Decentraland price eyes 32% rally as MANA avoids a bearish fate

- Decentraland price has bounced off a crucial support level at $2.20, avoiding a bearish fate.

- As a result, MANA has created a triple bottom setup, forecasting 32% in gains for the near future.

- A breakdown of $2.20 from a daily time frame would invalidate the bullish thesis.

Decentraland price action over the past three months has set up a bottom reversal pattern. This technical formation forecasts a trend shift favoring bulls is on its way. Therefore, investors can expect MANA to see substantial gains in the near future.

Decentraland price ready to explode

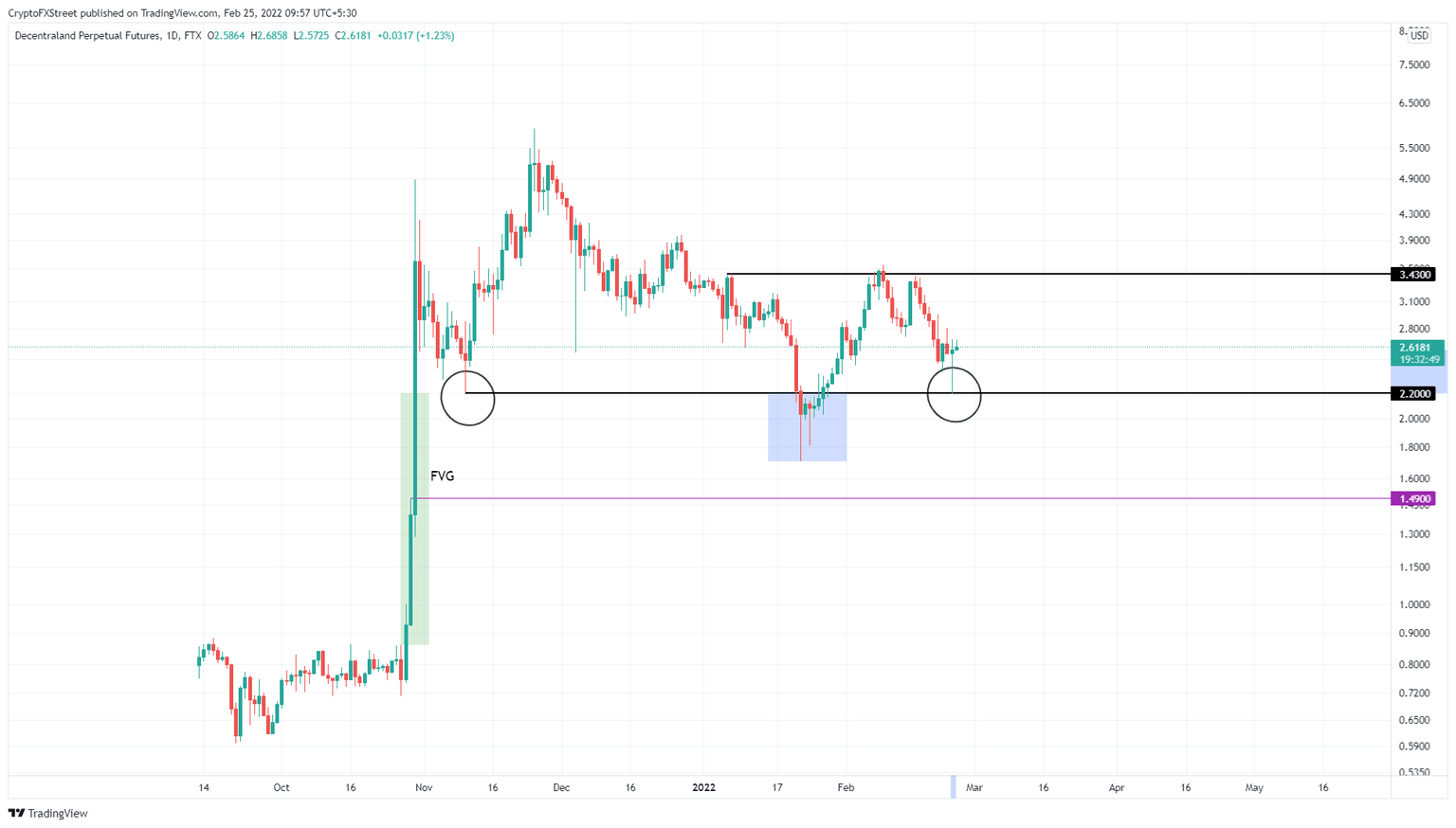

Decentraland price has created a triple bottom setup as it retested the $2.20 barrier thrice in the last four months. Since this setup forecasts a trend reversal, investors can expect MANA to see good returns in the upcoming weeks.

Since the last retest of $2.20 was on February 24, Decentraland price has rallied 17% to where it currently trades - $2.62. Going forward, MANA will likely continue this ascent until it tags the $3.43. In total, this run-up would constitute a 56% ascent from the third swing low. However, from the current position, it would amount to a 32% gain.

Regardless, investors should remain optimistic about Decentraland price action in the coming weeks.

MANA/USDT 1-day chart

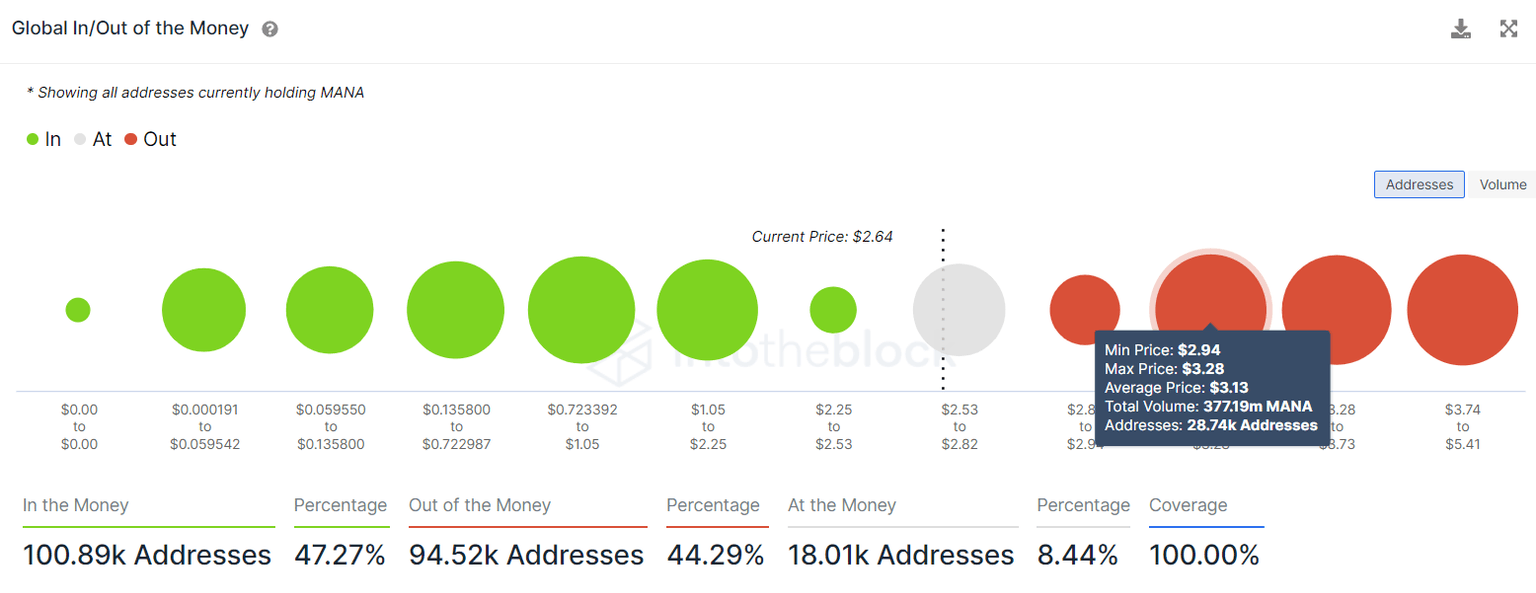

Supporting this bullish outlook for Decentraland price is IntoTheBlock’s Global In/Out of the Money (GIOM) model. This on-chain metric reveals that the immediate hurdle is relatively weak, so bulls can barge through these underwater holders and tag the next barrier.

Here, roughly 28,740 addresses that purchased roughly 377.19 million MANA tokens at an average price of $3.13 are “Out of the Money.”

Interestingly, this range also harbors the target obtained from a technical perspective, adding credence to the outlook.

MANA GIOM

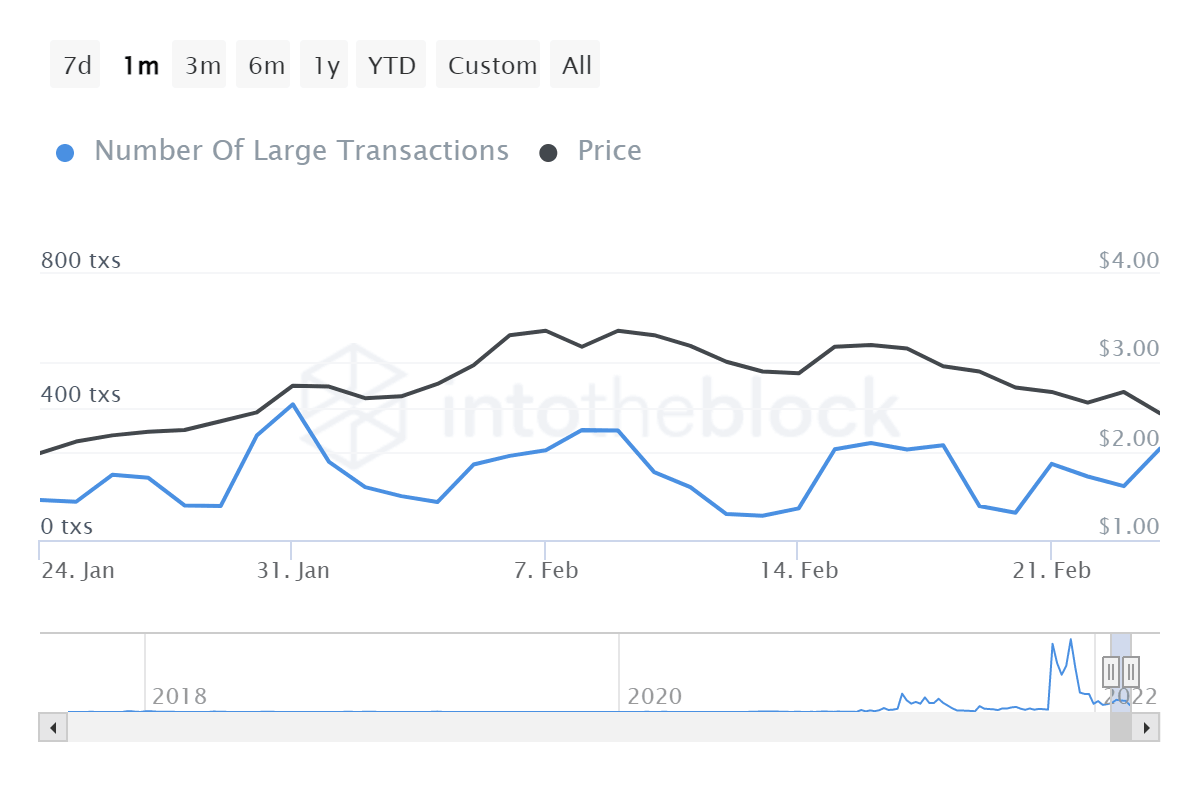

Further depicting the shift in trend from bearish to bullish is the recent uptick in the number of transactions worth $100,000 or more from 120 to 275 in the past month. This 129% increase in large transfers on the MANA blockchain serves as a proxy to the investment alignment of high networth investors, serving as a tailwind to the bullish thesis.

MANA large transactions

While the triple bottom setup sounds interesting, it has its limitations. A daily candlestick close below $2.20 will create a lower low and invalidate the bullish thesis for Decentraland price.

This development would be extremely fatal for MANA and could trigger a 31% crash to $1.49.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.