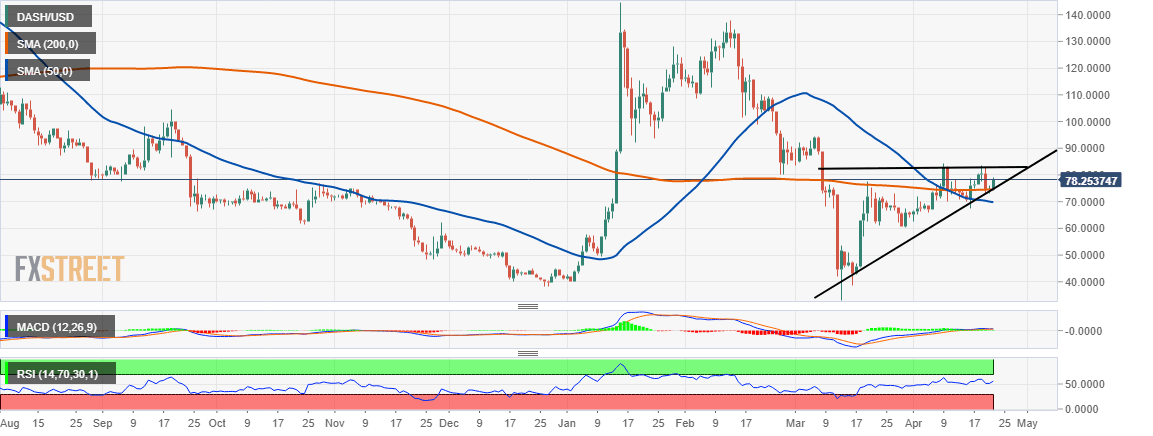

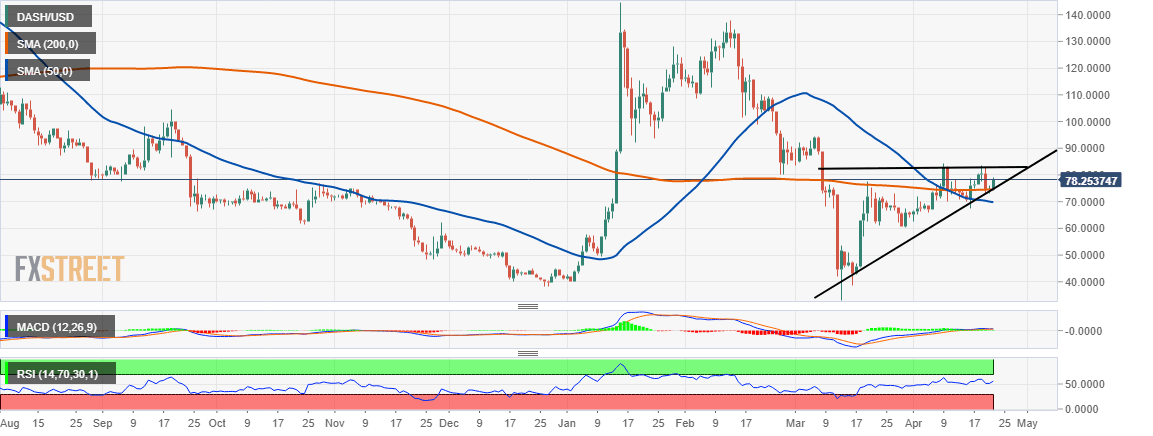

Dash Market Update: DASH/USD soars 5% in a dull cryptocurrency market

- Dash leads the cryptocurrency recovery, testing the short-term resistance at $78.

- DASH/USD grinds towards a possible triangle breakout, targeting $90.

Dash is among the biggest single digit gainers in the cryptocurrency market. Volatility is returning to the digital space following a drab action on Tuesday. DASH/USD is trading 5.46% higher on the day. The European session is likely to experience further upward movement ahead due to bullish trend and high trading volume.

The price is currently above the moving averages where the 200-day SMA is offering immediate support while the short term 50 SMA is in line to offer support at $70.00. Both the MACD and the RSI double-down in the increasing bullish influence. For instance, the RSI has bounced off support and point upwards. In other words, there is still room for growth before hitting oversold levels. Moreover, the MACD is in the positive region, emphasizing the growing bullish grip.

If the bullish action continues, Dash could break above the triangle resistance; a move that could stretch the bullish leg towards $90. Dash traded highs above $140 January before retreating in February and plunging to lows under $40 in March.

DASH/USD daily chart

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren