Dogecoin Price Analysis: DOGE battles key hurdles above $0.05 on Eion Musk’s tweets

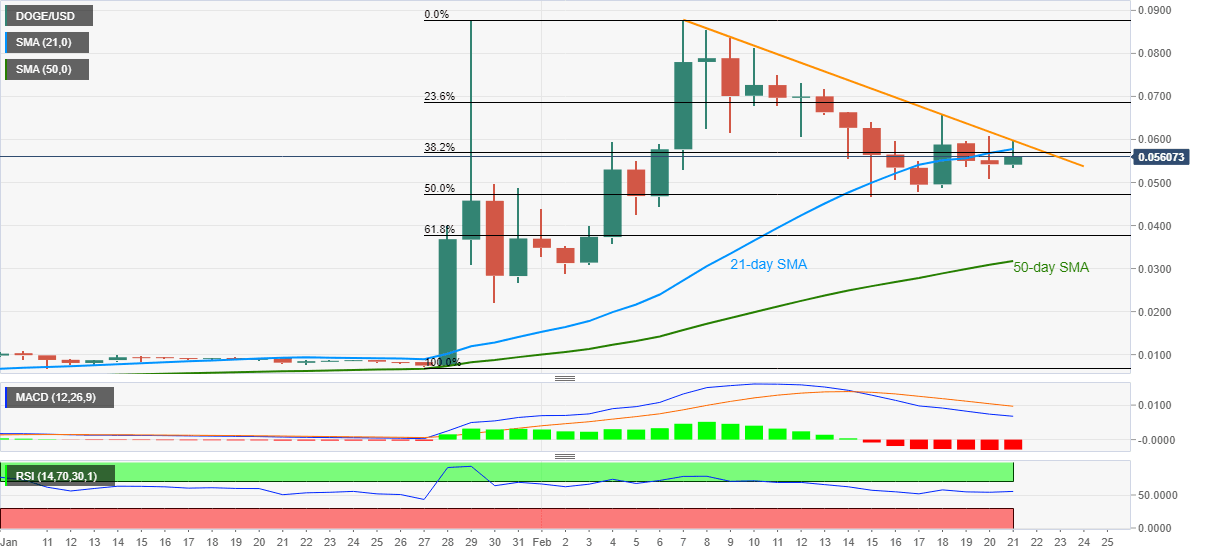

- DOGE bulls struggle to overcome three-week-old resistance line, 21-day SMA.

- Eion Musk tweets, “Dojo 4 Doge”, raise doubts over BTC, ETH.

- Bearish MACD favors further consolidation of gains towards the key Fibonacci retracement levels.

- Bulls can eye $0.1000 beyond immediate resistance breakout.

Dogecoin retraces the initial spike to 0.0597 while easing to 0.0560 during the early Monday. Even so, the cryptocurrency pair stays near the key resistances on Tesla's owner’s optimism for DOGE.

In contrast to Musk’s favor for the Dogecoin, the world’s second-richest man admits that bitcoin and ethereum 'seem high'.

While the market reaction on the BTC/USD and the ETH/USD has been mild, the DOGE/USD jumped from 0.0544 to 0.0597 following the tweets.

Even so, the Dogecoin bulls need to cross a descending resistance line from February 07 and 21-day SMA, near 0.0585-90, to gain the market’s confidence in witnessing the 0.1000 threshold.

Alternatively, 50% and 61.8% Fibonacci retracement of late January run-up, respectively around 0.0470 and 0.0375, will be the key to stop the DOGE/USD bears ahead of 50-day SMA, at 0.0317 now.

Overall, DOGE/USD is up for consolidating the wild gained marked a few weeks back. However, bulls shouldn’t be disappointed as fundamentals favor the coin.

DOGE/USD daily chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.