Decentraland price eyes liquidity above $3 as MANA bulls comeback

- Decentraland price has flipped the $2.57 resistance barrier into a support floor, signaling a bullish outlook.

- Investors can expect MANA to rally and retest the 50-day SMA and weekly resistance confluence at $3.

- A breakdown of the $2.44 barrier will create a lower low and invalidate the bullish thesis.

Decentraland price looks ready for a quick run-up after it flipped a crucial hurdle into a foothold. Investors can expect MANA to continue this rally until it faces another stiff hurdle.

Decentraland price eyes higher high

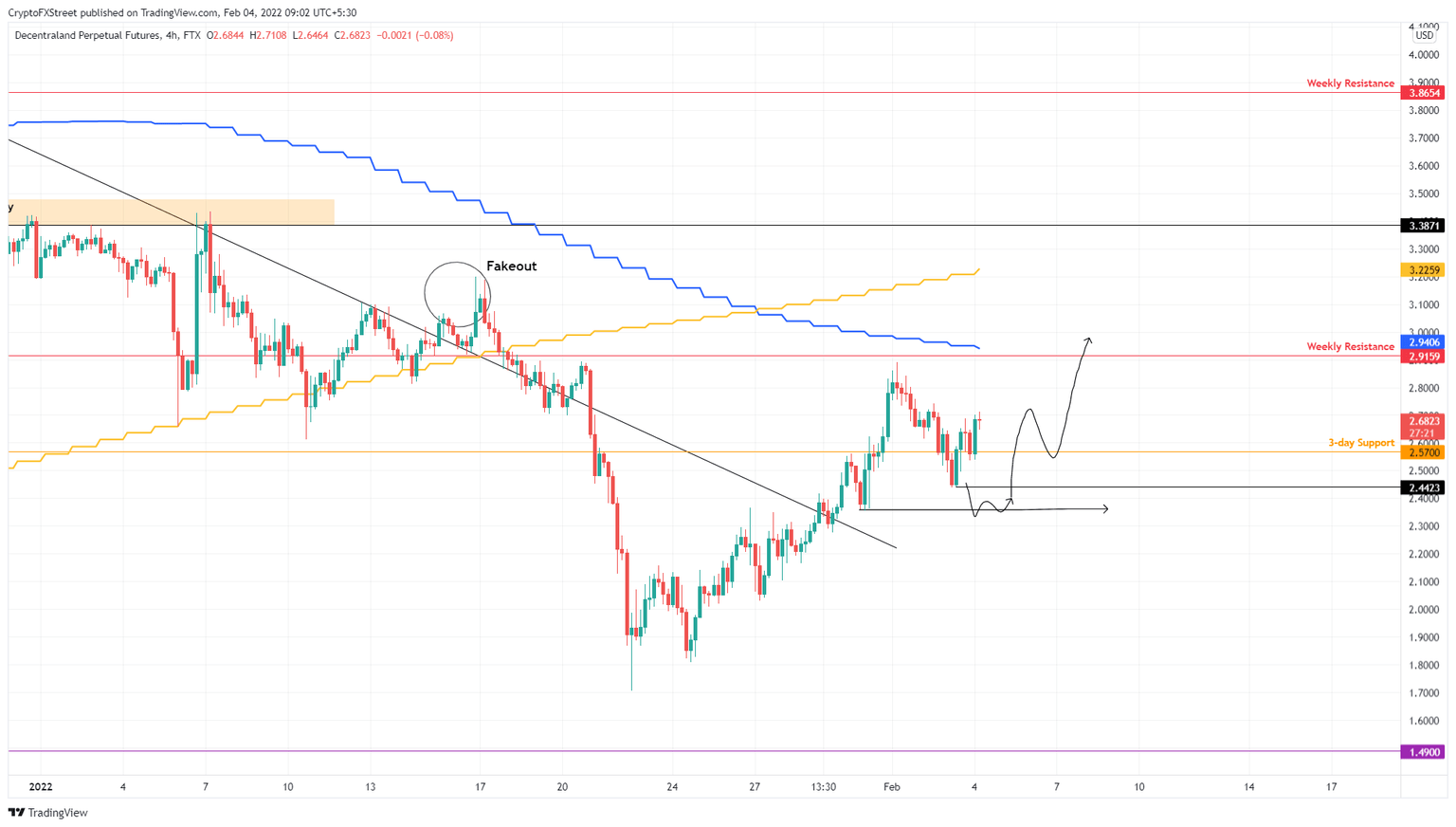

Decentraland price set up two swing highs just below the $3 level on January 20 and February 1 but retraced quickly after, leading to a massive downswing. As MANA recovers from this slump, it has flipped the $2.57 resistance barrier into a support level, signaling a resurgence of buyers.

Due to this development, investors can expect Decentraland price to continue moving higher. The 50-day Simple Moving Average (SMA) and the weekly resistance barrier confluence at $3 is the next target for bulls.

This uptrend could extend beyond $3 if buyers manage to flip the said hurdle into a foothold. Doing so will allow Decentraland price to rally to the 100-day SMA at $3.23, bringing the total gain to 20%.

MANA/USDT 4-hour chart

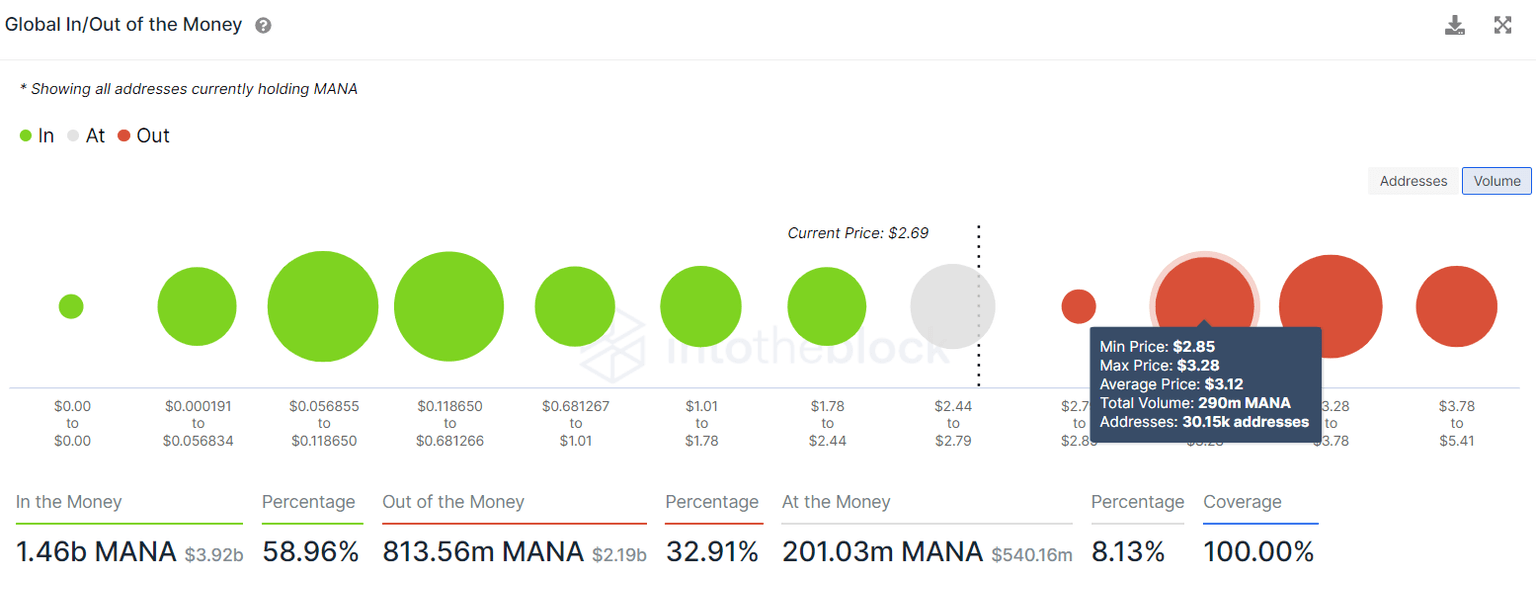

Supporting this ascent for Decentraland price is IntoTheBlock’s Global In/Out of the Money (GIOM) model. This on-chain index shows that roughly 30,150 addresses that purchased 290 million MANA tokens at an average price of $3.12 are “Out of the Money.”

Therefore, any short-term uptrend is likely to face headwinds from these holders trying to break even. Moreover, this level roughly coincides with the target obtained from a technical perspective.

MANA GIOM

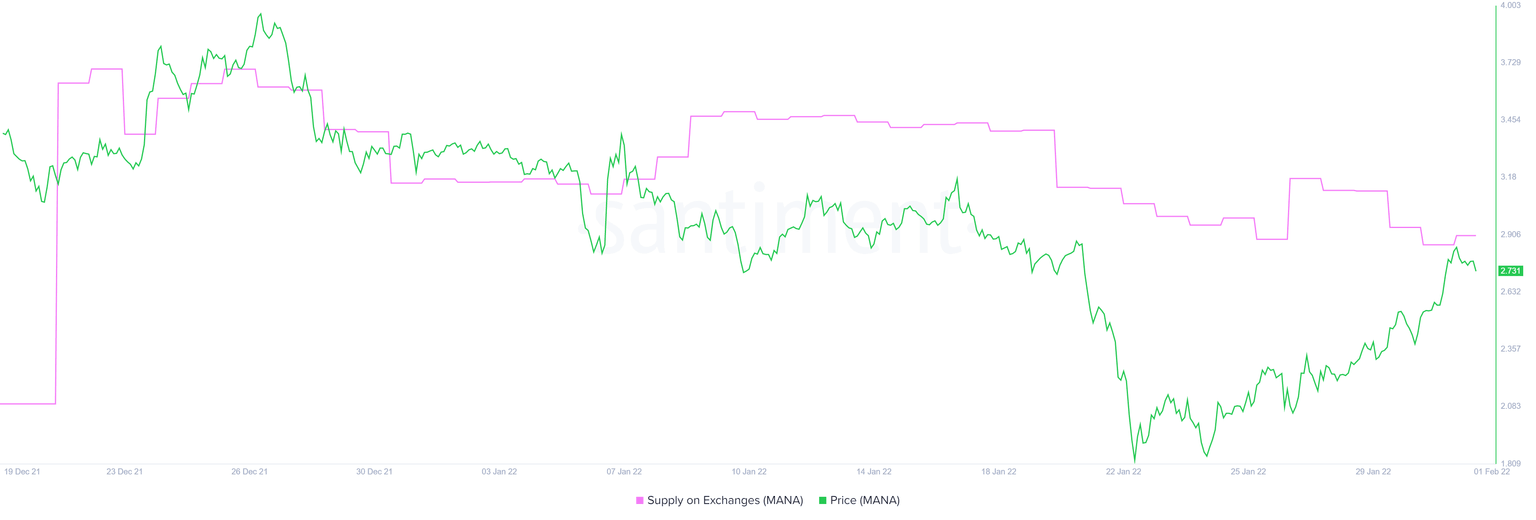

Further adding a tailwind to the bullish thesis is the decline in the supply on exchanges for MANA from 796 million to 789 million. This 7 million outflow of MANA tokens suggests that investors are confident in the performance of Decentraland price and are not planning to sell their holdings any time soon.

MANA supply on exchanges

While things are looking up for the Decentraland price, a breakdown of the $2.57 support level will dent the optimistic thesis. However, a four-hour candlestick close below the February 3 swing low at $2.44 will create a lower low and invalidate the bullish thesis.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.