Dogecoin Price Analysis: DOGE eyes $0.04 if this key support caves in

- DOGE/USD’s 12H chart points to more downside in the offing.

- Bullish 50-SMA at $0.0510 is the level to beat for the bears.

- RSI points south below the midline, backing the downside bias.

Dogecoin (DOGE/USD) is looking to extend Friday’s sell-off, as the bears fight back control following Thursday’s temporary reversal.

The meme-based digital currency, Dogecoin, has danced to the tune of the SpaceX CEO Elon Musk’s tweets so far this month but overall, the trend has been to the downside as the frenzy around the No. 13 subsides.

Commenting on Musk’s love for the Shiba Inu-themed cryptocurrency Friday, Binance Holdings Ltd. Chief Executive and Founder, Changpeng Zhao, said: “I’m surprised Elon is so gung-ho on Dogecoin -- but this is a decentralized, free world, anybody can like anything.”

Binance, the operator of one of the world’s largest crypto exchanges, has recently added Dogecoin futures on its platform to satisfy new liquidity demand.

DOGE/USD: Prepping up or for a big move to the downside?

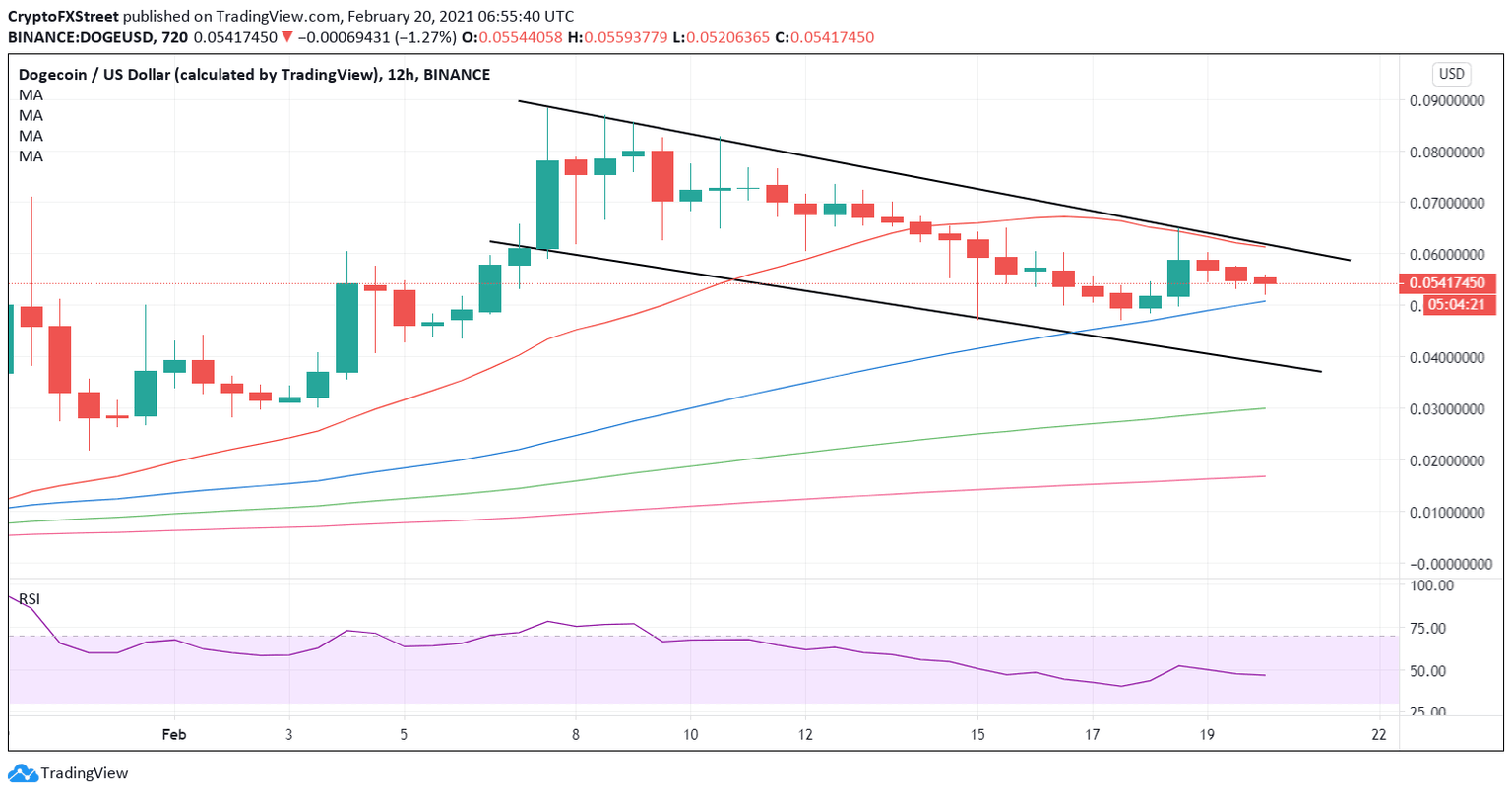

DOGE/USD: 12-hour chart

DOGE/USD is traversing within a falling channel after hitting record highs at $0.0881 on February 7.

As observed on the 12-hour chart, the price trying hard to defend the critical upward-sloping 50-simple moving average (SMA) support at $0.0510.

Should the aforesaid fierce support succumb to bearish pressures, the Dogecoin could witness a sharp sell-off to the falling channel support, now aligned at $0.0389.

The relative strength index (RSI) points lower, currently at 46.80, suggesting that there remains more room to the downside.

If the 50-SMA support holds, the DOGE bulls could look to challenge a powerful barrier around $0.0615, where the falling channel resistance and bearish 21-SMA coincides.

Acceptance above the latter would yield a technical breakout, negating the recent corrective decline while opening doors once again towards the all-time-highs.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.