Cryptocurrencies Price Prediction: BNB. Solana & Bitcoin – European Wrap 24 October

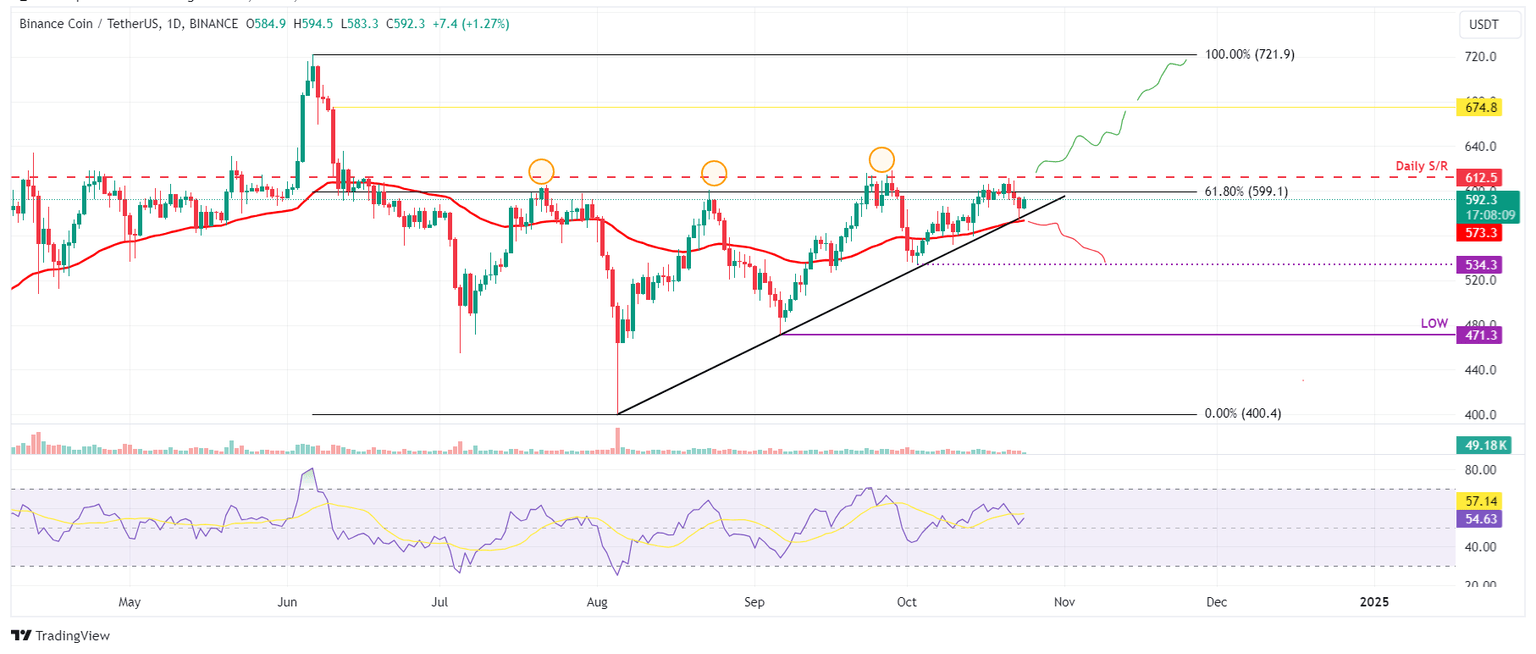

BNB Price Forecast: Technical outlooks favors bulls

Binance Coin (BNB) price increases to around $593 on Thursday after retesting and bouncing off a key support level on Wednesday. BNB's technical outlook suggests that further recovery is on the cards, while the coin’s long-to-short ratio also indicates that traders anticipate a rise in the price.

Unlocking liquidity: Gracy Chen insights on the future of Solana staking

In the rapidly evolving world of blockchain technology, the ability to efficiently manage assets is becoming a pivotal concern for both individual investors and institutions. Staking, a widely used mechanism to secure networks and earn rewards, has traditionally required locking up assets for a specific period, creating a dilemma between earning a yield and maintaining liquidity. For investors, this posed a challenge, particularly in volatile markets where the ability to quickly sell assets is crucial. The rise of liquid staking has introduced a potential solution to this problem, allowing investors to enjoy the benefits of staking without sacrificing liquidity.

Has Bitcoin completed a correction?

The cryptocurrency market has been rising since the start of the day on Thursday, recovering strongly from Wednesday’s late afternoon sell-off in the wake of global financial markets. At its lowest point, the market capitalisation was down to $2.23 trillion, and at the time of writing, it had risen to $2.32 trillion (+0.1% in 24 hours). The market’s intraday movements will reveal whether this marks the bears’ last stand or if the current rebound is just a bull trap.

Author

FXStreet Team

FXStreet