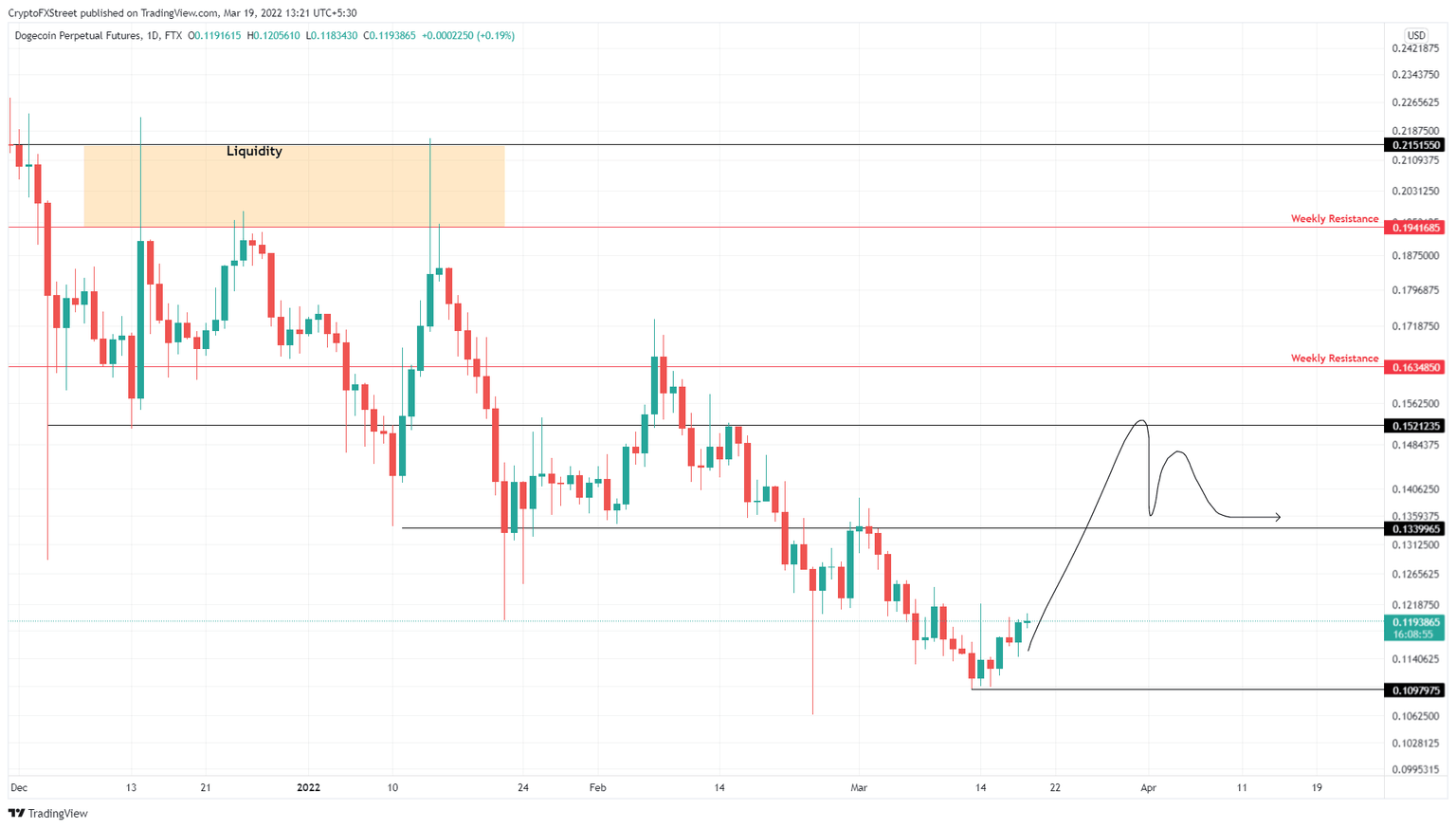

- Dogecoin price is looking to recover losses by rallying to $0.152.

- DOGE needs to shatter the intermediate hurdle at $0.134 to complete its 25% run-up.

- A daily candlestick close below $0.109 will invalidate the bullish thesis.

Dogecoin price has been unresponsive for most of the bull run in 2021. The lackluster performance was due to the attraction Shiba Inu garnered, which has caused DOGE to bleed slowly.

Dogecoin price tries to chip away the bears

Dogecoin price has dropped roughly 36% in the last month and flipped the $0.152 and $0.134 support levels into resistance barriers. This move has pushed DOGE to set a swing low at $0.109, which has allowed buyers to step in and trigger a potential recovery.

This relief rally is likely to propel DOGE by 12% to the immediate hurdle at $0.134. Flipping this blockade into a foothold will allow the buyers to prepare a launchpad for further ascent. In which case, the bulls will aim for the $0.152 barrier, indicating a total run-up of 27%.

Here, short-term holders are likely to book profits, kick-starting a correction. However, if these Dogecoin holders stay strong, there is a good chance this rally could extend to the weekly resistance barrier at $163.

DOGE/USDT 1-day chart

Regardless of the optimism if the Dogecoin price fails to move past the first hurdle at $0.134, it will denote weakness on the buyer's part. In such a case, if bears take control, DOGE will likely retrace lower and look for a support level.

If this downswing produces a daily candlestick close below $0.109, it will invalidate the bullish thesis for Dogecoin price and open the path for a 31% crash to $0.075.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.