Decentraland price to catch its breath before MANA bulls revisit $3

- Decentraland price rose 14% but faced stiff resistance at $2.54, leading to a retracement.

- Investors can expect MANA to retest $2.29 before making another attempt to tag $3.

- A four-hour candlestick close below $2.20 will invalidate the bullish thesis.

Decentraland price shows a lack of momentum after rallying over the last week, resulting in a correction. While this pullback is necessary for further gains, if not controlled, bears could ruin the picnic.

Decentraland price set for massive gains

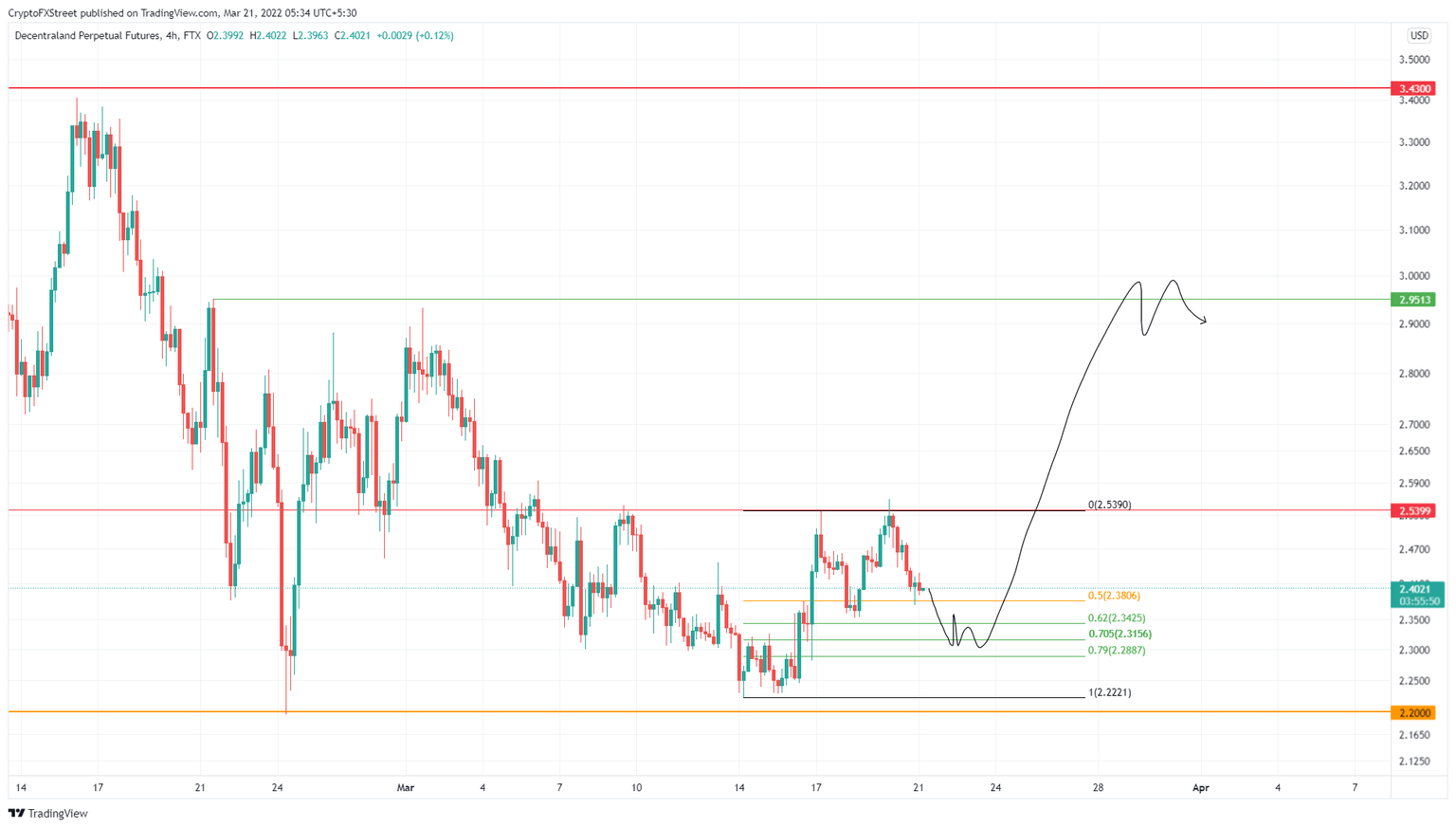

Decentraland price set a range extending from $2.22 to 2.54 after rallying 15.17% between March 14 and 17. This move was followed by a bullish uptick that allowed MANA to sweep the highs.

While optimistic, the uptrend failed to sustain above $2.54 and led to a correction. Decentraland price is currently trading at $2.40 and shows signs that this pullback will dig deeper. More specifically, MANA is likely to reverse its downtrend after retesting the 70.5% retracement level at $2.32.

Ideally, a trend reversal should occur anywhere between $2.89 to $2.34, but in an extreme case, Decentraland price might tag the $2.22 or $2.20 support levels before pulling ‘a hundred and eight.’

As long as the MANA price does not produce a decisive four-hour candlestick close below $2.20, the bullish thesis remains intact. Regardless of the reversal’s accurate position, investors can expect Decentraland to make an attempt to retest the $3 psychological level.

MANA/USDT 4-hour chart

While things are looking up for Decentraland price, it needs to be mindful of not allowing bears to take control. However, a four-hour candlestick close below $2.20 will invalidate the bullish thesis for Decentraland price.

Flipping the $2.20 support level into a resistance barrier on a daily chat will be a significant development and will open the path for further losses. In this situation, market participants can expect MANA to crash 32% before arriving at a stable support level at $1.49.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.