Cryptocurrencies under Selling Pressure

In the last eight hours, cryptocurrencies have been subjected to relatively strong selling pressure. Bitcoin (-1.6%), Litecoin (-2.97%) , Ethereum (-2.7%) and Ripple (-2.72%) fell modestly down, whereas Bitcoin SV is descending over 10.6%, along with Ethereum Classic( -5.5%) and MIOTA (-5.76%).

Among the overall selling sentiment, Tezos manages to gain 2.96%, and, notably, NEM moves up by 10.2%.

Ethereum tokens are also dropping. LINK (-6.43%), MKR(-5.6%), REP(-6.24%), CENNZ( -6.92%) and SNX(-7.32%) lead the downward movements. SPX (+18.52%) and LPT(+33.64%) are showing the best positive performance.

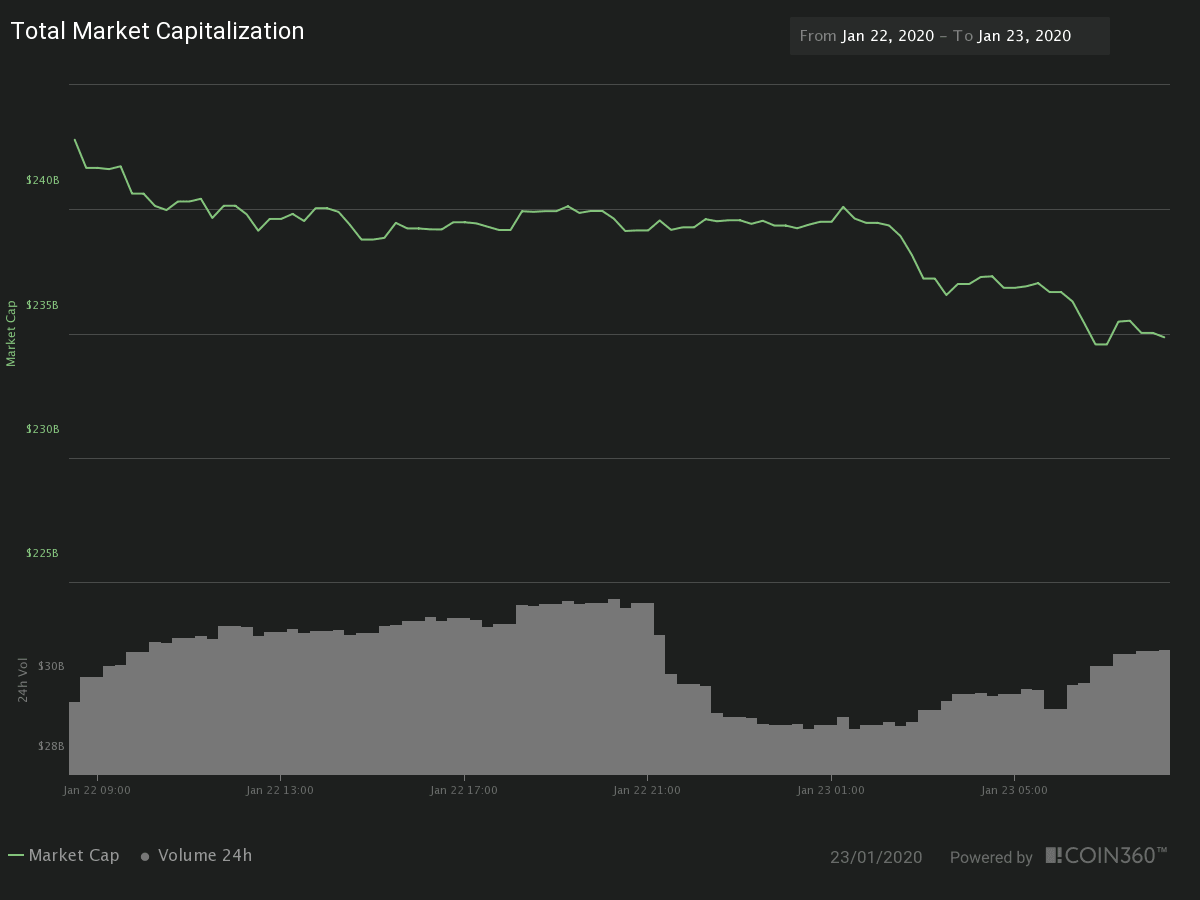

The market capitalization of the sector was moved down to $234.848 billion (-2.63%) in the last 24H, on a traded volume of$31.4 billion (+3.05%). The dominance of Bitcoin hasn't changed much and currently is 65.77%.

Hot News

Fintech firm Amun AG has listed an inverse Bitcoin ETP (Exchange.traded product) on SIX, Switzerland's leading stock exchange. Theoretically, this inverse ETP product would allow investors profiting from downward price movements of the Bitcoin. Amun AG currently has eleven crypto-ETPs listed linked to BTC, ETH, XRP, and others. Amun has received approval from Switzerland's Financial Supervisory Authority to expand its financial products in the European Union.

The US SEC doubts about the development efforts on the TON blockchain. That can be derived from its court filing on the NY South District in answer to Telegram's previous motion for summary judgment. "Telegram Has Put Forth No Evidence Regarding the TON Blockchain's State of Development at Launch. Telegram Marketed Few, if Any, Expected Uses for Grams." (source: cointelegraph.com).

Technical Analysis - Bitcoin

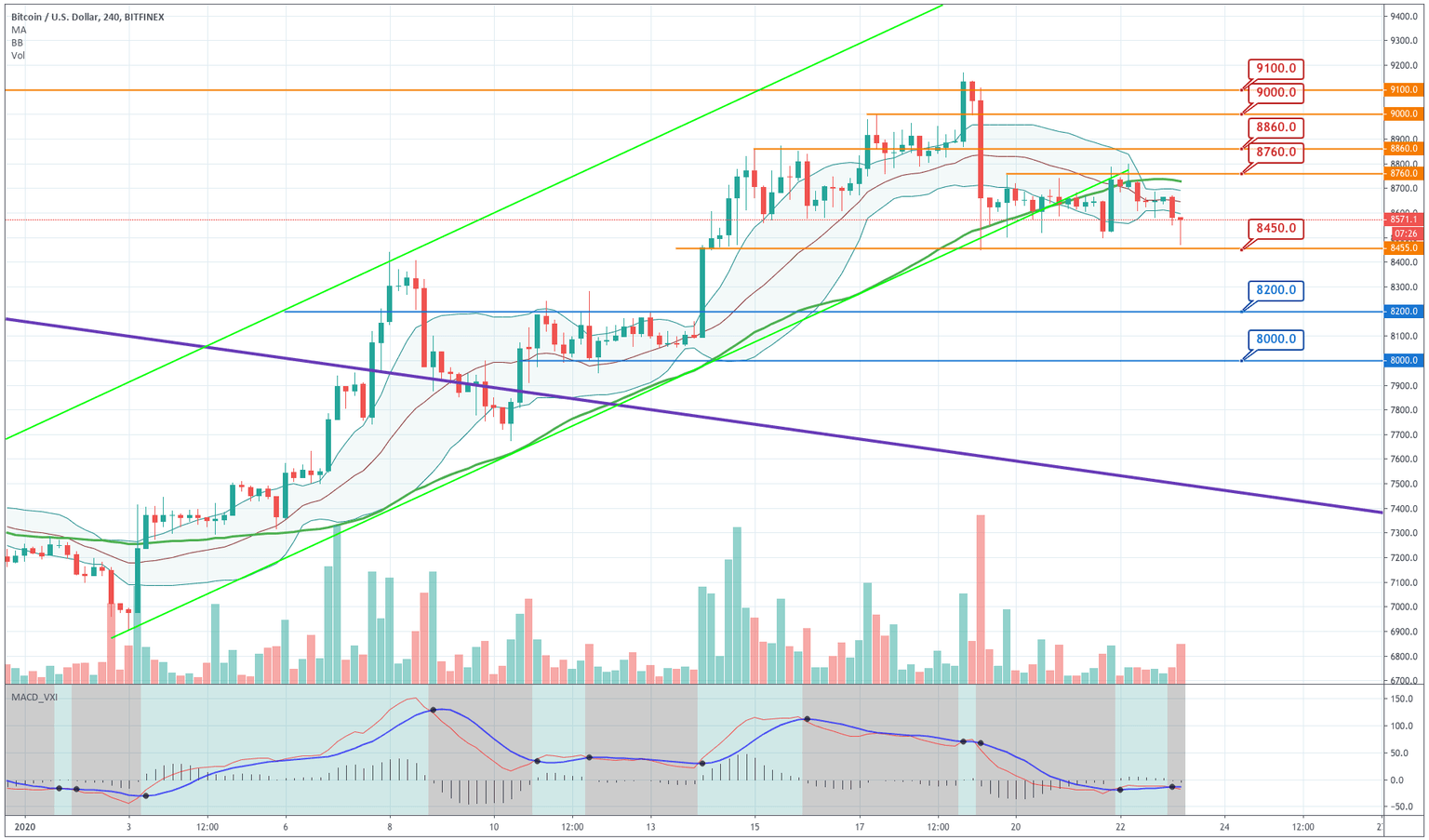

The last four hours of Bitcoin drops brought the digital asset from $8,660 to test its $8,450 low made on Jan 19. There, sellers have managed to create a credible bounce, and now is moving $100 higher. If the bounce manages to last, then Bitcoin has been saved from a potential Head-and-Shoulders pattern that would manifest itself after a break below the $8,450 line.

On the 4H chart, we see that the Bollinger Bands are contracting, which may implicate a sideways action. The MACD is giving no valuable information, as both lines are too close together moving horizontally.

On the negative side, Bitcoin's price has moved out of the ascending channel, and also it is moving below the 50 and 20-periods SMA, and below the -1SD line. The key levels are currently $8,760 and $8,450.

|

Support |

Pivot Point |

Resistance |

|

8,560 |

8,681

|

8,760 |

|

8,450 |

8,860 | |

|

8,340 |

9,000 |

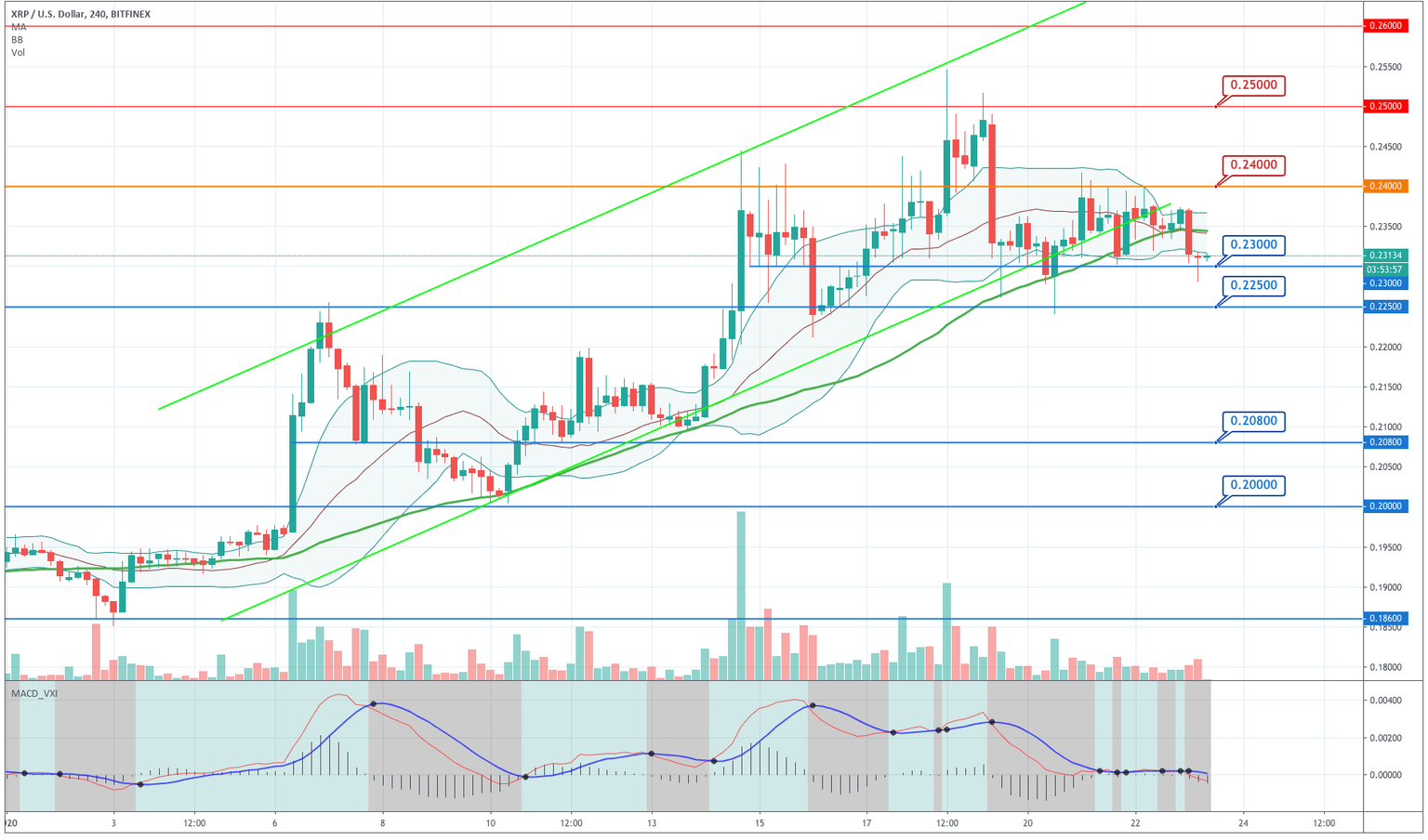

Ripple

Ripple had a relatively large red candle that was followed by a doji. This candle pierced the $0.23 level and then went back to its origin. Nevertheless, the price continues moving below the -1SD line, and the MACD is bearish. Also, the latest movements pushed the price below its 50-period SMA. If there is no positive reaction soon, the price may continue dropping towards $0.225. To the downside, the key level is $0.23, whereas $0.24 is the critical resistance to the upside.

|

Support |

Pivot Point |

Resistance |

|

0.2300 |

0.2360

|

0.2400 |

|

0.2250 |

0.2450 | |

|

0.2200 |

0.2500 |

Ethereum

Ethereum is in a similar situation as the rest of the leading cryptocurrencies. After the sharp drop made on Jan 19, the price has been moving horizontally between $162 and $170. In the last eight hours, the selling pressure brought ETH price down to test the $162 level again. From there, it bounced back and now is in the middle of the channel. The Bollinger Bands are shrinking, which means the average trading range has dropped, so a new push to the upside is likely.

The critical levels to observe on this asset were already mentioned: $162 is critical to hold the current uptrend, whereas a pierce through $170 would imply a new upward leg.

|

Support |

Pivot Point |

Resistance |

|

164.7 |

167.5

|

170 |

|

162 |

173.5 | |

|

159 |

177 |

Litecoin

Litecoin is mimicking the movements of the Ethereum, although its price movements seem more bullish since the $55.9 support line has been holding all the time. On the negative side, the price is now below its 50 and 20-period SMA, moving below its -1SD line and a MACD slightly in the bearish side. The Bollinger bands are shrinking, so the likelihood of the continuation of the sideways movement is high. The key levels are $55.9, which is critical to hold for buyers, and $58.3 to the upside.

|

Support |

Pivot Point |

Resistance |

|

55.9 |

58.3

|

58.6 |

|

53.9 |

60 | |

|

51.5 |

62.5 |

Author

EagleFX Team

EagleFX

EagleFX Team is an international group of market analysts with skills in fundamental and technical analysis, applying several methods to assess the state and likelihood of price movements on Forex, Commodities, Indices, Metals and