Decentraland bullish breakout setup presents buying opportunity before MANA returns to $4

- Decentraland price action develops a bullish breakout setup despite bearish market fallout from Russia's invasion of Ukraine.

- Bulls attempt to keep MANA in a support zone to prevent further declines.

- Volatility is expected to remain extremely high, with dramatic whipsaws higher and lower to continue.

Decentraland price action, like all financial markets today, is at the mercy of the volatility brought on by Russia's invasion of Ukraine. However, that has not prevented price action from developing a necessary bullish reversal setup on its Point and Figure chart.

Decentraland price may lead the crypto market out of a downtrend, major rally likely if buyers come in

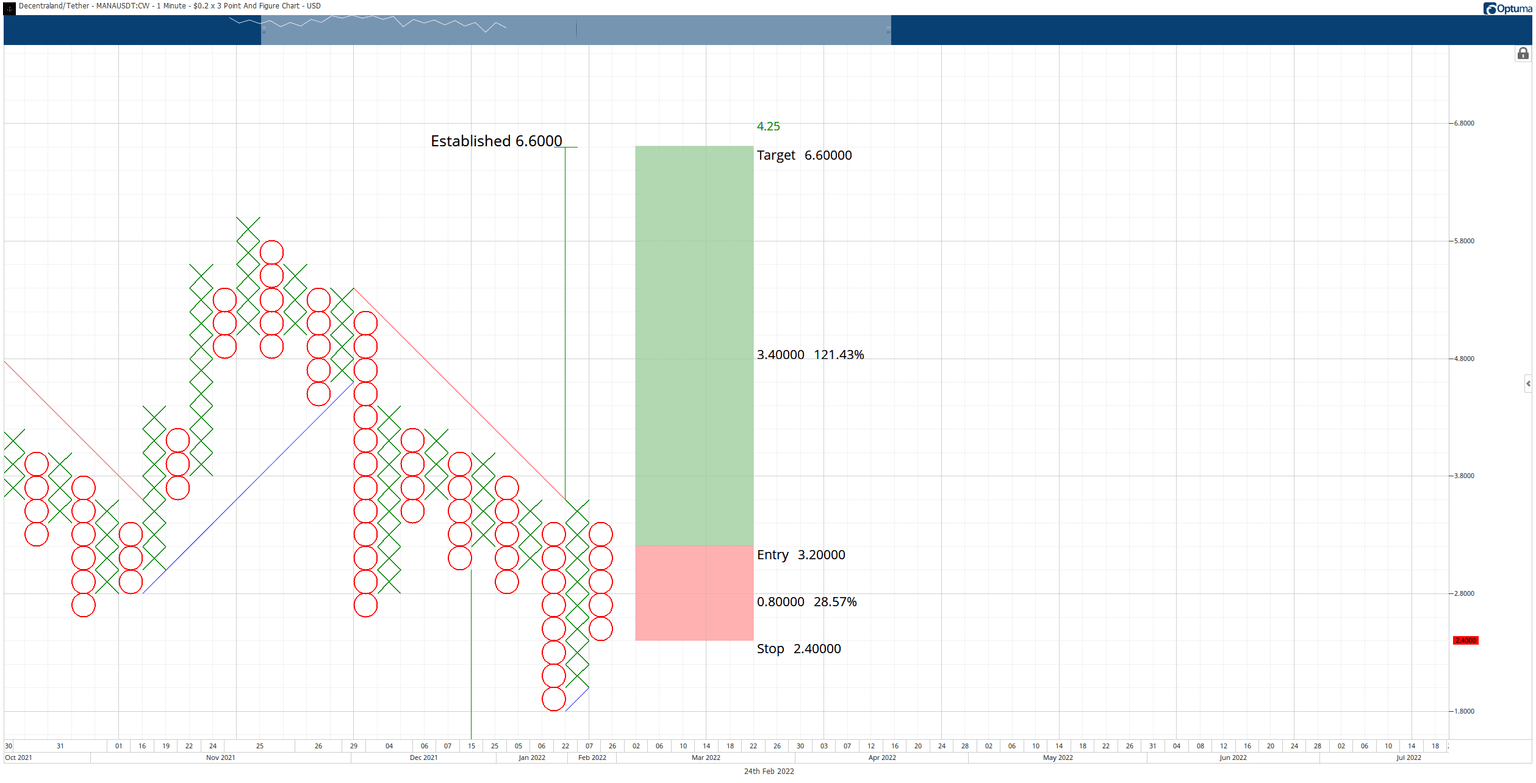

Decentraland price recently converted into a bull market on its $0.20/3-box reversal Point and Figure chart when it hit $3.60. The current O-column is the first pullback since converting into a bull market and is viewed as a sign of strength, not weakness.

The long trade setup is a buy stop order at the three-box reversal off the current O-column, currently at $3.20. The stop loss is a four-box stop (currently at $2.40), and the profit target, based on the Vertical Profit Target Method, is at $6.60. A trailing stop of two to three boxes would help protect any implied profit post entry.

The trade setup for Decentraland price is a 4.25:1 reward for the risk with an implied profit target of 121% post entry. However, the profit rarely is hit in a single column. Instead, several smaller trades hitting profit targets at $3.80, $4.80, and $5.80 is a good strategy.

MANA/USDT $0.20/3-box Reversal Point and Figure Chart

The trade setup is only invalidated if Decentraland price moves to $1.20 or lower.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.