Crypto influencer makes controversial Bitcoin price crash prediction to $45,000

- Bitcoin price rally to its new all-time high is largely driven by $7.35 billion institutional capital inflow to ETFs since its debut in the US.

- Crypto influencer Capo predicts Bitcoin price crash to $45,000.

- Bitcoin halving is 42 days away, the event has typically ushered a bloodbath in BTC price ahead of the block reward halving.

Bitcoin price rally to $69,000 has seen few obstacles as inflows to Bitcoin ETFs hit $7.35 billion in 2024. According to a recent Bloomberg report, the institutional capital inflow to the exchange traded fund has driven the ongoing bull run.

Typically, Bitcoin price nosedives in the days leading up to the halving event as seen in previous instances. A crypto expert, Capo, popular as a “perma bear,” someone who is permanently bearish on Bitcoin, predicted BTC price decline to $45,000, citing the Federal Reserve’s high interest rate. After BTC price rally to a new all-time high on Wednesday, the perma bear says the sentiment is bullish for now and once Bitcoin price dips below $60,000, it will mark the first bearish confirmation.

Also read: BTC/USD outlook: Bitcoin resumes rally after a mild consolidation, record high in focus

Bitcoin price rally largely driven by ETF inflows

A Bloomberg report on Monday highlighted how Bitcoin’s current rally is driven by institutional capital inflows. BTC price rally to its new all-time high above $69,000 was likely catalyzed by the expectation of exchange-traded funds’ demand among market participants.

BTC price made it past the $65,000 level for the first time since November 2021. Analysts attribute Bitcoin’s price rally to the BTC demand from US-listed ETFs, which began trading with the SEC’s approval on January 11.

Bitcoin price gained over 190% in the past 12 months and is up over 55% year to date. Bloomberg’s data shows that institutional investors have invested $7.35 billion since Spot ETF debut.

While Bitcoin price appears to be in discovery mode on Monday, “perma bear” Capo, behind the X handle CryptoCapo_ predicted a BTC price decline to $45,000.

Bearish thesis for Bitcoin price, drop to $45,000 likely?

Crypto expert and trader Capo is known for his bearish commentary on Bitcoin price. The influencer dropped a message on his Telegram group for traders, here he outlines how interest rates affect Bitcoin price and predicts a BTC price pullback to $45,000, owing to high interest rates.

In his message, Capo explains that high interest rates for a long period of time are detrimental to the economy. In his words, Capo states,

“Central banks intentionally maintain high interest rates in a phase known as QT (Quantitative Tightening), as a measure to slow down economic activity and control inflation. They achieve their goal, as inflation drops, but it has serious collateral effects, such as a possible recession.”

Capo notes that the UK and Japan have already announced they are in recession. As other countries confirm this, markets could return to their fair price, predicting a correction in Bitcoin and implying that $45,000 is a fair price for the asset.

Capo’s Telegram message. Source: X

Capo’s prediction is in line with typical Bitcoin price trend in the weeks and months prior to the halving event. The scheduled BTC halving will occur in April 2024, therefore a correction in Bitcoin price is likely. Following Bitcoin price rally on Wednesday, Capo informed his followers that the sentiment among market participants is currently bullish. Once Bitcoin price declines below the key $60,000 level, it would mark the first bearish confirmation for his thesis.

Capo's message. Source: Telegram

Bitcoin price correction trend prior to halving

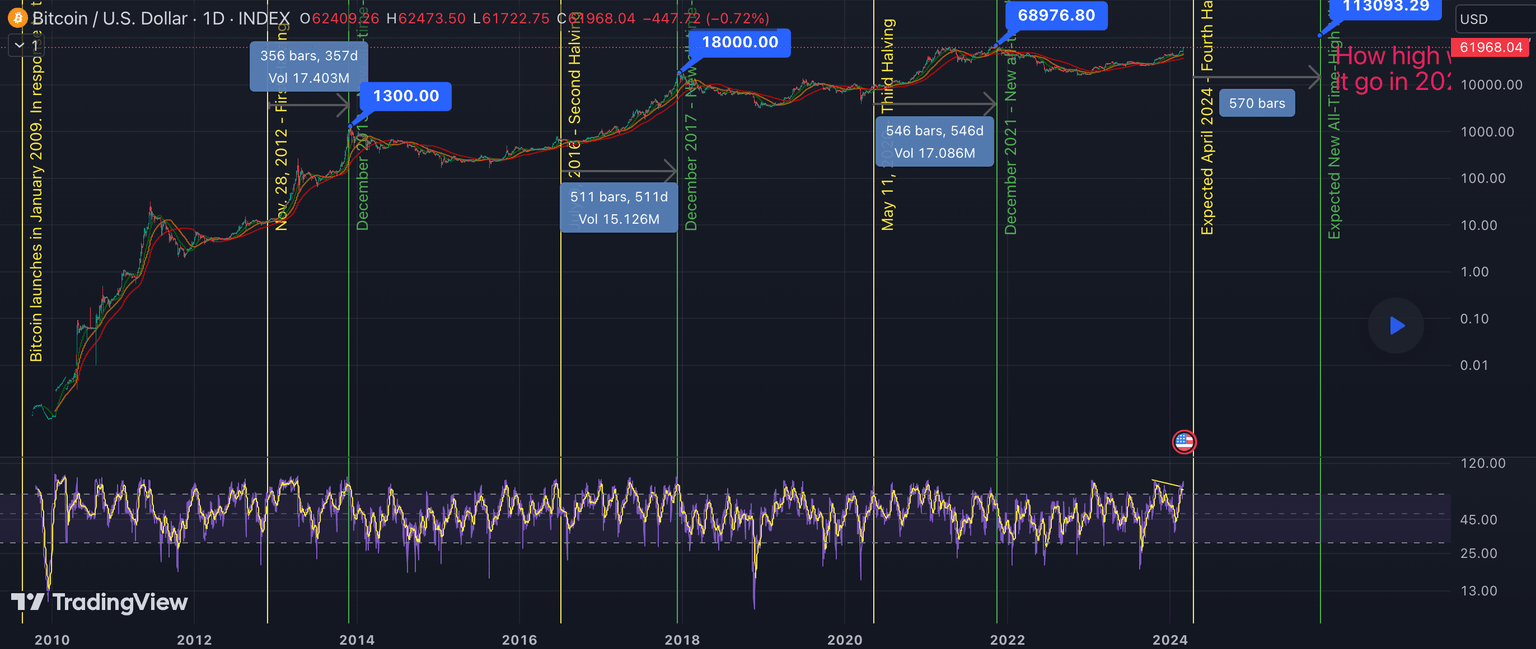

Three previous Bitcoin halving events have seen a considerable decline in BTC price prior to the event and a surge in the asset’s price in the months and weeks following the mining reward halving.

The chart below shows four year cycles for BTC halving and how the price dips before the event and BTC price typically hits a new all-time high after.

Bitcoin halving events. Source: TradingView

If Bitcoin price trend repeats, there is a likelihood of a pullback. Further, analysts at JP Morgan lend credence to the bearish thesis with their prediction of BTC price decline to $42,000. In a report, analysts wrote, “...This $42,000 estimate is also the level we envisage Bitcoin prices drifting towards once Bitcoin-halving-induced euphoria subsides after April.”

It's important to note that the Spot Bitcoin ETF has changed the scenario typical of previous halvings. Consistent demand from institutional investors could drive prices higher consistently, unlike previous halving events. What’s more, the ongoing bull run is largely driven by institutional entities and retail traders are on the sidelines. This is atypical of previous halving cycles and this could influence the asset's price positively. To find out more about this, check this out.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.