Cryptocurrencies Price Prediction: XRP, TVL & Bitcoin – European Wrap 18 April

XRP struggles to recover as lingering Ripple lawsuit could reach Supreme Court, former SEC litigator says

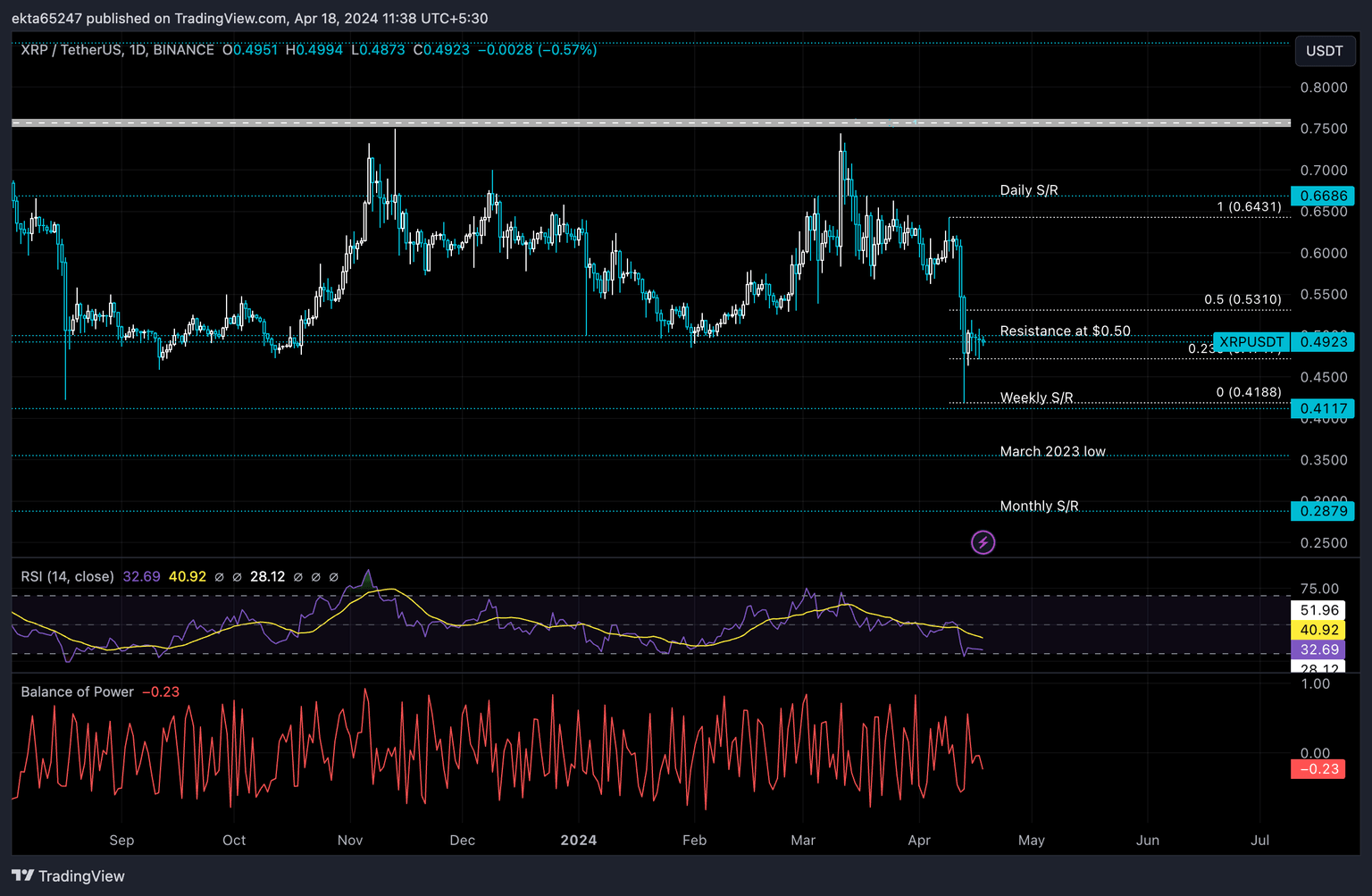

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

XRP’s subdued performance – its price has fallen by around 20% in the last seven days – comes amid a broad crypto market correction and as market participants continue to discuss the lingering legal battle between Ripple and the Securities Exchanges Commission (SEC). Former SEC litigator Ladan Stewart said on Wednesday that Ripple is likely to face a Supreme Court showdown with the US financial regulator.

Bitcoin Layer 2 Merlin chain TVL climbs 20%, defying broad market correction

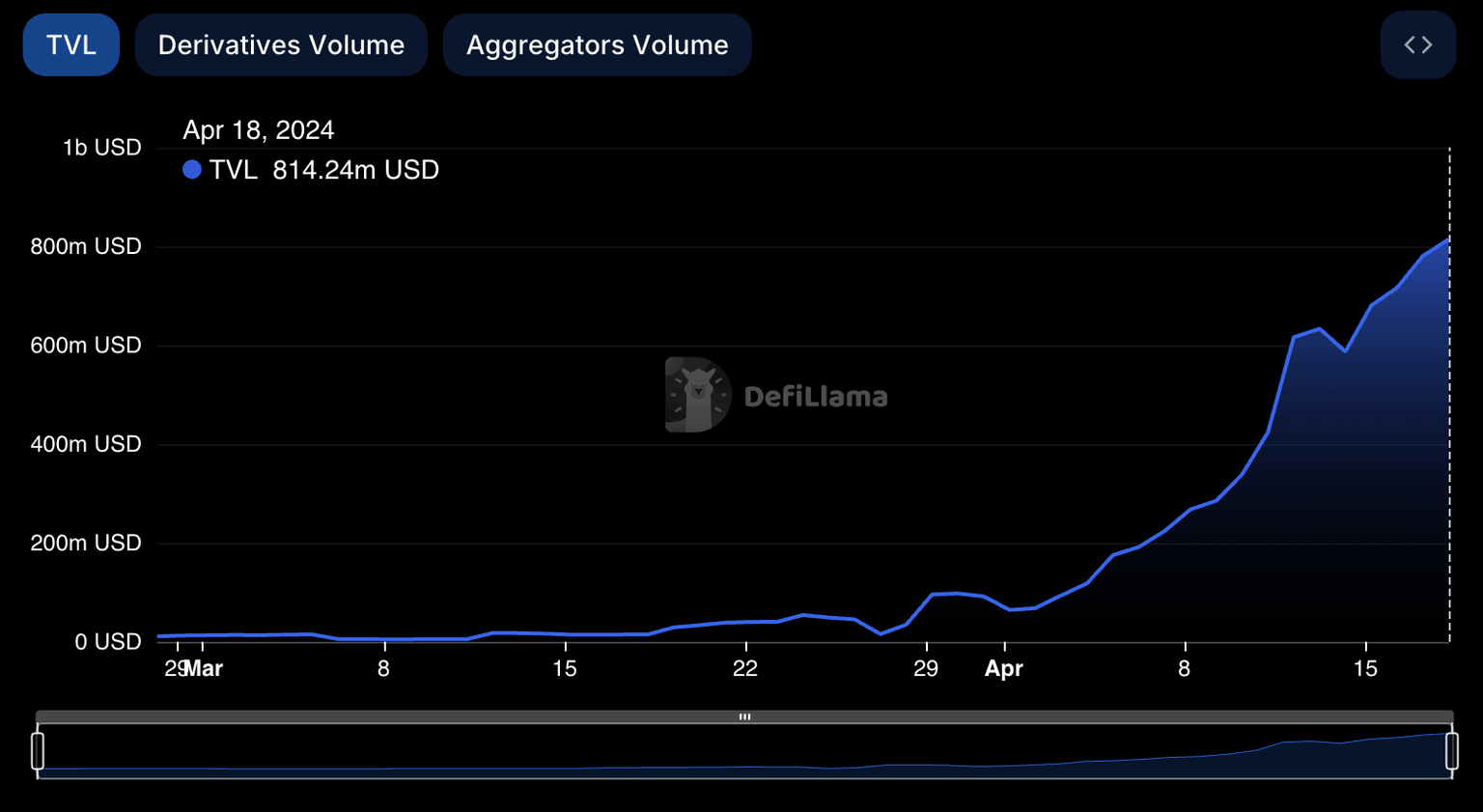

Merlin Chain, a Bitcoin Layer 2 solution, has amassed $814 million in total value of assets locked (TVL) in under two months, according to DeFiLlama data. The increase came despite Bitcoin’s decline to the $61,000 level, which dragged down the prices of other BTC Layer 2 solutions such as Stacks (STX), Elastos (ELA), SatoshiVM (SVM) and BVM (BVM).

Bitcoin Layer 2 chain Merlin experienced a 20% increase in its TVL this week despite the broad correction in BTC and its ecosystem tokens. BTC price has declined by around 13% in the weekly timeframe, dragging down its Layer 2 tokens with it.

If Bitcoin restarts bull run, these altcoins are likely to explode

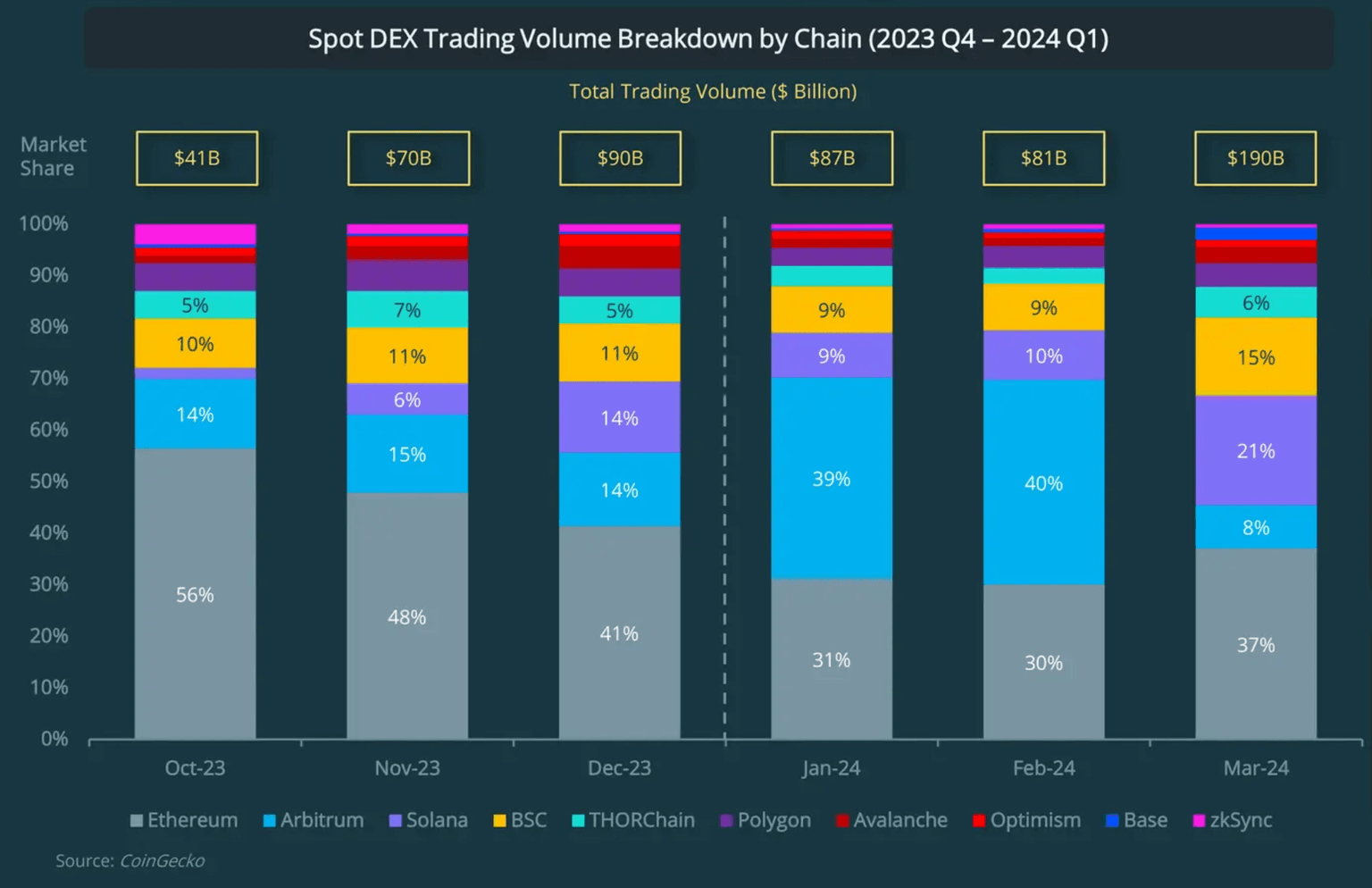

With Bitcoin price moving sideways, it is the best time to reflect on the bull run so far and find potential trends that could prove useful in the next part of the cycle.

Bitcoin (BTC) price saw a massive spike in buying pressure at the start of 2023. But on June 14, 2023, BlackRock’s Bitcoin spot ETF filing reshaped the crypto landscape. After this event, the market went full-throttle with specific cryptocurrencies kickstarting mind-melting rallies across the board.

Author

FXStreet Team

FXStreet