Cryptocurrencies Price Prediction: Bitcoin, Monero & Uniswap – Asian Wrap 13 Oct

Bitcoin Price Prediction: BTC flashes sell signal, short-term correction imminent

After falling from $11,925 to $10,165 on 2nd and 3rd September, Bitcoin entered a consolidation period, which lasted till October 7. During this period, the premier cryptocurrency managed to stay above the $10,000-mark. Finally, on October 7, BTC started a bullish rally, which saw it go up from $10,600 to $11,500 (as of writing).

Despite this strong upward movement, the price has currently faced rejection at the $11,700 resistance level.

-637381531050372689.png&w=1536&q=95)

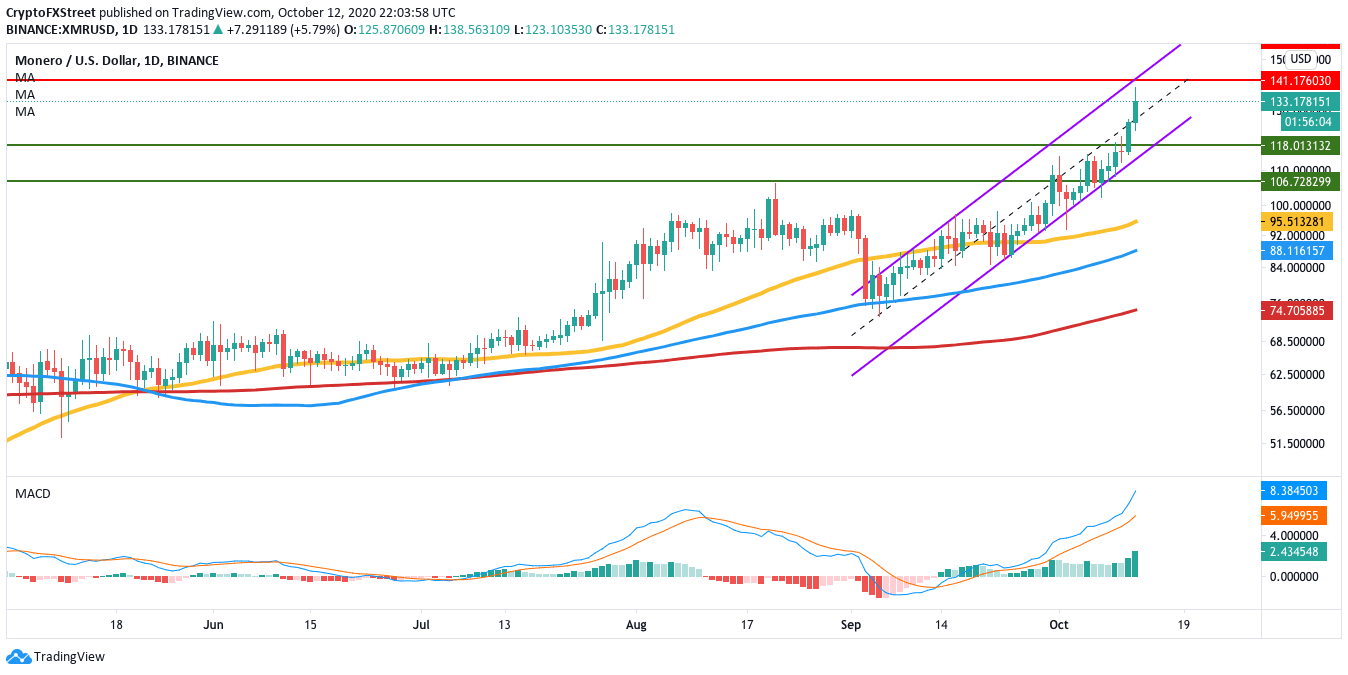

Monero Price Analysis: XMR jumps by more than 70% over the last one month

Monero is currently in the middle of a bullish rally and has reached its highest levels since early September 2018. Since September 3, 2020, the leading privacy coin has jumped by 73% from $77 to $133. The network is currently prepping for a major network upgrade that will take place on October 17.

XMR is presently trending in an ascending channel formation. As previously mentioned, XMR reached an intraday high of $138.50 this Monday, a level not seen since September 2018. The MACD shows increasing bullish momentum, which the buyers will want to take advantage of to break above the $140 resistance level.

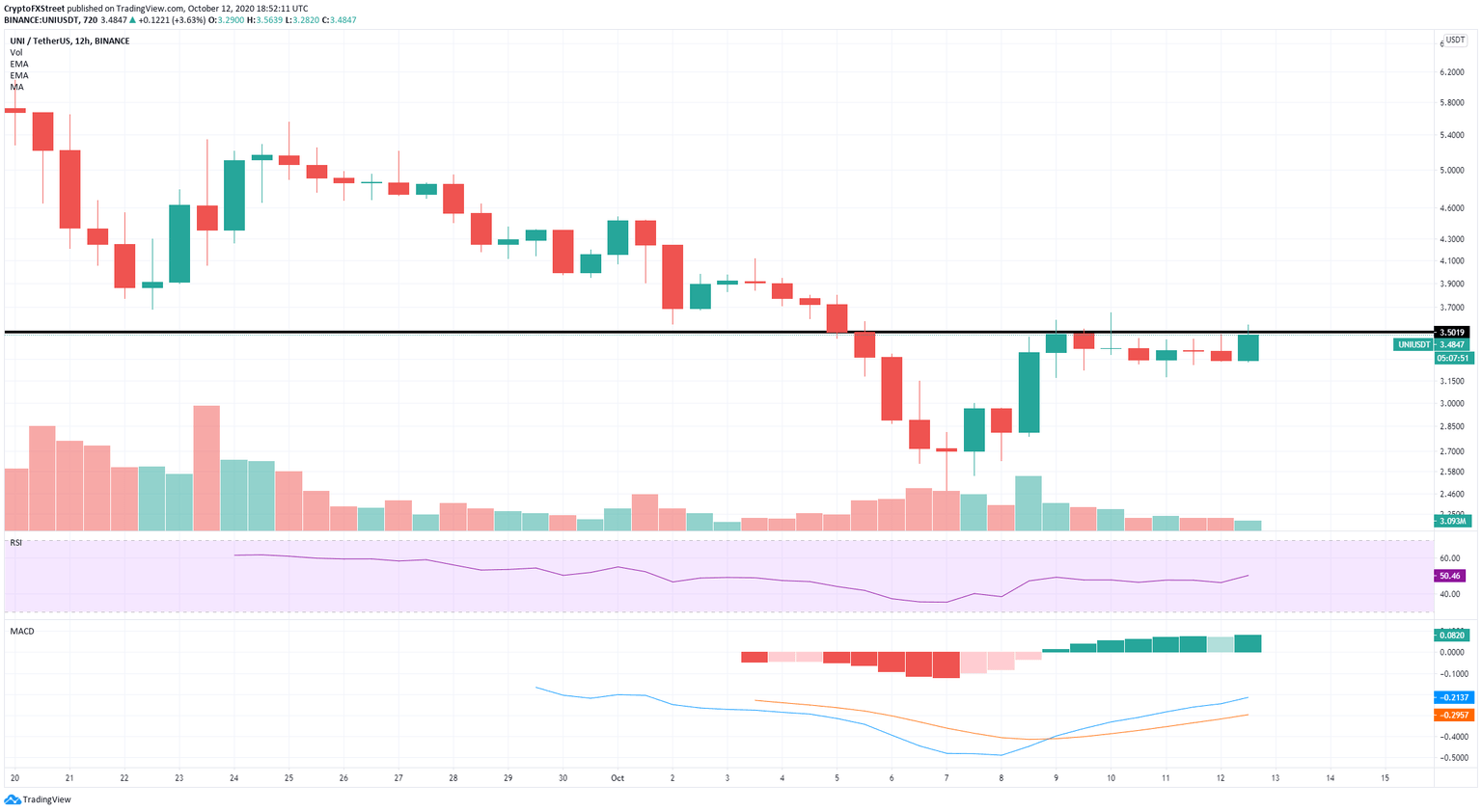

Uniswap Price Prediction: UNI eying up a significant price move, shows indicators

The release of UNI was one of the most successful ones, rapidly climbing towards a $700 million market capitalization and getting listed on all major exchanges like Binance, and others. The initial bull rally didn’t last long and after peaking at $8, UNI is now only trading at $3.29.

Although UNI has managed to rebound from the low of $2.47, it is still facing an important resistance level established at $3.5 on the 12-hour chart and tested several times during the past week. Rejection from this level has the potential to take UNI down to $3 in the short-term.

Author

FXStreet Team

FXStreet